These 6 REITs Are Increasing Dividends In December

Buy shares in these six stocks for a steady and increasing income stream that is much safer than junk bonds and yields much higher than CDs. Once these stocks announce their dividend increases look for their shares to pop.

I live for dividend increases. My investment approach is to find stocks with attractive yields that will grow those dividend payments over time. One strategy that can often give a nice increase to your brokerage account value is to buy REIT shares before they announce a new, higher dividend rate.

A significant portion of the REIT universe announce dividend increases at about the same time each year. On an individual company basis, the announcements happen almost every month of the year. Although these payout increases are very regular, few in the investing public know or track when a new higher dividend announcement is due. A higher dividend rate often results in some additional buying and an increase in the share price. With the information that a dividend increase is pending, you can either buy while shares are low to boost your investment yield or go for a shorter term trade to make a quick profit.

Historically December is an active month for higher dividend announcements. My database includes about 90 REITs that have increased their dividends in the past year. Here are six companies that have a high probability of announcing a new, higher dividend rate in December.

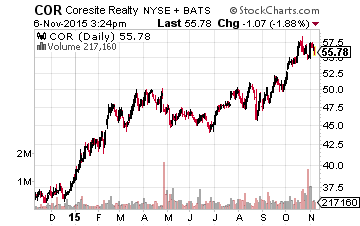

CoreSite Realty Corp (NYSE: COR) is an owner and operator of data center real estate properties. The company currently owns 17 data centers in eight markets that blanket the U.S. from Miami to Boston to Denver to Silicon Valley. Funds from operations (FFO) per share has grown at a 23% annual compound rate over the last three years. In December 2014, the COR dividend was increased by 20% and the payout was increased by 30% in 2013. This is a high growth rate REIT. The dividend announcement should come in the first week of December with an end of the month record date and mid-January pay date. COR yields 3.0%.

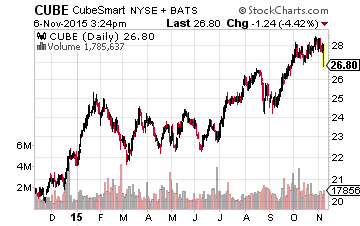

CubeSmart (NYSE: CUBE) owns and operates self-storage facilities. The company owns 440 facilities with almost 30 million rentable square feet. Last year the dividend was increased by 23%. To date in 2015, FFO per share is up over 20% so a similar dividend increase is in the cards. Historically, CubeSmart announces a new dividend rate in mid-December with an early January record date and middle of the month payment date. CUBE yields 2.3%.

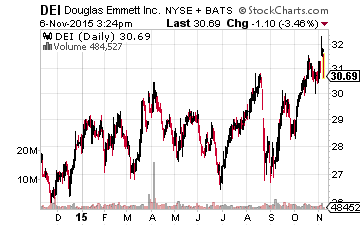

Douglas Emmett, Inc. (NYSE: DEI) owns and operates office and multi-family rental properties in the Los Angeles, CA area and Honolulu, HI. The company assets include about 15.5 million square feet of class A office space and 3,300 apartments. Douglas Emmett has been increasing its dividend on an annual basis since 2010. For the last three years, a higher dividend rate has been announced in the first week of December with an end of month record date and mid-January pay date. Last year the dividend rate increased by 5%. DEI currently yields 2.7%.

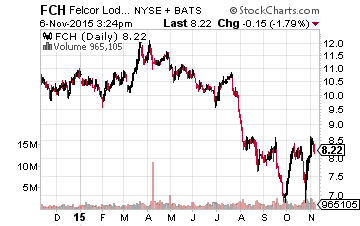

FelCor Lodging Trust Incorporated (NYSE: FCH) owns a portfolio of about 40 upper-scale and luxury hotels. The company started paying a dividend in January 2013 at 2 cents per share. In December last year the dividend was doubled to 4 cents. FFO per share is growing at an annual 20% year-over-year rate and was $0.24 per share for the 2015 third quarter. The next dividend will be announced at the end of December with a mid-January record date and an end of January payment date. There is lots of cash flow headroom for another high-percentage dividend hike. FCH currently yields 1.9%.

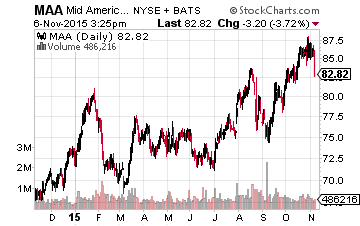

Mid-America Apartment Communities Inc (NYSE: MAA) lives up to its name and owns multi-family assets in the Southeast and Southwest regions of the U.S. Currently, the REIT owns over 250 communities with 79,000 apartments. Mid-America Apartment Communities has been a steady dividend grower since its IPO in 1994. Since 2010 a higher dividend rate has been announced in early December for the dividend to be paid in mid-January with a January 1 record date. Last year the dividend was increased by 5.5%. For the first three quarters of 2015, core FFO per share is 11% higher than in 2014. MAA yields 3.7%.

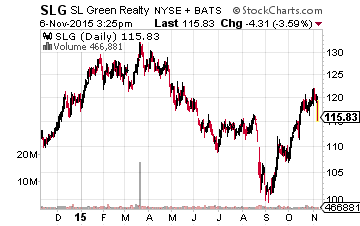

SL Green Realty Corp (NYSE: SLG) owns interests in commercial office properties in the New York Metropolitan area, primarily in midtown Manhattan. They also provide property management services for other office building owners. In addition to the real estate assets, SLG owns about $1.5 billion of debt and preferred equity securities. This is another high dividend growth rate REIT. Last year the SLG dividend was increased by 20%. FFO per share for the first three quarters of this year is double the dividend rate. The next dividend rate will be announced any time in the first half of December with an end of the month or first of January record date and mid-January payment date. SLG yields 2.1%.

December looks attractive if you like high dividend growth rate stocks. Share prices are fighting the effects of an interest rate increase from the Fed, and a large dividend rate increase could put some stability back into a share price.

Finding companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and consistent dividend growth in stocks is what has given me the most consistent gains out of any strategy that I have tried.

Disclosure: more