Same Store Retail Sales Growth - Best In 12 Years

Same Store Retail - Department Store Black Friday Shopping

Bears will claim Black Friday holiday shopping was weak because traffic to stores fell, while bulls will point to great online sales growth. I think it was a great holiday shopping season. Online sales growth had been sagging a bit recently.

However, Black Friday is a unique event for online sales to gain traction. The crowds at stores make Black Friday shopping much worse than usual. It makes much more sense to shop from home than to wait outside a store for hours.

The initial data isn’t perfectly accurate. We’ll need to wait for the November retail sales report and Q4 earnings reports from retailers early next year to determine how it went.

We’re only seeing slight weakness in the jobless claims. Gas prices are falling quickly and wage growth is accelerating. Personally, I think this holiday shopping season is going to be fantastic.

According to RetailNext, which uses cameras to track traffic at malls and stand alone stores, traffic on Thanksgiving and Black Friday fell from 5% to 9%.

It would be surprising if that data is accurate. Even though shopping online makes more sense, the strong economy should prevent declines of that magnitude.

ShopperTrak estimates traffic fell 1% year over year. I expect that estimate to be more accurate.

Same Store Retail - Great Online Sales

According to Adobe, online sales from Wednesday through Black Friday increased 26.4% to $12.3 billion.

It’s easier to track online sales than in-store sales, which means I trust this data more. That would be a big increase. Online sales are likely above 10% of overall sales. They boosted this holiday season’s sales sharply.

The only problem for retailers is online sales have been hurting gross margins as we saw in Target’s latest report.

Same Store Retail - Best Redbook Sales Growth In 12 Years

Redbook’s weekly year over year same store sales growth for the week of November 24th was 7.9% which was much higher than the prior growth of 6.2%.

This weekly report was spectacular as this was the strongest annual growth in at least 12 years. The full month year over year gain of 6.7% is now the year high.

Clearly, retail sales growth this holiday season has been strong. I’m wondering how traders balance this great short term news with the potential negative catalysts coming next year.

Same Store Retail - 20 City CoreLogic Price Weakness

As you can see from the chart below, the September 20 city seasonally adjusted Case Shiller price index was up 0.3% month over month. It met estimates and was up from 0.1% growth.

This data is delayed. We’ve already seen some results from November. October and November appear to have been worse than September. Meaning, this report could weaken.

Non-seasonally adjusted month over month growth of 0% was the same as last month. Non-seasonally adjusted year over year growth was 5.1%. It missed estimates for 5.3% growth and last month’s growth of 5.5%.

With Seattle weakening, Las Vegas has taken the reign as the hottest housing market in the country. Las Vegas and Phoenix have the strongest month over month growth which was 0.9%. Atlanta and Tampa followed close behind.

Seattle and San Diego have had monthly declines for 3 straight months. Yearly, Las Vegas and San Francisco were the hottest markets as prices were up 13.5% and 10%. Seattle was up 8.4%. That is weak for Seattle’s standards as it was in the double digits in 2017 and the beginning of 2018.

Weakest cities were New York and Washington D.C. which only increased 2.7% and 2.9%. New York state has the greatest amount of people leaving it in the country. Upstate is very weak, so it’s not all about the city.

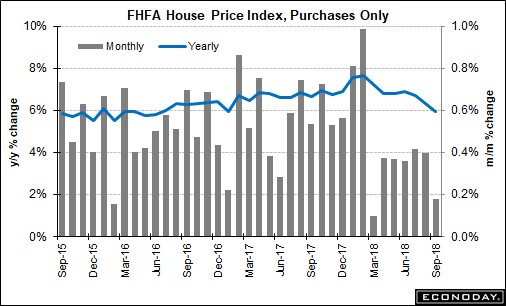

Same Store Retail - FHFA Housing

As you can see from the chart below, September FHFA monthly house price growth was 0.2%. It missed estimates for 0.3% growth and last month’s growth rate of 0.4%.

Year over year growth fell from 6.3% to 6%. That’s the weakest reading since January of last year.

Mountain region was the strongest as prices were up 1.3% monthly and 9.5% yearly. Pacific region was hurt by the recent weakness from Seattle as prices fell 1.1% month over month and only increased 5.5% year over year.

Weakest region was the Middle Atlantic as prices were up 0.4% monthly and only 4.1% yearly. This region includes the 2 weakest cities in the Case Shiller index I just reviewed. These were Washington D.C. and New York.

Same Store Retail - Consumer Confidence Forecasts The End Of The Cycle

We have a good idea that spending growth on and around Black Friday was strong this year. Consumer confidence report still is interesting because it gives us a look at the future. The headline index fell from 137.9 to 135.7. That missed estimates for 136.5.

Problematic news was the difference between current conditions and future conditions widened. Meaning, the cycle is close to ending.

The present conditions index was up 0.8 to 172.7. This correlates well with the strong holiday shopping season. However, the expectations index fell 4.1 points which indicates economic growth is slowing.

Inflation estimates were up 0.1% to 4.9%. That’s nowhere close to CPI and PCE inflation, but it’s low for this survey.

As you can see from the chart below, 74.4% of respondents stated they think interest rates will rise in the next 12 months. Only 5.5% think they will fall.

Those saying they had plans to buy a home were steady at 6.4%. The percentage of stock market bulls fell from 43.6% to 35% which is very bullish.

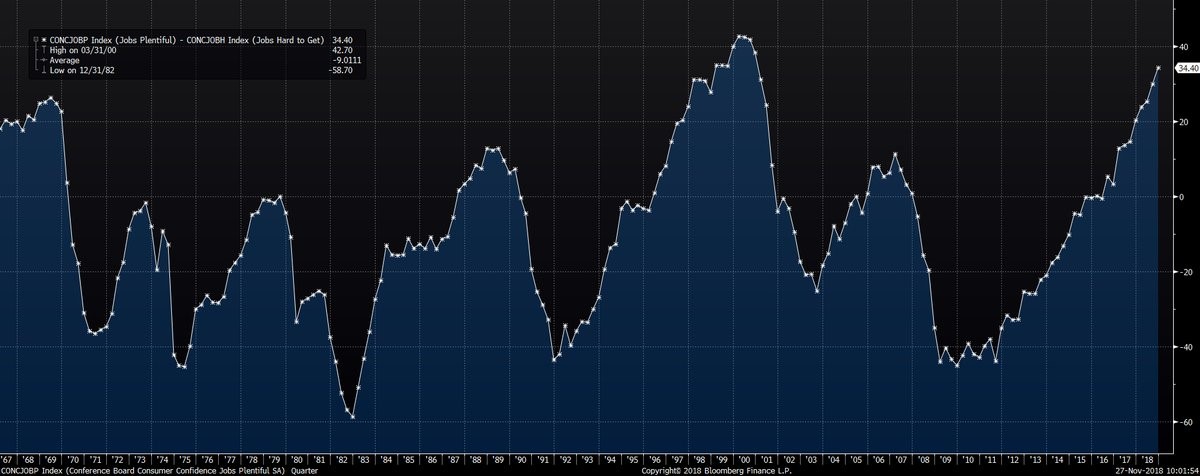

As you can see from the chart below, the difference between those saying jobs were plentiful and those saying jobs were hard to get increased to 34.4%.

Those saying jobs were hard to get fell 1.2% to 12.2%. Those saying jobs were plentiful increased 1.2% to 46.6%. This is the peak of the labor market. Since 1967, this indicator has only been higher in 2000.

(Click on image to enlarge)

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more