You’ll Want To Own These Stocks When The Fed Hikes Rates

Every investor’s highest priority in this uncertain environment should be to shield their investments from rising rates and in turn pick the right stocks that will grow in these conditions. Nobody knows exactly what might happen when the Fed ups the rate, but to be prepared we have compiled a diversified list of investments for you that could weather an economic downturn and surely a rate hike.

The question has become when, not if, the Federal Reserve will raise interest rates.

Since the end of January, when the Fed’s opened the door for a June rate hike, many of the major income generating industries have taken a beating.

With that, over the last couple months high-income stocks have been on the fall. The Alerian MLP (NYSEARCA: AMLP) is down 5%, the Vanguard REIT Index Fund (NYSEARCA: VNQ) is off 5.5% and the Utilities SPDR ETF (NYSEARCA: XLU) has fallen 11%. Meanwhile, the S&P 500 is flat.

The reason being that as bond yields go up, investors will trade in high yielding stocks for the “safer” fixed-income securities.

Yet, things might not be as bleak as the market is indicating. Meaning, the recent sell-off of high yield stocks might be premature.

Specifically, REITs are interesting here, and not just from a yield perspective, but also the equity upside. Something you won’t get from most fixed-income securities.

This part of the market will continue to be steady revenue generators, because rent payments have to be made regardless of how the broader economy is doing.

REITs can also provide inherent diversification, as they generally have properties across a number of states. And by building out a portfolio with the top REITs in various industries, you can diversify even further — giving yourself a fairly diversified income portfolio with just REITs.

Even still, many investors are worried about what higher rates will do to REITs. So, with all the fear mongering of higher rates, let’s put things in context. Even when rates do start rising, the pace will be slow. It’s not like the Fed will be going from near zero rates back to 2% to 3% in six months.

The rate increase will likely be minor for a number of reasons, with the Fed being a victim of the circumstances it’s created.

The dollar is winning the global currency wars, which isn’t necessarily a good thing for many of the U.S. multinationals. The Fed would like to help the dollar renounce its leadership position, but raising rates would have the opposite effect.

Then there’s the fact that the economy might not be as strong as the Fed would like. Consumer spending has fell for two straight months and we haven’t seen a material boost in retail sales from lower gas. A significant rise in rates would stifle any economic growth we are seeing, which again is the opposite of what the Fed wants.

As well, there’s no rush to raise rates to help curb inflation. The Fed’s inflation rate target is 2% and we’re well below that at around 1.3%.

So we have the fact that the Fed’s rate increase will be minimal, but there’s also demand aspects that will help keep rates on fixed income securities relatively low. The demand from foreign investors for U.S. Treasuries is still high, which comes as rates in Asia and Europe are even lower than in the U.S. Increased demand should help keep a lid on Treasury rates.

And the 10-year bond yield is just under 2%, so it still has a long way to go before becoming more attractive than REITs; the Vanguard REIT Index Fund is yielding 3.6%.

With all that said, let’s have a deeper dive into some REIT names. Again, with the idea of building out a more diversified REIT portfolio that can weather an economic downturn and a Fed increase.

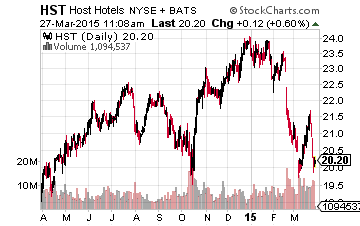

Hotel REITs have proven to be some of the better performing REITs and their yields are holding up nicely. Host Hotels & Resorts (NYSE: HST) is one idea, being a leader in the hotel REIT space. It offers a 3.9% dividend yield and is actually benefiting from increased business travel, which accounts for a sizable chunk of its traffic. One of the real beauties of Host Hotels is its stellar balance sheet, sporting one of the lowest debt-to-EBITDA (earnings before interest taxes depreciation and amortization) ratios in the space, coming in at less than 3.0x.

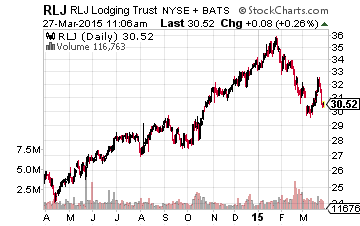

Then there’s RLJ Lodging (NYSE: RLJ), which pays a 4.3% yield. It’s a bit smaller than Host Hotels, but has been performing nicely as its upper midscale brands gain traction — such brands include Hyatt Place, Homewood Suites, Courtyard and Hampton Inn.

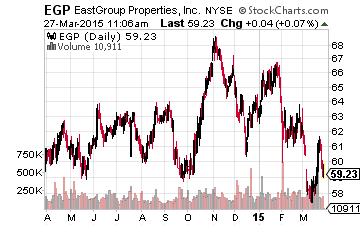

Meanwhile, there are other areas of strength, such as industrials. The likes of Eastgroup Properties (NYSE: EGP), paying a 3.9% dividend yield, is a key player here. It owns and operates industrial properties like distribution centers and business service spaces. Its speciality is on local distribution in the Sunbelt markets.

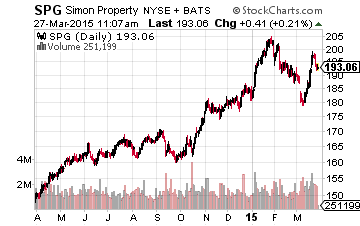

And let us not forget about the retail space. Simon Property Group (NYSE: SPG) is the leading mall operator in the U.S. Its dividend yield is the lowest of the REITs we have listed, coming in at 2.9%, but it’s going to give you exposure to a part of the economy that should benefit from economic growth. Granted, malls have taken some heat given the rise in online shopping, the nice thing about Simon Property Group is that it’s malls are in well-trafficked locations. It also calls many of the largest retailers its customers.

Then there’s the healthcare REITs, which are attractive given the rapidly aging population. Plus, thanks to healthcare reform, there’s been an increase in the number of individuals with healthcare coverage.

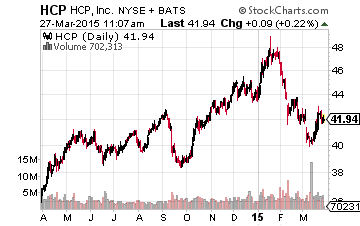

The leading player in this space is HCP (NYSE: HCP), offering a hefty 5.4% dividend yield. It has exposure to nearly all the major healthcare property types, including medical offices, hospitals, senior housing and skilled nursing facilities. Now, the beauty of HCP is that healthcare costs aren’t a discretionary item. This helps make healthcare REITs even less susceptible to the economic environment.

In the end, the fear of a rate hike is overblown and won’t tank your income portfolio. Essentially, the market has reacted to the news of a rate hike without taking into account other factors that impact debt yields and high-yielding stocks like REITs. The pace of a Fed rate hike will be minimal and cooler heads will prevail as the market rationalizes the fact that REITs are still out yielding major fixed income investments, while also being a steady long-term revenue generator.

Disclosure: None

I'm confused. Weren't these the same stocks that sold off big on rate hike fears?