Screening To Shield REIT Yield Hogs From The Butcher’s Knife

Income investors know all too well, especially in today’s still-stingy environment, that high yields typically come with high, often too-high as it turns out, risks. But there are “inefficiencies” to be found, especially with Real Estate Investment Trusts (REITs), where Mr. Market often waffles between seeing stock-like securities or ownership interests in real estate. This opens up opportunities for venturesome income-seekers to find unexpectedly high yields on unexpectedly good-quality REITs.

They Look Like Stocks

REIT units are often confused for common stock. That’s not surprising since they trade in the same marketplace the same way using the same brokers using a familiar ticker protocol, order entry protocols, conformations, etc. The entities also report financials the same way.

But They Aren’t Stocks

The T in REIT strands for Trust. For most purposes, the difference between a publicly-traded investment trust and corporation is confined to obtuse legalese about which we needn’t worry, except that there is one thing we can’t ignore: Trusts are not taxed the way corporations are. Unlike a corporation, a bona fide REIT (i.e. one that is operating as a REIT should) pays no taxes and distributes substantially all of its profits to the unit holders (shareholders) as dividends.

This, of course, has no impact on yield; that’s determined by how Mr. Market chooses to price the units. But typically, they are priced such as to make for higher yields than is typically seen on corporate stocks of comparable business risk. There are several reasons for this.

- Because REITs are, in effect, paying dividends from the equivalent of pretax earnings (as opposed to corporations, which can only distribute after-tax earnings), REIT dividends are more generous (a target 100% payout ratio will do that) and are taxed as ordinary income, rather than at lower rates accorded to what the I.R.S. deems “qualified” dividends.

- Because REITs have to pay out all of their income as dividends, the notion of internal growth (growing by reinvesting profits) does not exist, as it does for corporations. To grow, a REIT must obtain new debt and/or equity capital. The only thing it can do without external financing is trade its portfolio of properties with the idea of selling slow growers and replacing them with more promising properties.

- Because internal growth is not part of the picture here, an important motivation that causes investors to tolerate low or non-existent yields is absent. Low growth is the other reason (besides high risk) why a yield might be higher.

- Because REITs can’t retain earnings, there is no rainy-day stockpile that can be tapped in down years, meaning that dividend fluctuations are more likely than with corporate dividends. Lower dividend security, even for good quality REITs, also tends to push yields higher. (In other words if REIT A and Corporation B have identical levels of business risk, A’s dividend will be less secure simply because it has no surplus that can be used to fund the dividend in down years; on the other hand, shareholders get 100% of what A has but a small percentage of what B has because the IRS and the Board’s desire to retrain earnings come ahead of shareholders).

So REITs are of interest for income seekers who aren’t bothered by the ordinary income tax status of the dividends, either because the units are held in non-currently-taxable accounts or because the owner’s tax bracket is such as to allow for better after-tax returns even after factoring in the non-qualification.

Hence REITs Should Be Evaluated Differently

The absence of internally-funded growth and the mandatory pass-through of profits to shareholders strengthens the relationship between the shareholder (for convenience, I’ll use the language of stocks) and the business itself. It’s said by some in the guru-sphere that investors should think of themselves as owning stakes in real businesses rather than pieces of paper (or nowadays, digital memos). For the typical corporation, however, that’s often impractical given the way the wide discretion enjoyed by corporate managers can and typically does keep large walls between shareholders and the business.

The link is, on the other hand, clearer with REITs. If you own a REIT that has an office-building portfolio, your fortunes, or lack thereof, will be tied to the ebb and flow of the office markets just as if you actually had your name on the deeds as a part owner and signed onto the contract that hires a property management company. If you own units of a healthcare REIT, you’re tied to the healthcare markets in the locales touched by the property portfolio. Etc.

