Omega Healthcare: High Dividend, Unique Risk

Omega Healthcare Investors (OHI) is a Real Estate Investment Trust (REIT) with a high 6.9% dividend yield. It also offers attractive price appreciation opportunities considering its leadership position in the high growth Skilled Nursing Facilities (SNF) industry. Further, a variety of valuation and risk metrics suggest the dividend is relatively safe and likely to grow.If you are comfortable with the unique risks of an SNF REIT, Omega currently offers an outstanding opportunity to buy in at a very attractive dividend yield.

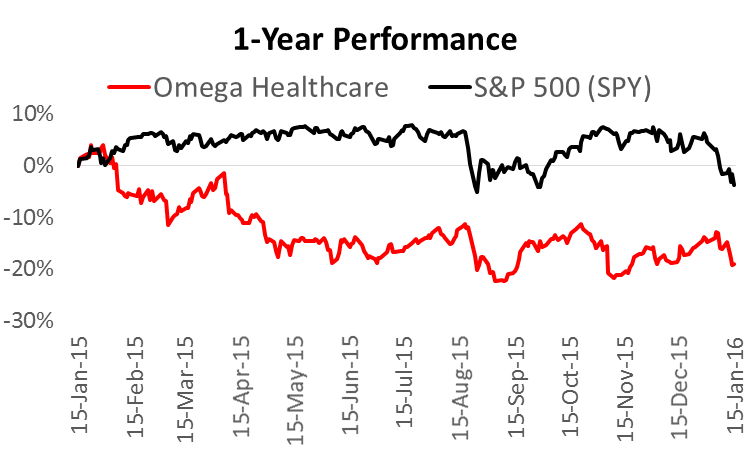

(data source: Google Finance)

About Omega Healthcare Investments

Omega provides financing and capital to the long-term healthcare industry with a particular focus on skilled nursing facilities. Skilled Nursing Facilities (SNF) are healthcare institutions that provide around the clock care to patients by trained nurses. As of September 30, 2015, the company’s portfolio included over 900 properties located in 42 states (and the UK) and operated by 83 different operators. Over the last 1-year period, the total return on Omega has been negative 19%, and we believe this offers an attractive margin of safety due to the company’s unique opportunities, valuation, and risk exposures.

(Total Returns, data source: Yahoo Finance)

Unique Opportunities and Risk Exposures

Unlike many of its healthcare REIT peers, Omega is a pure-play SNF REIT. This uniqueness creates opportunity and risk. Generally speaking, SNF REITs are more risky than other types of healthcare REITs (e.g. medical office building REITS, senior living property REITs) because of their dependence on Medicare and health insurance. Government cuts to Medicare and health insurance programs can have a very negative impact of SNF REITs such as Omega. For example, the following excerpt from Omega’s most recent 10K describes the risk:

Changes in the reimbursement rate or methods of payment from third-party payors, including the Medicare and Medicaid programs, or the implementation of other measures to reduce reimbursements for services provided by our operators has in the past, and could in the future, result in a substantial reduction in our operators’ revenues and operating margins… which could cause the revenues of our operators to decline and negatively impact their ability to meet their obligations to us.

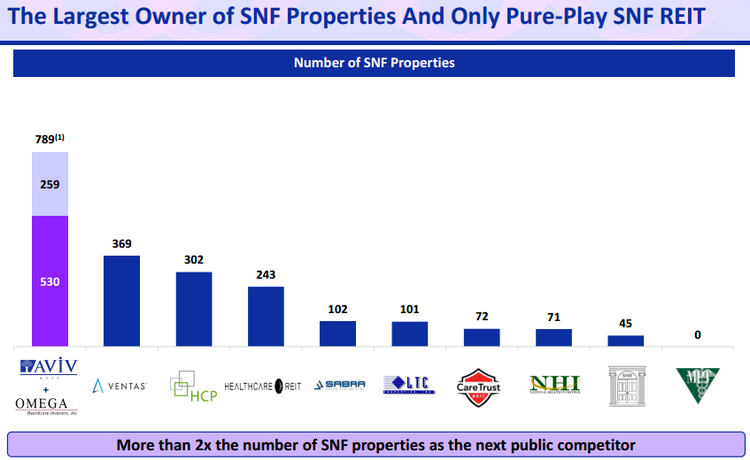

As a specific example, on January 3, 2013 the American Taxpayer Relief Act cut future payments to SNF’s by approximately $600 million (10K, p.22). As another specific example, just last week Kindred/Rehab Care agreed to pay the US Government $125 million for causing an SNF customer to bill for unreasonable and unnecessary rehabilitation therapy. Because of the unique risks of the industry, many of Omega’s peers have limited their exposure to SNF properties. For reference, the following chart shows Omega is the largest owner of SNF properties.

