Real Estate Investing Basics

Key Takeaways

- You should consider getting started in real estate investing if concepts like financial stability or creating sustained wealth resonate with you.

- Be sure to avoid rookie mistakes by taking tips from the pros into consideration.

- Follow our step-by-step guide to getting started in real estate to see if you have what it takes.

If you are someone who has recently gotten a taste for real estate investing, you are probably looking for a great real estate investing 101 crash course. Although it is impossible to learn all of the pertinent real estate investing basics in a short amount of time, by actively searching for a resource, you have already set yourself up for success. Read on to receive an overview of the basics of real estate investing and how to get started.

Why Should I Get Started Investing In Real Estate?

You should consider getting your start in real estate investing if any (or all) of the following statements resonate with you: “I have a genuine interest in real estate,” “I want to achieve financial stability,” “I wish to create wealth for myself and for my family,” “I am interested in changing or supplementing my career,” “I need a way to secure my financial future.”

If you agreed with any combination of the statements above, getting into real estate 101 and exploring the basics of real estate investing can be a great way to get your feet wet. Real estate investing is a great way to build wealth, either as a career or as a supplemental activity. However, it is best left for driven and passionate individuals who are willing to put in hours of hard work and research. Find out if you naturally possess the traits of a successful real estate investor, here.

For those wondering “how much money do you need to invest in real estate,” it should be known that it is possible to get started with little to no personal capital. Part of learning real estate 101 includes getting to know the various kinds of financing strategies, which include how to invest in real estate with no money and bad credit. Before getting started, however, it is important to reflect upon and identify your personal and financial goals. Since the realm of real estate investing is so vast, it can be easy to lose focus if you do not have a clear vision. By being mindful and aligning your investing strategies in such a way that will help you meet this vision, the more likely you will be to find success. Start devising your strategy by exploring some of the most common types of real estate investments, which include wholesaling, buy and hold real estate, and rehabbing.

Types Of Real Estate Investments

-

Wholesaling: Wholesaling real estate is a popular way for individuals to get their foot in the door, as it requires little to no personal capital. Over the course of the wholesale process, the investor serves as a “middleman” that connects sellers with buyers. Typically, a wholesaler will first identify a property being sold for under market value, and arrange for the contract to be assigned to another buyer, such as a rehabber. The wholesaler makes a profit by charging a service fee. That, or they will conduct a double close.

-

Buy And Hold: “Buy and hold” refers to a strategy through which an investor acquires property to retain under ownership over an extended period of time. The property will likely appreciate in value over time, and can be sold when the market is most favorable. Many investors will rent out these properties as a means to create cash flow in the meantime.

-

Rehabbing: Reality television shows have made the concept of rehabbing, or “fix and flip,” quite popular in the last few years. In an ideal world, an investor will purchase a distressed property, invest the capital to fix it up, and sell it at or above market value for a profit. However, new investors should understand that this strategy does come with risk, and requires a significant amount of skill, diligence and patience.

Real Estate Investing Basics: Top Tips From The Pros

There is no better type of real estate investment 101 than the type of advice you can glean from industry veterans who have learned lessons through years of experience. Make sure to take some of these top tips on real estate investing basics to heart:

-

Make your goals very specific by setting a timeline, and making them realistic and measurable.

-

Find a mentor who is willing to sit down with you and help you analyze your first few deals and contracts.

-

Prioritize your networking activities. You will be surprised at how many of your deals and funding opportunities will come from personal references.

-

Spend time meeting with different types of lenders so that you learn eligibility requirements and see what areas you can improve upon.

-

Arranging a partnership for your first few deals, one where you put in much of the grunt work in exchange for your partner’s funding and experience, can be a great way to learn on the job while mitigating risk.

-

Adding a savvy real estate agent to your team of professionals can help you gain access to property listings on the Multiple Listing Service (MLS).

Real Estate Investing For Beginners: Mistakes To Avoid

When analyzing different scenarios on what could go wrong for beginner real estate investors, almost all mistakes can be attributed to a lack of research or preparation. For example, a common mistake is assuming that your location of residence will render itself the best investment market. Instead, spend time researching different neighborhoods and make your selection based on key indicators such as local schools, employment rates, job growth, and average rental rates. Be sure to select your target market strategically for your specific investment property type.

A second common rookie mistake is rushing into a purchase just because a property is being sold for what appears to be a great price. There are many things that can go wrong in this scenario. Investors should make a practice of always, without fail, minding due diligence and running their numbers to make sure that the deal will actually deliver a profit. A helpful practice is to always arrange for a property inspection before committing to a deal, so as to be able to estimate possible expenses as accurately as possible.

These two common mistakes should serve as examples that demonstrate how an investor’s lack of research and diligence can lead to their own demise. Learning the basics of investing in real estate should focus largely on analyzing markets and deals extensively, so that educated, measured decisions can be made.