Because of this, I chose to assess and screen for REITs using the sort of metrics I’d be looking at if I were investing directly in the real estate. In that case, I’d be most wired in to “cash-on-cash (COC) return” which, essentially, is pretax cash flow divided by total investment (equity — typically down payment — plus closing-related costs and if relevant, renovation costs). I’d need a satisfactory COC return right now unless I had serious and credible expectations of capital gains down the road (if I were buying property in an area I expect to gentrify, I’d even take a negative COC return right now expecting to take a big profit by selling down the road, or maybe by getting high rents later; in the latter case, I’d have to add rehab costs to the denominator (the investment amount) part of the equation. But absent something like that, I’d really need to see a good COC return right now.

COC return is not included in public reporting of REIT financials. Also, COC is a property-specific rather than firm-wide measure. So as is often critical to all of investment analysis, I must approximate. I believe Funds From Operations (a REIT-specific figure that is publicly reported) divided by Total Equity. Funds from operations is standard Net Income plus Depreciation and Amortization plus or minus capital gains or losses incurred through the sales of properties. Again, this is an approximation for the aggregate of all COC figures for all properties. But I think it gives public shareholders the same sort of message bona fide COC figures give to the operator; information on overall effectiveness. If COC return is too low, there’s a good chance the REIT is putting more cash into properties than it should. is not doing a good job getting as much return as it could, or simply owns too many weak properties.

Like corporate return on equity, a REIT’s COC return can be boosted, sometimes sharply, by the aggressive use of debt. That’s all well and good if plans and dreams come to fruition. But as too many learned about 10 years ago, often reality disappoints and at such times, overly leverage real estate properties, REITs and corporations all face the same consequence and it’s typically ugly.

But we do have to allow for the notion that even the best REITs will be more debt-heavy than a business corporation of comparable quality. Because REIT’s can’t fund growth internally, and because secured borrowings (construction loans and then mortgages) are so much a part of like in the world of real estate, which is a classic OPM (Other People’s Money) business.

But even here, borrowings can’t be unlimited and if you ever applied for a mortgage or a construction loan, or a private (“hard money” loan to support a fix-and-flip, you know that the amount a lender will lend is going to be based on a percent of property valuation (the “appraised” value, the “ARV” or after-repair value, or something like that) the idea being to give the lender a margin for error if you can’t pay and it has to take the property, sell it, and use the proceeds to pay beck the debt. So when evaluating REITs we accept leverage as normal, and a higher level than we might for a corporation but we still remain sensitive to the potential of a degree of leverage that is excessive.

Building a REIT Dividend Screen

I’m looking for here-and-now income. Suppressing current income to allow for big gains down the road is something that could be appropriate for me to do with a property investment whose story I personally research and develop. But when it comes to delegating authority to nameless faceless managers, as we all do when we enter the public securities markets, I want them to stick to the basics. So I’m unapologetically aiming for yield. My goal is a 5-REIT portfolio consisting of the five highest yields.

Sorting on the basis of yield and picking from the top is reasonable only if one heavily pre-qualify the list to eliminate REITs most likely to bring disaster down on me (the highest yields get that way because Mr. Market is scared of the companies and pushes price down and although Mr. Market has been depicted as a manic-depressive nut case by the likes of Ben Graham and Warren Buffett, I’ve actually seen that when it comes to assessing dividend risk, Mr. Market tends to be a lot more proficient than many realize). The job of the screen is to do the pre-qualification.

The Recipe

- I start by eliminating a sub-group known as mortgage REITs. I want genuine real estate operations, not wannabe-but-less-regulated banks. The data I use doesn’t work for them and I’m not confident in my ability to evaluate the kinds of risks they present.

