Tanger Realty Is A Dividend Champ

Tanger realty is a bit over its 52-week lows, but we think there is still plenty of value in this dividend champion. Yes, we know mall REITs are struggling. Yes, there is a shift towards more online competition. Yes, rates have played havoc in REITs in general. However, SKT has done a substantial amount of work on replacing its underperforming tenants and even added some new, and much stronger, tenants to the mix. With all of the fear, we think value is being hidden here as the stock get pounded. Take a look at the action in the stock.

Source: Yahoo Finance

That is a pretty ugly chart, we can all agree. While it appeared there may have been some bottoming action in late fall, that was short lived as 2018 has seen immense pressure once again.

Here is the issue. In 2016-2017 anything to do with retail was beaten up, with little exceptione. Foot traffic happens to be down in many stores, while competition is fierce, particularly online. That all said, we think the negative catalysts of rate hikes and retail fears are more than baked into the stock here. Let us discuss the company a bit and why we think there is value as we approach $20. This is because we think the retail landlords are oversold. This especially true for those that have solid occupancy and agreements with long-term customers. We will add that our coverage of the retail sector suggests many of the occupants who do business with Tanger are going to survive online blitz.

What is more, there is room for growth, but the company is conservative on this front. anger’s properties are in 22 states, as well as in Canada. We know that the company has staying power. It has been operating for nearly four decades, and currently boasts nearly 200 million shoppers annually. While this is most definitely counting repeat customers, it is still impressive. What we think is more impressive is that unlike other major REITs, such as Realty Income (O), there is a lot of room for growth.

Source: Tanger 2017 presentation

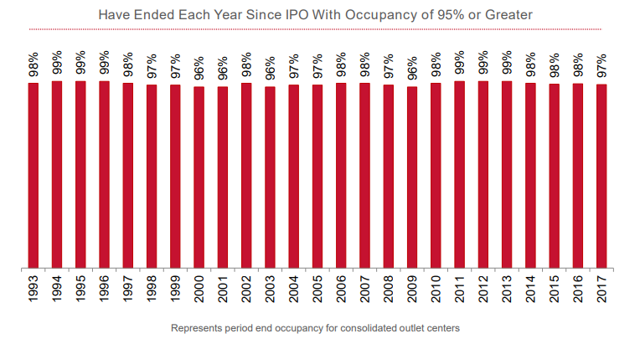

This begs the question of “how does Tanger make money?” Well, Tanger leases its ideally placed locations outside of major urban areas at rates that ensure occupancy whilst remaining competitive and protecting the top line. Despite pain in retail, Tanger’s portfolio is strong and storefronts do not remain empty for long. We are impressed by the occupancy data. With occupancy of 95% or greater since the initial public offering, the top line has always been strong, despite a recent decline from 99% to 97% occupancy.

Source: Tanger 2017 presentation

With this strong occupancy, we should discuss performance. Now, we do want to point out that like we saw with retail names, Tanger had a great Q4 report. In the company’s Q4 report, it actually beat on both the top and bottom lines against consensus expectations. It was a bit of a turnaround quarter after a terrible year.

First, income. In Q4 2017, net income was $0.33 per share, or $31.2 million, compared to $0.25 per common share, or $23.8 million last year. It is important to realize there were no asset sales in the quarter trumping up these numbers, which strengthens the year-over-year comparison.

Funds from operations are a strong way to look at REITs. Year-over-year, we saw an improvement once again. Funds from operations came in up 11% to $0.68 per share. Making adjustments comparability, we see that adjusted funds from operations were up 8% to $67.5 million, or $0.61 per share.

Ultimately, we want to know if the company is making money (it is) and if the dividend is covered. Well, the key here is that at this level, we have sufficient dividend coverage of the $0.3425 quarterly dividend that was paid out. That is what we care about. Is the dividend covered? The answer 100% yes.

This is why we are buyers. The dividend has been more than covered from funds from operations every quarter even during this downturn. It is not unheard of from the company to pay out a special dividend as well. We fully believe this dividend coverage will continue for years to come.

We hold no position in SKT but plan to initiate at $20

Quad 7 Capital is a leading contributor with various financial outlets, and pioneer of the BAD BEAT Investing philosophy. If you like the ...

more