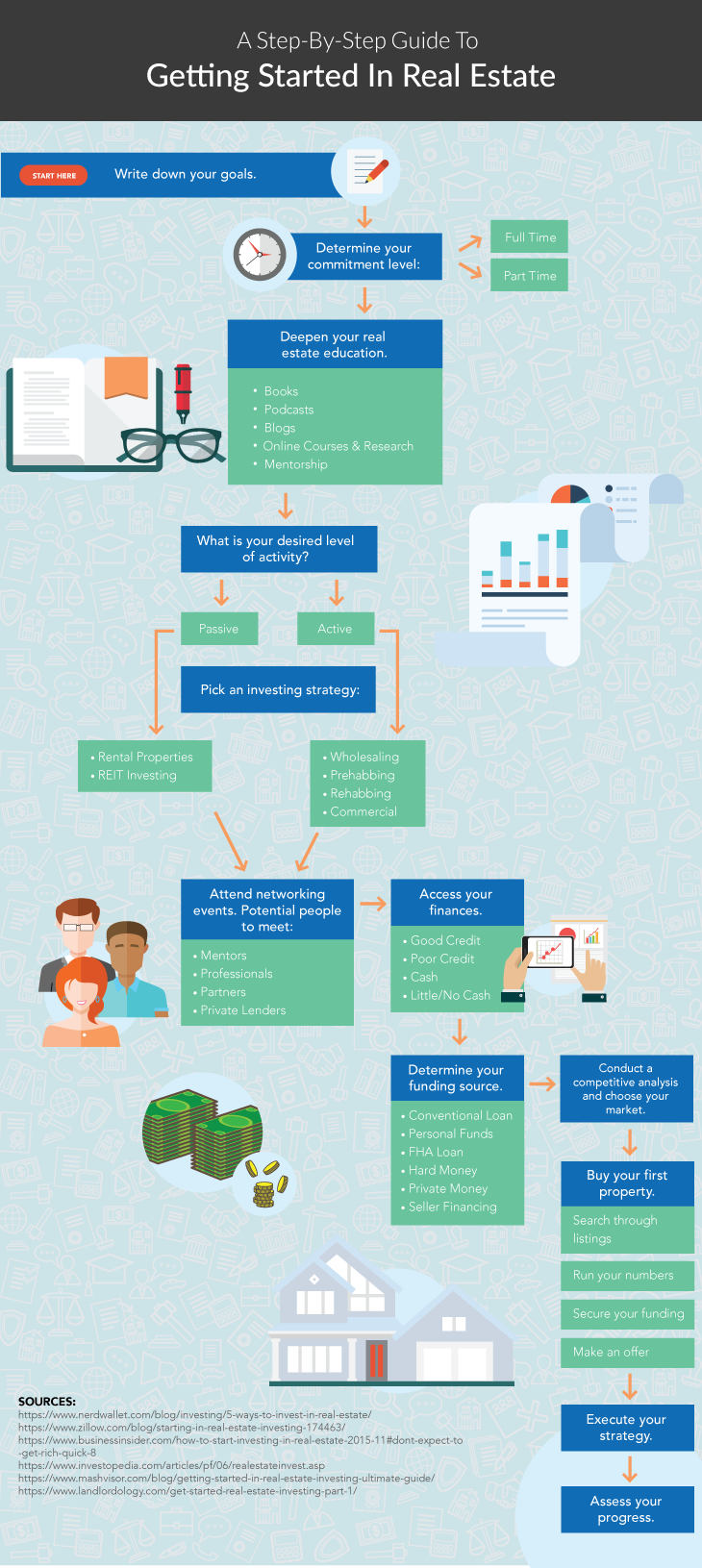

Step-By-Step Guide To Getting Started In Real Estate

Getting started in real estate can be a strenuous, befuddling process. There is no right or wrong way to develop your career as a beginner real estate investor, which can even add to some of your confusion. To help clear away any feelings of anxiety you may be experiencing at this moment, here is a step-by-step guide on how someone might get their start in real estate:

-

Find clarity in your personal and financial goals by writing them down.

-

Before diving in, determine whether or not you want to pursue investing full time or part time.

-

Set a plan for how you will continue your real estate education throughout your career, starting off with real estate investing 101, whether it be through mentorship, online researching, reading books, or other channels.

-

After conducting some research, decide whether you want to take a more active or passive approach to investing.

-

Based on your decision, select an investing strategy. For example, passive income investors can choose between investing in rental properties or Real Estate Investment Trusts. Investors who want to be more active can tackle activities such as wholesaling, fixing and flipping, or even investing in commercial properties.

-

Do not hesitate to start attending networking events as soon as you discover an interest in real estate investing. Use these events as opportunities to meet new mentors, possible partners, private lenders and other types of professionals you can rely on throughout your career.

-

Once you have an idea of your desired investing strategy, you will need to assess the state of your finances. Whether you have good or poor credit, as well as how much cash you possess, can help determine your funding strategy. It is important to understand the different eligibility requirements of the various types of lenders. Some may require applicants to have strong credit with the ability to make a large down payment, while others may overlook your credit history, as long as your property analysis shows promise.

-

Spend a significant amount of time conducting a competitive analyses on different markets that attract your interest. Be sure to look at important indicators such as school districts, infrastructure, employment rates, demographics and rental rates before selecting your target market.

-

Once you feel confident in your selection of an investing strategy and a target market, you can finally commence the process of buying your first property.

-

If you have successfully executed your first investment deal, take a moment to congratulate yourself. Be sure to assess your outcomes and how this investment deal may have or may not have helped position you to better achieve your goals.

Although the sections above are by no means intended to replace a full real estate investing 101 course, they should have provided a framework upon which you can base your research. If you gleaned anything from this discussion, it should be that real estate investing requires determination and diligence over any type of inherent skill or talent. Those who are willing to put in the work to learn the ropes, both through research and through experience, are those most likely to reach their goals.

What are some of the goals you hope to achieve through real estate investing? Feel free to share in the comments below.