- Next, I try to weed out dividend problems that have already surfaced. I ban REITs that have eliminated the dividend in any of the last four quarters. In a perfect world where we could always count on dividend achievers, dividend aristocrats, etc., I’d also expel REITs that have reduced, but not completely eliminated, the dividend in any of the past four quarters. But if I’m going to focus on business factors, I have to cope with the reality that sometimes, things get choppy. As pass-through entities, REITs don’t have as much leeway to pay out much smaller portions of earnings; a practice corporations use to smooth things when they hit some turbulence. Hence even good, worthwhile, REITs are going to reduce payouts every now and then. I’m trying to reduce the likelihood this will happen in the future while I hold the shares, but if I wag my finger every time it happened in the past, I’ll wind up eliminating far too many meritorious operations. So I’ll tolerate reductions in dividend over the past four quarters, so long as the drop wasn’t so severe as to be the functional equivalent to an elimination.

- The next test may come as a surprise considering the expressed ideal of aiming at the top of the high-to-low yield sort: No REIT makes it into the sorting if its yield is in the top 10% relative to the REIT group. As noted, Mr. Market is remarkably good at recognizing the most dangerous income plays and signaling the world by pricing the securities such as to push yields up to the stratosphere.

- Now I look at COC return and limit consideration to REITs that rank in the top 50% of the group when the numbers are calculated for the trailing 12 months and also over the past three years.

- Finally, I address (debt) leverage; I won’t invest in a REIT with a debt-to-equity ratio above 2, which by Real estate standards, is conservative.

- From among passing REITs, select the five that have the highest yields

- I refresh the screen and reconstitute the portfolio, as needed, to equal weighting, every four weeks.

Testing the Model: Past Performance and Future Prospects

This is the place where I’d be expected to dazzle you with tables and/or illustrations showing spectacular back-tested performance. That’s not going to happen. This is a case where the standard boilerplate to the effect that past performance does not assure future outcomes is more likely to cast test results in a favorable rather than an unfavorable light. A yes-no decision on whether to use the model should always be based on the appeal of the strategy rather than the results of a test, but here, that imperative is more clear cut than usual.

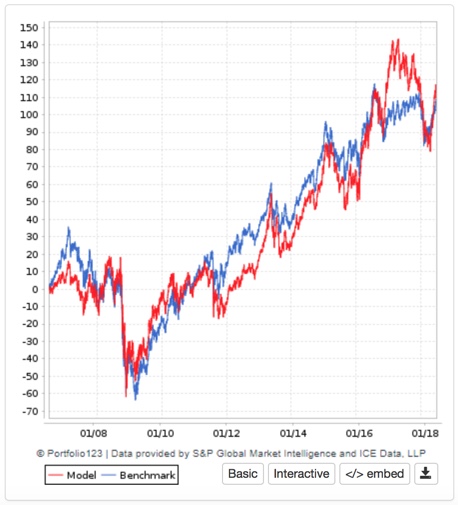

The approach used in this screen produces the REIT equivalent of low-beta high-stability consumer staples-type stocks. We’re going for quality, not swinging for the fences. We expect to underperform when the bull is stampeding, and outperform when the market and economic environments are challenging.

For much of the time covered by the backtest period (post 2008), real estate was on fire — in a good way. The economy was fine and rising property values often made it easy to escape the consequences of bad operating decisions. Aggressiveness was rewarded; prudence wasn’t. The backtested performance of the model reflects just that; actually, all things considered, I’m satisfied by how close the hypothetical portfolio based on the screen came to the REIT benchmark I used (VNQ, the Vanguard REIT ETF) .

Figure 1

The real story of this test is to be found, not in a set of start-to-end statistics such as return, beta, alpha, etc. but in the results of rolling tests where a set of portfolios was formed each week and run for four weeks.

Table 1

| Avg. of 4-week Tests | Average Return % | ||

| Portfolio | VNQ | Port. Excess | |

| Last 15 Years | |||

| All | 0.51% | 0.90% | -0.40% |

| Market Up | 3.27% | 4.34% | -1.07% |

| Market Down | -4.24% | -5.00% | 0.76% |

| Last 10 Years | |||

| All | 0.72% | 0.82% | -0.11% |

| Market Up | 4.32% | 4.58% | -0.26% |

| Market Down | -4.94% | -5.07% | 0.13% |

We see what we expect to see; superior performance for the model during down periods, but laggard behavior during good times. The question we have to ask is what we expect going forward.

