Urstadt Biddle Properties: 5%+ Dividend Yield And Growth From High-Quality Properties

Urstadt Biddle Properties (UBA)(UBP) is a high-quality REIT that has employed a successful strategy. It has targeted growth in a high-income, densely populated area of New York, with limited supply.

This has given Urstadt Biddle a durable competitive advantage, which has allowed the company to pay dividends for several decades.

The company has paid uninterrupted dividends for 46 years in a row.

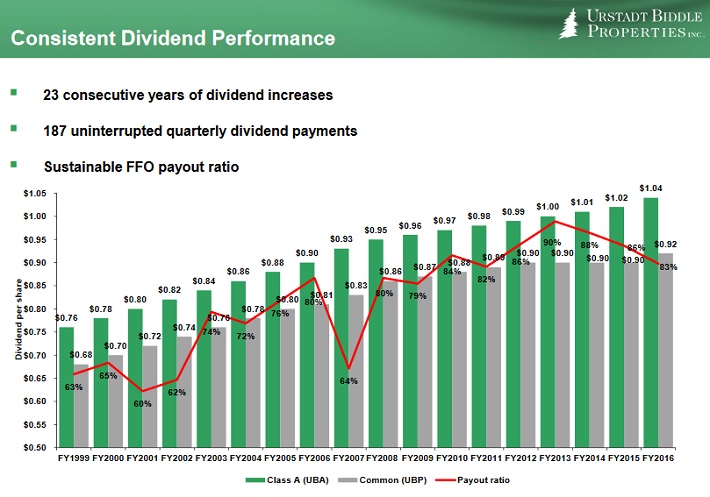

It has also increased its dividend payout for 23 years in a row. This qualifies Urstadt Biddle as a Dividend Achiever, a group of 264 stocks with 10+ years of consecutive dividend increases.

In addition to its dividend growth, the stock offers a high yield above 5%. It is one of 416 stocks with a 5%+ dividend yield.

This article will discuss how Urstadt Biddle’s successful real estate investment strategy makes it a strong high-yield dividend stock.

Business Overview

Urstadt Biddle owns, operates, and redevelops retail shopping centers, which are mostly located in the New York Metro area. It focuses on cities within commuting distance to New York City.

The company believes its properties provide several competitive advantages, including:

- Dense populations

- High local incomes

- High barriers to entry

This strategy has worked well. According to the company, the median household income within a 3-mile radius of UBP’s properties is approximately $95,400, which is 85% higher than the national average.

Source: NAREIT June 2017 Presentation, page 4

Urstadt Biddle has a strong property portfolio.

As of May 15th, 2017, there were 80 properties in the portfolio, 94% of which was leased. Annual base rent is approximately $22.28 per square foot.

The portfolio is sufficiently diversified across the following industry groups:

- Supermarket/Wholesale clubs/Drugstores (82% of square footage)

- Neighborhood convenience retail (8% of square footage)

- Regional centers adjacent to regional malls (8% of square footage)

- Office buildings/Bank branches (2% of square footage)

Urstadt Biddle’s portfolio strategy has led to strong growth rates for many years.

Growth Prospects

Urstadt Biddle’s growth is very impressive, especially for a REIT, which are typically slow-and-steady stocks.

From 2000-2016, Urstadt Biddle’s revenue and FFO both increased by 8.4% each year, on average. FFO, meaning funds from operations, is a non-GAAP measure typically used by REITs as an alternative for earnings-per-share.

Since REITs absorb high depreciation expense, which is a non-cash charge, FFO is widely seen as a more accurate measure of a REIT’s cash flow.

Urstadt Biddle’s growth has accelerated more recently. In 2016, the company grew FFO by 15%. On a per-share basis, FFO-per-share increased 12% from 2015.

The strong results continued in 2017. First-quarter FFO rose 19%, or 8% on a per-share basis.

A key piece of Urstadt Biddle’s growth strategy is investing in new properties. A few of its major acquisitions in the past year are as follows:

Source: NAREIT June 2017 Presentation, page 8

Generally speaking, Urstadt Biddle’s acquisition strategy is to focus on smaller properties that fly under the radar of larger REITs, which are accretive to future cash flow.

The company hit a bump in the road in the most recent quarter. For the fiscal second quarter, FFO-per-share declined 3% from the same quarter last year.

However, this should be a temporary slowdown. FFO was reduced after the Westchester sale. But, the sale has helped finance new acquisitions, such as the 36,500 square foot Van Houten Farms Shopping Center, among others.

The newly acquired properties will begin generating cash flow soon, which should return Urstadt Biddle to growth in future quarters.

Dividend Analysis

There are two classes of Urstadt Biddle common stock that investors can purchase, under the ticker symbols UBP and UBA.

The two classes are almost identical, except when it comes to dividends.

UBA stockholders will receive at least a 10% higher dividend than UBP. In return, UBA has 1/20th of the vote that UBP has.

Ownership of UBP is significantly made up of company management. As a result, UBP is not heavily traded. UBA is more liquid, since it has a higher degree of institutional ownership.

The decision for investors, is whether additional voting rights is worth a lower dividend yield.

In either case, Urstadt Biddle has maintained an impressive dividend track record. It has paid 187 uninterrupted dividend payments in a row, and has increased its dividend for more than two decades.

Source: NAREIT June 2017 Presentation, page 16

In addition to raising external capital, mostly through issuing equity, the company uses existing cash flow and property sales to fund acquisitions.

On March 1st, 2017, Urstadt Biddle sold its Westchester Pavilion property for $56.6 million. The company realized a gain of $19.4 million on the sale, not including closing costs.

Proceeds will be used to repay a portion of its $23 million revolver balance, and reinvest in existing and new properties.

Importantly, the dividend appears to be sustainable, given the company’s cash flow generation. It has a payout ratio of 83%, based on 2016 FFO.

The payout ratio has steadily trended down over the past several years:

- 2013 payout ratio of 90%

- 2014 payout ratio of 88%

- 2015 payout ratio of 86%

- 2016 payout ratio of 83%

The declining payout ratio is because company’s FFO growth has exceeded its dividend increases. This sets the stage for continued dividend growth going forward.

And, Urstadt Biddle has a strong balance sheet, which adds to its dividend sustainability. For example, the company has a debt-to-total assets ratio of 22%, which is fairly low.

Most of its capitalization (62%) comes from equity, with another 16% from preferred equity. Only 22% of capitalization is derived from mortgage debt, which has low rollover rates moving forward.

There are no rollovers in 2018, and only $27 million of rollovers in 2019. This will help the company navigate rising interest rates, while continuing to raise its dividend.

Final Thoughts

You may have heard that retail is dead, but Urstadt Biddle proves that is far from reality. A high-quality portfolio and a savvy acquisition strategy have fueled the company’s consistent dividend growth over the past 23 years.

As the stock market keeps hitting fresh records, while interest rates remain very low, high yields are hard to find.

But, for investors looking for a strong company with a 5%+ dividend yield, Urstadt Biddle is worth further consideration.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more