(source: merger presentation, p.8)

Another important point that this chart displays is the relatively recent (April 2015) merger of Omega and AVIV (AVIV was a standalone REIT focused on skilled nursing facilities). The merger creates some beneficial economies of scale, an attractive risk profile, and eliminated a relatively large competitive force (AVIV) in the fragmented SNF industry. The merger also helps clear the path for Omega’s continued growth.Worth noting, Omega’s credit rating was recently (September 2015) upgraded by Standard & Poor’s to BBB- from BB+ suggesting the merger is progressing smoothly and Omega is on stable ground.

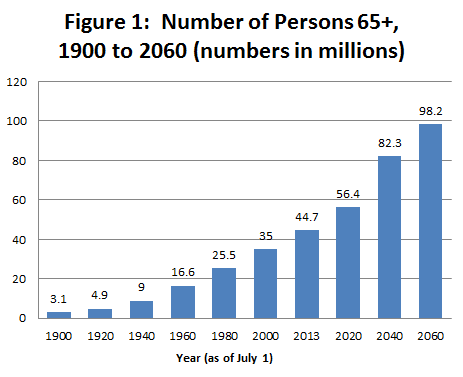

Additionally, Omega has demographics on its side as the number of persons over the age of 65 continues to grow.

(Source: U.S. Census Bureau, Population Estimates and Projections).

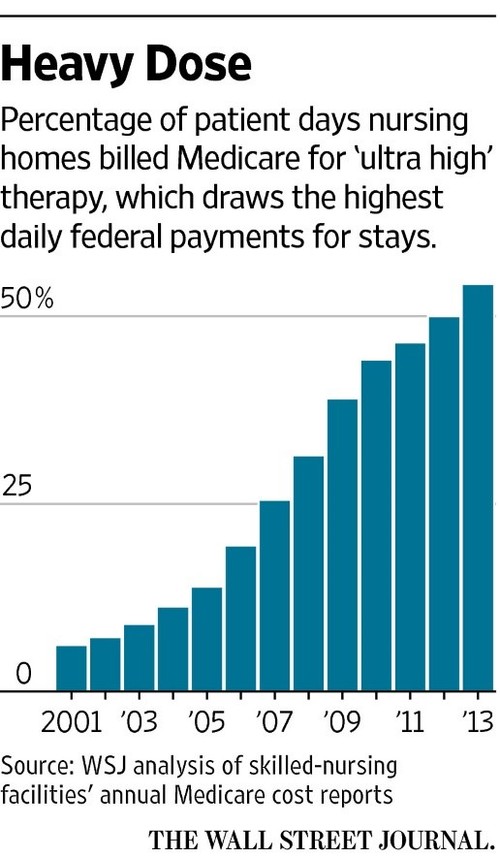

For some additional perspective, the following chart shows the explosive growth in the billing of “ultra high” SNF therapy, which draws the highest federal payment amounts.

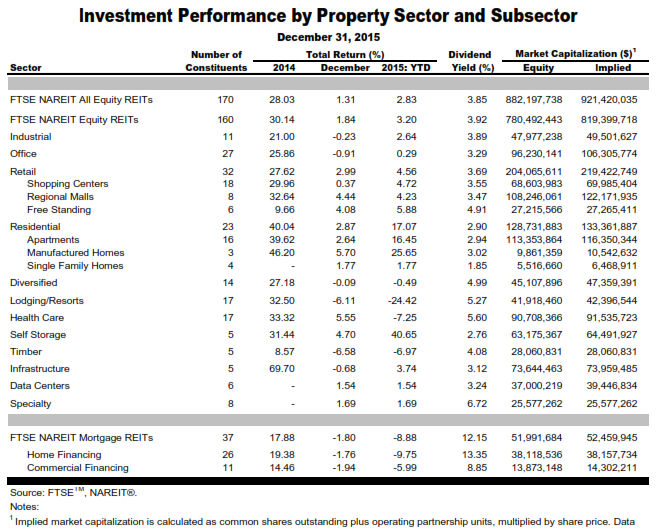

Recent sector performance:

The following chart shows the 2015 and 2014 performance of real estate by various subsectors:

As the chart shows, healthcare real estate underperformed in 2015, which is not uncommon after having a great year in the year prior (in this case 2014).