I don’t expect a bull or bear REIT market per se. What I do expect is a REIT market that will be different from what we’ve seen in the test periods.

First, I have to issue a caveat that applies not just here but in anything I would have to say about any equity investment. I’m presuming that tariffs won’t lead to an economically destructive trade war. If things turn out badly, REITs will get caught up, albeit not directly and not on the front lines (economic shocks will have to work their way through all the intermediate factors that ultimately lead to leasing activity, rent levels, sale prices, etc.). If REITs do eventually sustain damage, they won’t by any means be alone; it’ll be pretty much the whole equity market. This aside . . .

I don’t envision a real estate recession or depression. Different segments of the real estate industry behave differently based on the economic characteristics and dynamics as play in their respective areas. While there are likely to be pockets of challenge here and there (suburban shopping malls for example), I expect real estate as a whole to move forward with the overall economy and for COC return to be able to point us away from troubled REIT sub-sectors, or at least steer us toward REITs outperforming troubled sub-sectors.

But it’s inevitable that the interest environment in which we’ll all operate will be vastly different. Almost all of the backtesting came against the backdrop of a bold and historic downtrend in interest rates. That was a climate in which bad decision-making was bailed out by Uncle Fed and prudence pushed to the back of the pack.

Looking ahead, even without a 2008-like banking crisis, less thoughtful real estate players will, I expect, find themselves in a new world in which the best case scenario would be for interest rates to move sideways. The alternative is to go higher. Either scenario will mean that bad decisions won’t any longer be perfumed over by Uncle Fed and place a bigger premium on making money the old fashioned way, by doing things well. This is why I expect operating proficiency (as reflected in cash on cash returns) and sensible approaches to risk (as reflected in my limitation on leverage) to be favored in the future. In other words, with REITs, I expect past performance (in which often reckless behavior benefitted from the falling-interest-rate tailwind) to be quite the different from what is likely in the future.

Transitioning From Old to New

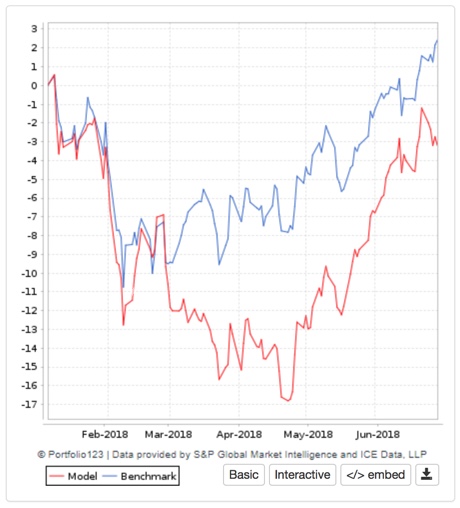

Change can be perplexing and confusing. That can be seen in the bizarre performance of this strategy since I started using it with real money (Figure 2) and in the rolling 4-week tests conducted over the past year (Table 2).

Figure 2

Table 2

| Avg. of 4-week Tests | Average Return % | ||

| Portfolio | VNQ | Port. Excess | |

| Last 12 Months | |||

| All | -0.79% | 0.03% | -0.82% |

| Market Up | 1.62% | 2.16% | -0.53% |

| Market Down | -3.75% | -2.58% | -1.17% |

Early in this brief test period, income investing as a whole was slammed by the market and REITs with higher yields (i.e. with their income characteristics especially highlighted) were slammed to a greater extent. But none of this reflected bona fide analysis; such as, for example, the way dividends can grow in a strong economy that causes rates to rise, or the beneficial impact of the way higher immediate dividend payouts can be reinvested at rising rates or the commonsense notion that when an investment is challenged, it’s better to get bigger portions of total return paid in cash up front.

