My 3 Boldest Predictions For The Market In 2016

Every year can be defined by a few key events that shape the entire outcome and affect everybody’s lives. With that in mind, here are our three boldest predictions for what will end up being some of the biggest headlines in 2016, and how to prepare your portfolio.

Investors got treated like the proverbial rented mule in the opening two weeks of 2016. Equities behaved a bit better in the back half of the month, and thanks primarily to a big rally on the last trading day of January actually posted slight gains. Still, the major indices were down five to eight percent for the month, and January will now be recorded as the worst monthly performance in years. Small caps, biotech, and other high beta sectors of the market were hit even harder and are in official bear market territory.

So what will February bring? Barring any major geopolitical event or the domestic economy slipping into a recession, I don’t think there is much chance that the second month of the year treats investors as poorly as the opening stanza of 2016 did. That does not mean we will see a substantial rally from what look like at least somewhat oversold levels, but February should see a bit more sunshine than January. Here are three predictions for the new month that I feel pretty good about right now.

Bold Prediction #1: The Fed Will Grow More Accommodative

The big rally in the market on Friday, January 29th was primarily triggered by the surprise decision of the bank of Japan to move to a negative interest rate policy or NIRP for the first time in its history. Whether this will help the Japanese stock market or economy in the long run absent long overdue structural reforms is certainly debatable. However, it did cause investors to rejoice at least for a day, and global markets put their rally cap on. It also caused the Yen to appreciate nearly two percent against the greenback.

More importantly, it really made the Federal Reserve which is wary of an even stronger dollar more unlikely to stick with their forecast for four quarter point hikes in 2016. The market has already come to the conclusion it is more than likely that there will only be two hikes this year. However, having the central bank get on the same page would be beneficial for equities.

I think by the end of February the Fed will back off their earlier stance. Either we get a hike in March with clear wording that the Fed is in “wait and see” mode now or the central bank backs away from even that quarter point rise altogether. Either course should help equities.

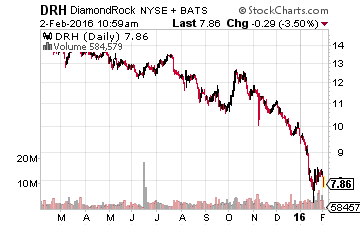

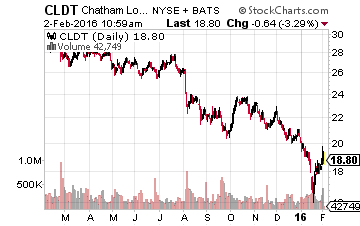

The high yielding sectors of the market should do particularly well in this scenario especially real estate investment trusts (REITs) which have been severely beaten up of late due to the spike in volatility in the high-yield credit markets. If you have not picked up positions in previously profiled lodging REITs like Chatham Lodging Trust (Nasdaq: CLDT) or Diamondrock Hospitality (NYSE: DRH) which yield six to seven percent and are 30% to 40% off from recent highs, you might want to do so soon. This “sale” might not last too much longer.

Bold Prediction #2: Oil Will Stabilize

This is more gutsy call than the Fed backing off from their projections for interest rate hikes in 2016. However, after falling to as low as $27.00 a barrel during January crude recovered to end the month at just over $33.00 a barrel. More importantly, some key OPEC members like Kuwait are starting to make increased noises about the need for some sort of production cut. The Russians also seem to be coming around to this view and seem willing to participate. Although the Saudis certainly are not on board yet, it does appear talks are happening at high levels in other major producers and something could be on the horizon to boost oil’s prospects. Given the rapidly deteriorating finances of most large crude producing nations outside of North America, including Russia, Nigeria, Venezuela, and others that are just collapsing, a production cut that buoys the oil markets appears to have an increasing likelihood of happening.

This in turn would help the high-yield credit or “junk bond” market which has been impacted increasingly severely by the collapse in crude and other commodities. Stabilization here would help small caps and about any concern that has any significant debt that does not have an AA or AAA rating. An investor might want to try to position in back door plays that will be boosted if oil rises, but will not hurt too much if this prediction does not play out.

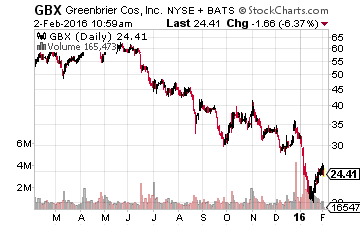

Railcar maker Greenbrier Companies (NYSE: GBX) fits this bill. The stock rallied some 20% in the last two weeks of January as oil moved up. The stock still trades at just over four times both this just completed fiscal year’s earnings and what the company has guided to for profits in the current fiscal year. Greenbrier also posted quarterly earnings of $2.15 a share on January 7th, 52 cents a share above expectations. 80% of the company’s huge $3 billion plus order backlog comes from outside the energy sector as well.

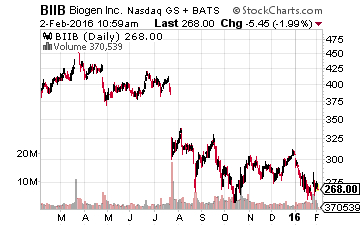

Bold Prediction #3: Big Biotech Will Bottom

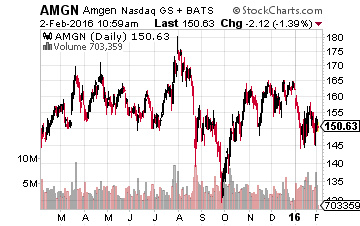

Obviously, this is the most controversial of my predictions for February. The overall sector is down over 30% from its highs in July. Large cap stocks in the space have held up much better than their smaller brethren but are still sporting significant losses. We also have congressional hearings on drug prices to begin the month.

However, the large cap part of the sector is as cheap as it has been on a valuation basis since 2011. The industry is also one of the few that should churn out solid revenue and earnings growth in 2016 despite anemic global demand and the strong dollar.

Initial earnings reports from biotech stalwarts like Amgen (Nasdaq: AMGN) and Biogen (Nasdaq: BIIB) have exceeded both bottom and top line expectations early this earnings season. I have been incrementally adding to these and other core positions like Celgene (Nasdaq: CELG) and Gilead Sciences (Nasdaq: GILD) every time the sector has dipped in 2016 and will continue to do so.

That is one man’s take on the month ahead. My hope is that February will be much kinder to investors than the opening month of 2016.

Position: Long AMGN, BIIB, CELG, CLDT, DRH, GBX, and ...

more

So, in order to protect the banks, the Fed is capable of insulating those big banks. How that impacts upon the real economy is the question. The Fed literally seems to be divorced from the real economy and is only acting in the interest of the banks. What that means going forward is what I don't quite understand.