Valuation and Risk Metrics:

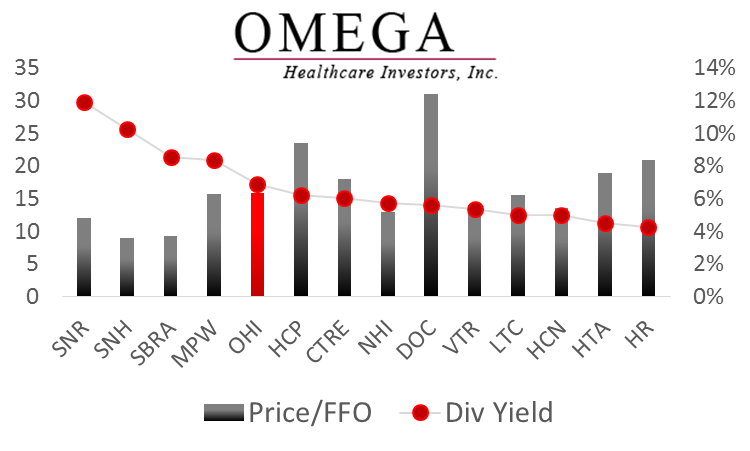

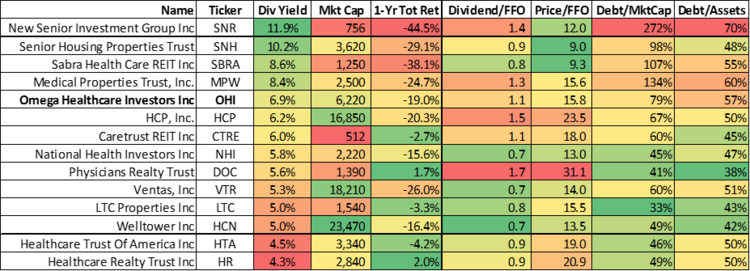

The following table provides a variety of valuation and risk metrics for Omega and some of its peers:

(data source: Google Finance)

High Dividend Yields and Negative 1-Year Performance:

The first thing that stands out about this table is that the REITs that have the worst 1-year performance also have the highest dividend yields.And while a declining stock price mathematically contributes to an increasing dividend yield, this is only part of the story.A high dividend yield could be a sign of value, but it could also be a sign of extreme risk and distress.For example, in the case of New Senior Investment Group (SNR), its whopping 11.9% dividend yield seems to be a clear red flag (its debt levels are extreme, its low price-to-FFO valuation is likely an indication of very high risk, and realistically no company can maintain an 11.9% dividend yield over the long-term with no risk because investors would buy up the stock driving up the price and driving down the dividend yield).Relative to Senior Investment Group, Omega’s dividend yield is much more reasonable.WE believe Omega’s dividend yield is a sign of value considering its one year price decline combined with its successful integration of AVIV and its future growth plans (i.e. it’s the clear leader in the growing SNF industry).

Debt Levels:

Omega’s debt levels are more reasonable than some of the riskier healthcare REITs.For starter’s Moody’s recently upgraded Omega’s debt rating following its acquisition of AVIV which is a sign of manageable debt.Omega’s credit rating was already “investment grade” prior to the upgrade, and the upgrade is a signal of increased confidence from the rating agency.Also, Omega’s debt-to-market cap ratio may be higher than some peers, but this ratio can improve quickly based on Omega’s stock price. Additionally, Omega’s debt-to-assets ratio is not unreasonable relative to peers.

Valuation Metrics:

Price-to-FFO is a valuation metric commonly used for REITS, and it is a quick measure used similarly to the way price-to-earnings is used for other non-REIT stocks.FFO stands for funds from operations, and it’s basically earnings (net income) adjusted for depreciation/amortization (because depreciation is so high for REITS) and adjusted for gains on sales of assets. FFO is a more pure way to gauge a REIT’s performance.Omega’s price-to-FFO is reasonable relative to peers, and it is attractive considering Omega’s plans for continued growth. Specifically, the SNF industry is highly fragmented, and Omega is a clear leader in this space with lots of room to grow.

