Is This Dividend Stock Is Too Good To Be True?

f you are an income investor, you will probably soon run across a new, 10% yield REIT,Communications Sales & Leasing Inc. (NASDAQ:CSAL). While CSAL has a good story, this company needs some seasoning before income focused investors decide to jump in. Don’t drink the Kool-Aid, wait for the meat.

CSAL has started a brand new category of REIT. The company owns fiber optic and copper wire telecom infrastructure assets which are used by telecom service providers. CSAL leases out its owned assets on long-term (15 years plus) triple net leases. The company launched with an April 2015 IPO as a spin-off from Windstream Holdings, Inc. (NASDAQ:WINWIN). With a planned $2.40 annual/$0.60 quarterly dividend, the new REIT was priced at $30 to yield 8%. The shares now trade at $22.80, pushing the current yield up to 10%.

The investment analysis of CSAL has two parts: What the company is, and what it says it will be.

Currently, CSAL (with a $3.5 billion market cap) has a single customer, Windstream Holdings, which the market values at $680 million. This is the biggest risk to CSAL: All of its eggs are in one basket, and the basket consists of a single small-cap telecom company.

The lease with Windstream will not generate enough cash flow in 2015 to cover the planned dividend payments. In its second quarter earnings report, CSAL provided 2015 cash flow guidance of funds from operations –FFO– between $1.71 and $1.73 common share and AFFO between $1.73 and $1.75 share. In REIT analysis, AFFO is the cash available to pay dividends. The company declared a $0.60 dividend for the second quarter and will pay two more for the rest of 2015, bringing the total payout to $1.80 for the year. The realized FFO per share is below the dividend rate primarily because the company’s second quarter results came from less than a full quarter due to the late April IPO date. A little prudence on management’s part would have had the company pay a pro-rated dividend for the second quarter. No reason was given for a full payout from shortened quarterly results.

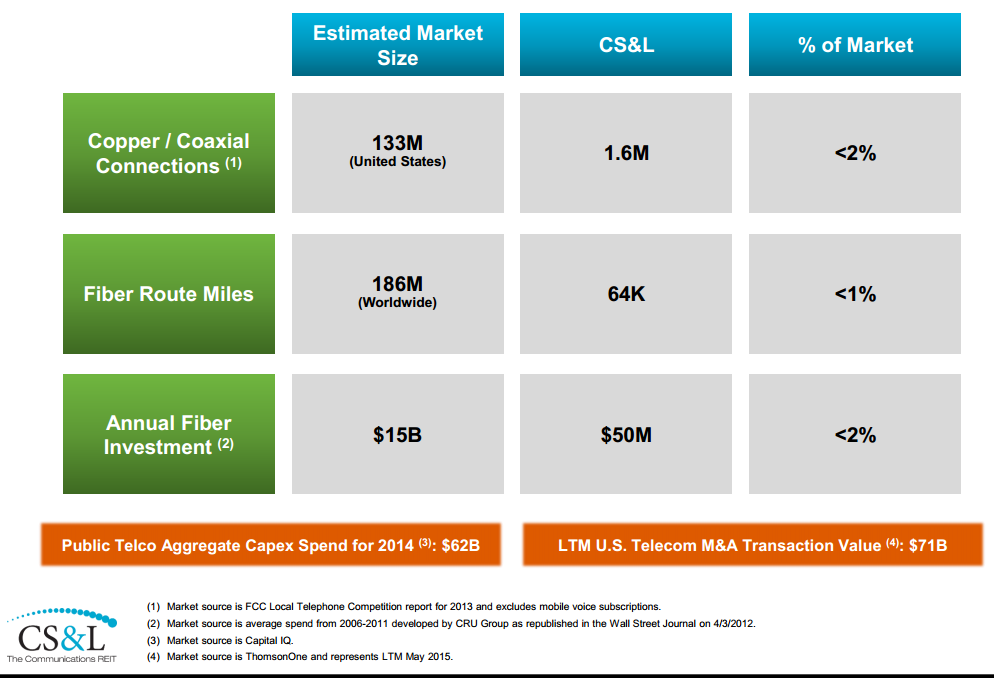

The “real” story behind CSAL’s investment potential is the management team’s story about growth prospects in the telecom industry. The company wants to buy similar telecom assets and put them on long-term leases back to the telecom companies that use the lines, and possibly wireless assets. In a recent presentation, CSAL included this table to show the very large potential for the company to add assets:

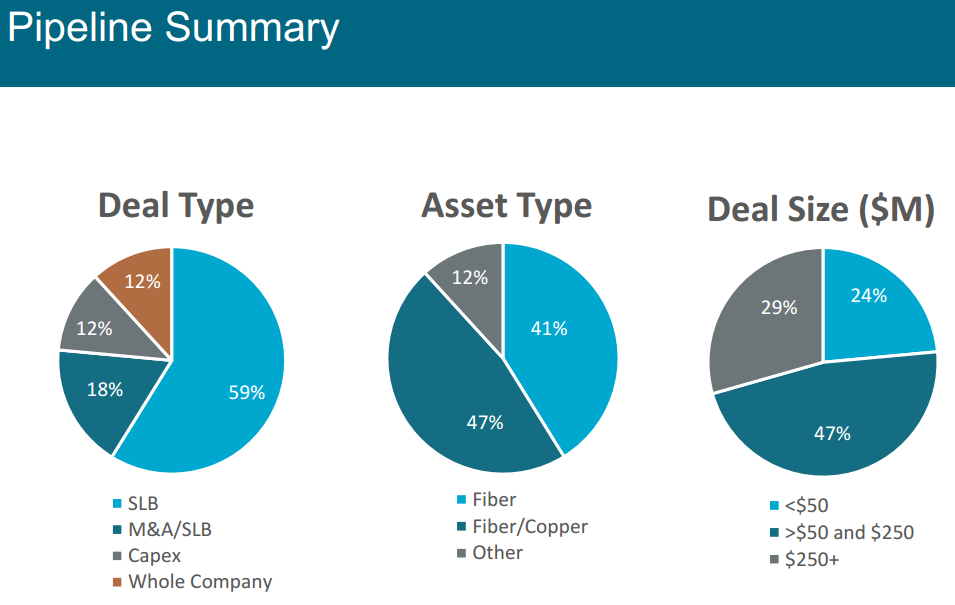

During the second quarter earnings conference call, CEO Kenny Gunderman spent a lot of time talking about how many deals the company had in its pipeline and all of the potential future growth as well as the myriad potential acquisitions in the telecom space.

To me, it sounded like Gunderman and the management team was trying too hard to sell CSAL’s growth prospects. In general, I prefer management teams that make the great deals and then make the announcement, giving good news on done deals. With only one current client, I need to see a couple of things happen before I make CSAL a Dividend Hunter recommendation –and I would love to. Great high-yield stocks are hard to find! First the company has to announce some signed and closed deals that significantly reduce the company’s dependence on Windstream. One-quarter to one-third of total revenue away from Windstream would be a good target. Next, I need to see that the company can buy at prices that will allow accretive FFO growth without a high level of added debt leverage. Let’s see that AFFO per share start to grow. Finally, I want to see quarterly FFO amounts that provide a cushion on the current dividend rate, not the current cash shortfall.

There is potential for both growing dividends and a growing share price (as the market brings down the yield) from CSAL. However, there is the risk that the company will not be able to grow cash flow at a rate that will allow dividend growth. CSAL is a “show me” stock and I will be watching to see if the management team can actually meet its high, shared growth expectations.

There are great opportunities in the tax-advantage master limited partnership –MLP– sector. MLPs develop, own and operate a large portion of ...

more