When’s The Next Dividend Cut Coming For This 11% Yielder?

Pretty soon is my guess.

Mortgage REITs are popular with investors because of their high yields. Many of them pay double digits.

AGNC Investment Corp. (Nasdaq: AGNC) is one of them. It sports an 11% yield, but that’s likely going lower.

The company is a serial dividend cutter. AGNC’s dividend is 61% lower than it was just a little more than six years ago.

In early 2011, it paid a $5.60 per share annual dividend. Today, investors receive just $2.16.

The chart above shows that AGNC cut its dividend in each of the past five years since 2011.

Unless it raises its dividend this year, 2017 will be the sixth straight year of lower dividends.

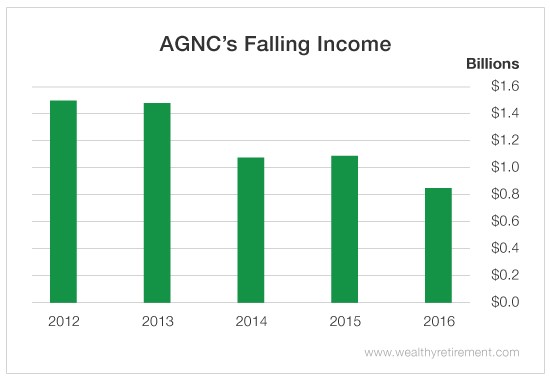

It’s not surprising when you see the following chart. The company’s net investment income (NII) has also been steadily falling.

This chart shows AGNC’s NII, which is a measure of cash flow for investment companies.

As you can see, NII has eroded over the last several years, which is why the company was forced to reduce its dividend every year.

There’s no NII estimate for 2017. Higher interest rates could help mortgage REITs, though it’s too early to tell if they will have much of an effect on AGNC.

There’s an expression that goes “When someone shows you who they are, believe them.”

AGNC is a company with declining NII and a shrinking dividend every year.

Management has shown you time and again who they are. Believe them.

Dividend Safety Rating: F

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker in the comments section.

Disclaimer: Nothing published by Wealthy Retirement should be considered ...

more