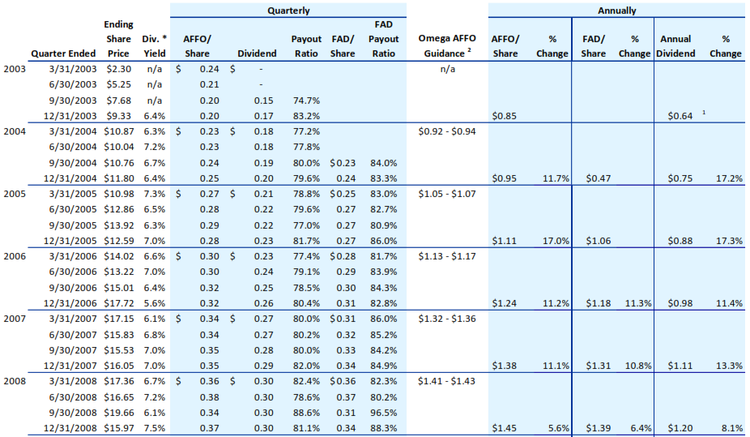

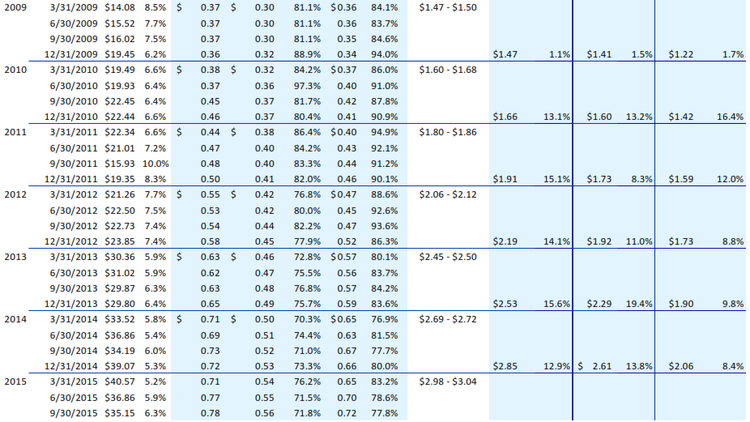

Dividend-to-FFO measures a REIT's dividend payments relative to its funds from operations. And while Omega’s dividend-to-FFO ratio may seem concerning because it’s over 1.0 (they’re paying more dividends than they are generating funds from operations), it’s really not because of the company’s continued growth plans. Additionally, on and Adjusted FFO (AFFO) basis Omega’s payout ratio is more reasonable.AFFO is FFO adjusted to exclude the impact of non-cash stock-based compensation and certain revenue and expense items. For reference, the following table shows Omega’s historical dividend-to-AFFO ratio:

(source: Supplemental Information, p.12)

Omega’s AFFO payout ratio is consistently below 1.0, and provides an increased level of confidence that the firm can continue to meet (and grow) its dividend payments. For reference, FAD (also in the table) is “Funds Available for Distribution.”

Market Capitalization: Worth noting, Omega’s market capitalization makes it a “mid-cap” stock by many measures. This suggest the company has successfully reached some level of critical mass (i.e. it’s not a high-risk small-cap), but it still has room to grow compared to some of its large-cap peers and considering the growth opportunities based on the highly fragmented and growing SNF industry.

Diversification Considerations:

Omega is less diversified (and therefore more risky) than other REITs considering its concentrated exposure to skilled nursing facilities. For example, Welltower (HCN) and HCP, Inc. (HCP) are two large-cap REITs that invest in a wider variety of healthcare property types including senior housing, life sciences, medical offices and hospitals. Further, there are other types of REITs altogether such as Industrial, Residential and Retail REITs. However, even though these two large-cap Healthcare REITs may offer less risk and more diversification, they likely don’t have the price appreciation potential that Omega offers. Additionally, they offer lower dividend yields than Omega.

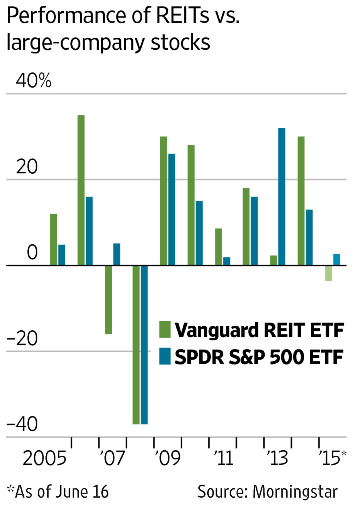

It may also be worth considering how REITs fit into your larger investment portfolio. It is true that historically REITs have offered a lower correlation with other stocks, which has helped reduce big swings in the value of many investment portfolios (see chart below).

Also worth considering, REITs have likely benefited in recent years from the US Federal Reserve’s low interest rate policy. Many investors seeking yield have purchased (and bid up the value of) high dividend REITs instead of purchasing low interest bearing bonds. This dynamic could change if the US Federal Reserve dramatically increases interest rates in the coming years (which seems unlikely, but is still possible).

Conclusion:

Barring significant changes to Medicare and health insurance laws, we believe Omega’s high dividend payments are safe and likely to grow. Additionally, Omega offers significant price appreciation opportunities because it is a leader in the fast-growing skilled nursing facilities industry. Further, we believe Omega’s 1-year price decline provides some margin of safety for potential buyers, especially considering the valuation and risk metrics we presented earlier. Lastly, we don’t have enough information about your situation to have an informed opinion on whether Omega is right for your own personal investment portfolio, but the goal of this article is to highlight some of Omega’s risks and opportunities so you can stir them into the pot and decide for yourself.

Disclosure: None