I believe the market is usually tolerably rational but never immune to the kinds of logic breakdowns cynics assume are always present. We’re most ripe for this sort of thing when confronted with something new, whether it be the so-called new economy of the turn of the century, or as we see now, the ongoing shift to an interest rate paradigm not seen during the lifetimes or at least adult lifetimes of many (perhaps most) of today’s market participants (who need to learn from scratch how to function in a world without falling interest rates).

Transitions to newness can be painful, perplexing, irritating, etc. but history has shown that eventually, the market figures things out. This is why I’m willing to ignore the test results and even early disappointment seen in the live performance information, and stick with what I believe to be the future of REIT investing; income as opposed to expectations of big gains in asset values, sensible (by real estate standards) limitations on borrowings, and indications of sound REIT management, as reflected in COC return.

The Passing REITs

The five REITs that pass the screen are:

Brixmor Property Group(BRX)

CoreCivic(CXW)

Kimco Realty(KIM)

National Health Investors(NHI)

W. P. Carey(WPC)

Here are the Yield, COC Return and Leverage tallies.

Table 3

| % Yield | Cash on Cash % Return | Total Debt to Equity – MRQ | ||

| TTM | 3 Yr Avg | |||

| BRX | 6.31 | 21.77 | 21.75 | 1.95 |

| CXW | 7.20 | 18.10 | 20.23 | 0.99 |

| KIM | 6.59 | 12.52 | 11.96 | 1.01 |

| NHI | 5.43 | 16.89 | 17.89 | 0.87 |

| WPC | 6.15 | 15.51 | 15.01 | 1.26 |

| Portfolio | 6.34 | 16.96 | 17.37 | 1.22 |

| REIT Universe | 3.09 | 12.27 | 12.52 | 2.28 |

| VNQ Benchmark | 4.36 | |||

Data from S&P Compustat via Portfolio123.com and reflects Compustat standardization protocols, TTM = Trailing 12 Months, MRQ = Most Recent Quarter

Conclusion

Real estate is often proposed as a stand-alone asset class that should be included in a fully-diversified portfolio given low correlation to stocks and fixed income. I’m not going to go there. Regardless of what a statistical report card might show for a specific measurement period in the past, going forward, I see real estate as part and parcel of the economy and the REITs as part of an income universe.

Sometimes, real estate will turn out to be better than other income choices. Other times, it won’t. It’s fine, if you wish, to enter or exit this group as per your views on the relative merits of real estate.

Beyond that, though, there’s the human element of real estate. We as a species have an attachment to it in ways that transcend financial consideration or even the utils that get counted up in utilitarian theory that’s supposed to serve as a foundation under financial theory. I’m not proficient in the language of behavioral finance (which is where this may belong), but I’m enough of a history buff to know how much warfare and political upheaval has been and still is based on land ownership and use, and enough of an observer of the world around us to note that even 2008 barely dented the popular love affair with real estate. So in my view, it’s perfectly fine to dabble here with what some regard as the “fun money” portion of their portfolios, especially if one can get such a good yield on such entertainment.

Disclosure: None.

I liked how you used a paradigm of directly investing in the Real Estate assets yourself, in order to analyze the RIET investment candidates. Do you ever find yourself researching areas that companies in which you invest buy properties? This would follow logically from the perspective of direct investing. When I invest in equities, I also use the perspective that I'm a part-owner of the business (which you referenced), and I find it trickles into the total approach I use for analysis. In the case of RIETs, examining the individual areas (but not the individual properties- that would be cumbersome for an individual investor) would potentially yield additional insights in the investment. What has been your experience in this area? Do you find this to be true?

Thanks for the great article!

I don’t do that becasuse I don’t have the expertise to second-guess management. I figure that if the #s are good, management earns the right to be trusted in their judgments. (This is where publicly-owned entitites differ from closely-held companies. There’s a limit to how far we can take the part-owner idea.)

Right, that makes sense. The contrast between public and private ownership seems very valid. Thanks for your answer!