Mortgage REIT, Managed By TPG, Prepares For IPO

TPG RE Finance Trust (TRTX), a mortgage REIT managed by TPG that focuses on commercial real estate debt, is expected to IPO on Thursday (7.20). The New York, NY-based company plans to offer 11 million shares priced between $20 and $21 and expects to raise $225.5 million. The REIT is currently managed by an affiliate of the PE firm TPG and will continue to be managed by this affiliate after the IPO.

Assuming TPG RE Finance Trust prices at the mid-point of its proposed price range, it would command a fully diluted market cap value of $1.25B.

Underwriters for the IPO include: Barclays, Morgan Stanley, J.P. Morgan, Deutsche Bank, Wells Fargo Securities, Goldman Sachs, Citi and BofA Merrill Lynch.

Company Overview

Founded in 2014, TPG RE Finance Trust is a mortgage REIT for commercial real estate securities. The company originates and manages commercial loans in large metropolitan areas in the US; 73% of its assets are underpinned to properties in the 10 largest metropolitan areas.

The commercial real estate company directly creates, acquires and oversees commercial mortgage loans in addition to other commercial real estate-related debt instruments for its balance sheet. The mREIT's mission it to provide attractive risk-adjusted returns to its stockholders via capital appreciation and cash distributions.

As of its IPO, its portfolio consisted of four mezzanine loans and 54 first mortgage loans with aggregate unpaid principal balances of $58.5 million and $2.6 billion, respectively.

Executive Management

Greta Guggenheim is currently the Chief Executive Officer, President, and Director of TPG RE Finance Trust, Inc. She also serves as the Chairman and President of Guggenheim, Inc. as well as President and Chief Financial Officer of Ladder Capital Realty Finance, Inc. Her prior experience includes positions at Ladder Capital Finance, Dillon Read Capital Management, and Bear Stearns & Co. Ms. Guggenheim graduated from Swarthmore College, where she earned a B.A. in Economics & Spanish Literature. She also holds a Master of Business Administration from The Wharton School of the University of Pennsylvania.

Avi Banyasz serves as chairman of the board, a position he has held since its founding in 2014. He is also a partner of TPG and the co-head of TPG Real Estate. Prior experience includes: managing principal and a member of the investment committee of Westbrook Partners and Bear Stearns & Co. He received is B.S. in Economics and Finance from the University of Toronto.

Financials

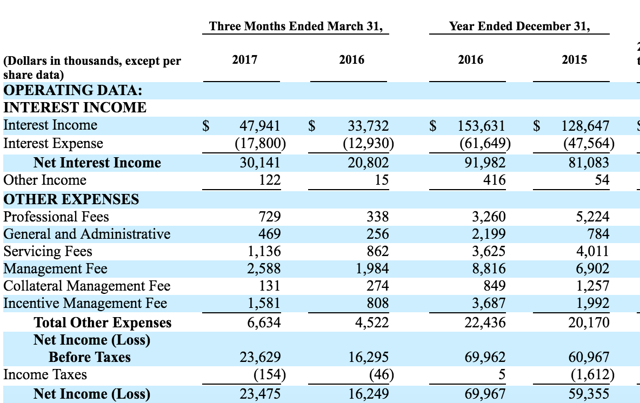

For the year ended 2016, TPG RE Finance Trust generated $153.6M in interest income, up from $128.6M in 2015. Interest expenses as a percentage of revenue increased from 36% in 2015 to 40% in 2016. Other expenses included: professional fees, general administrative, servicing fees, management fee, and collateral management fee. Net income was $59.3M and $69.9M in 2015 and 2016, respectively.

(S-1/A)

To maintain its status as a REIT, TPG RE Finance Trust is required to distribute 90% of more of it net profits to shareholders. The company distributed $1.99 per share in 2016. Assuming it prices at the mid-point of its proposed price range, this is equivalent to a 10.3% yield.

Competition

TPG RE Finance Trust valuation compares favorably to competitors. Other public mortgage REITs include: Annaly Capital Management, Inc. (NLY) and Two Harbors Investment Corp (TWO). Both trade at a lower book value per share while offering similar yields.

|

Ticker |

Market Cap |

Book Value/Share |

Yield(%) |

|

TRTX |

$2.5B |

15.93 |

10.3 |

|

$12.56B |

12.40 |

10.0 |

|

|

$3.43B |

10.33 |

10.6 |

(GoogleFinance)

Conclusion: Consider A Modest Investment

TPG RE Finance's valuation is in-line with peers, and we expect the REIT will continue to benefit from its relationship with TPG in terms of expertise and strong financial infrastructure.

However, the mortgage REIT industry is extremely sensitive to any changes in interest rates.

For investors looking for exposure to this space, we recommend no more than a modest investment.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in TRTX over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more