How To Minimize Taxes On REITs

Mortgage REITs normally pay a very nice dividend. But the tax bill can be hefty. REITs are taxed at ordinary income tax rates and this puts a major dent in the after-tax rate of return. But there is a way to get around this tax bill if an investor has capital losses he can use. I call this strategy dividends to capital gains conversion.

Here is what an investor can do: You take the dividends in capital gains form and offset those with losses. This can reduce your tax bill to 0%.

So how does one go about converting dividends to capital gains? It takes some monitoring, but it could very well be worth your time. Here is the definition of the ex-dividend date:

The ex-dividend date is the day on which all shares bought and sold no longer come attached with the right to be paid the most recently declared dividend. This is an important date for any company that has many stockholders, including those that trade on exchanges, as it makes reconciliation of who is to be paid the dividend easier. It is just as important for investors, however, since you must own a stock before the ex-dividend date in order to receive the next scheduled dividend.

If somebody buys the stock on the ex-dividend date, he or she will not receive the next dividend.

Given this, an investor can buy a stock the day of the ex-dividend date and sell the day before the next ex-dividend date, and be assured that he will never receive a dividend. Some might be saying, what a horrible deal! But Mr. Market is no dummy. Those who buy on the ex-dividend date and sell the day before the next one will benefit from the stock price climbing by the amount of the dividend during this time. If you ever notice why a stock's price drops the of the ex-dividend date, this is because those buying it on that day will not receive the next dividend. In fact, the price drops by the amount of the next dividend. Conversely, the stock price will begin climbing the day after the ex-dividend date and will eventually rise by the amount of the dividend. Of course, the price will fluctuate due to other variables, but the amount of the next dividend is always embedded in the price.

If this makes sense to you then you can use this strategy to substantially reduce your tax bill on REITs. I want to take a look at a sample case using Annaly Capital (NLY ). Annaly currently has a dividend yield of 10.6%.

Here is an example: I buy 5,000 shares of NLY. The combined federal and state tax rates add up to 35%. I can offset the capital gains with losses and let’s say I pay $10 per trade. I ran this case in our calculator called Minimize Taxes by Trading Dividends for Capital Gains.

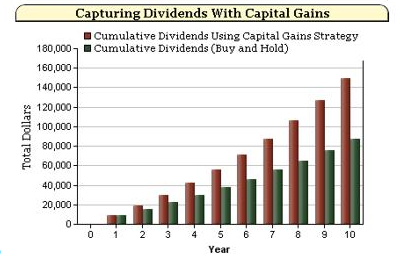

Over ten years I will have nearly $62,000 more just because I used this strategy.

I will have accumulated nearly $63,000 more over 10 years using this strategy. This is an incredible boon to my retirement plan.

You would need to monitor the REIT so this is really only best suited for stocks with high dividend yields. If the yield is below 3%, it’s probably not worth your time.

What would increasing your savings rate or investing in different asset classes do to your retirement plan? Could you handle a stretch of stock-market volatility? WealthTrace can help you find ...

more