The 11% Dividend Stock No One Knows About

I was shocked! On Friday of last week I was making a presentation at the Orlando MoneyShow on the topic of “Building a High-Yield Stock Portfolio for Investors Who Want Cash Income Now!” The room was packed with over 100 attendees and when I asked if anyone owned shares of a REIT, about half the room stuck up their hands.

A little later in the presentation, I wanted to use a specific high-yield REIT as an example, so I asked who owned this particular stock. When I named this stock, I was very, very surprised when not one person raised a hand. This finance REIT yields over 11%, has paid two additional special dividends since doing its IPO spin-off in May 2013, and in December announced its first dividend increase, boosting the payout to investors by 8.5%. Yet out of a whole room of seasoned, income-focused investors, not one had discovered this gem of an income stock.

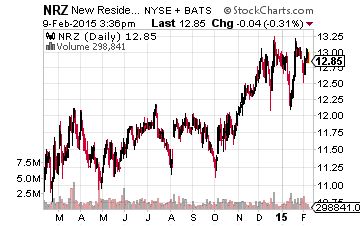

The REIT I asked about in my presentation is New Residential Investment Corp. (NYSE:NRZ). New Residential was spun-off with a May 2013 IPO by Mortgage REIT Newcastle Investment Corp. (NYSE: NCT) and is a significant part of the portfolio of The Dividend Hunter. Newcastle had accumulated a portfolio of specialized, mortgage servicing rights assets, known as MSRs in the REIT world, which were transferred and became the core holdings of the new REIT – NRZ. New Residential looks for above average return prospects in a range of primarily real estate related financial assets. The company currently holds the following types of investments:

- Mortgage servicing related assets: 5% of portfolio. Mortgage servicing companies receive a portion (usually 0.25%) of the interest paid on residential mortgages. It costs less than the servicing rights to actually handle the mortgage paperwork, producing excess mortgage servicing rights. New Residential buys the right to receive future excess MSRs covering pools of mortgages at a discount. Servicing rights are expected to produce a 15% to 20% annual return. Since starting with these investments in 2012, returns have been right in the middle of the expected range.

- Residential securities and loans constitute 10% of the portfolio. The company invests in non-performing loans, re-performing loans, and non-agency qualified mortgages. Expected returns on invested capital are 12% to 20%.

- Other investments account for 36% of holdings. Currently this category consists of an investment in a pool of consumer loans. Expected annual return on is 20%+.

- Cash: At the end of the 2014 third quarter, New Residential was holding cash equal to 20% of its portfolio investments. Management believes it can put this money to work in investments that will generate 15%+ annual returns.

The company’s relationships in the finance industry have helped New Residential find and invest in niche type of mortgage related investments that can produce 15% or better returns. In October 2014, New Residential approved a 1 for 2 reverse stock split, which resulted in a split-adjusted $0.35 quarterly dividend. In December the dividend was increased 8.5% to $0.38. NRZ currently yields 11.7%.

New Residential gets lumped together in investor minds with other, more interest rate sensitive high-yield REITs. In reality, this is a dividend growth stock with the potential to generate growing cash flow in all market conditions. Income investors can improve their results by digging into lesser known stocks to dig out the nuggets like NRZ.

I recommended this REIT to The Dividend Hunter subscribers in August 2014.

The Monthly Dividend Paycheck Calendar is set up to make sure you’re getting ...

more