HCP’s Big Dividend And Its New QCP Risks

HCP Inc. (HCP) is an attractive big-dividend (6.0%) healthcare REIT that has been plagued by ongoing challenges with its largest tenant, HCR ManorCare. This week we received new information on HCP’s plans to spin off HCR ManorCare (later this year) into a separate REIT (Quality Care Properties). Based on the new information, we continue to believe the spinoff is a smart decision that will unlock value by giving HCP shareholders exactly what they want (i.e. a big dividend, low risk, and “Dividend Aristocrat” status), while simultaneously buying time and options in determining how best to maximize the value of HCR ManorCare via Quality Care Properties (QCP).

About HCP

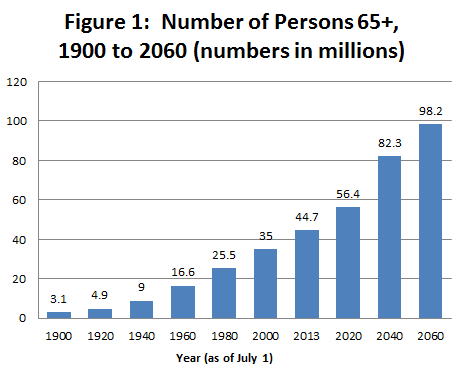

HCP invests primarily in real estate serving the healthcare industry in the United States across five distinct sectors: senior housing, life science, medical office, hospital and post-acute/skilled nursing. Generally speaking, this is an attractive market from a secular growth standpoint as the majority of HCP’s business may benefit from an aging US population as shown in the following chart.

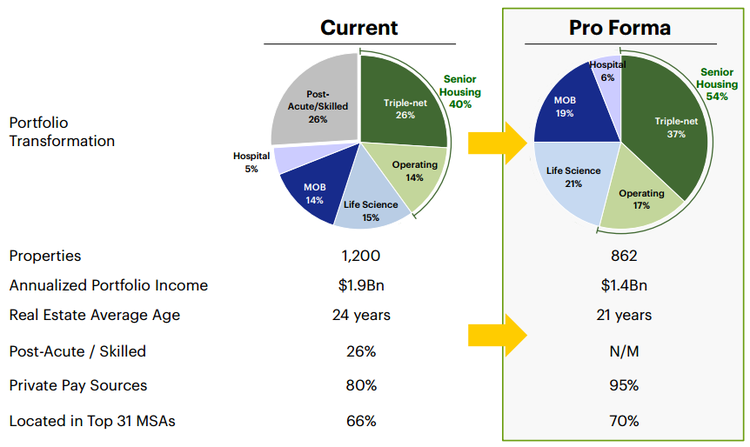

However, following the planned spinoff of Quality Care Properties, HCP will exit the post-acute/skilled nursing sector, and its business segments will be reallocated as shown in the following pie charts.

For some perspective, according Quality Care Properties’ recent registration statement, HCR ManorCare represented approximately 94% of QCP’s total revenues for the six months ended June 30, 2016.

Why the Spinoff?

We believe there are three main benefits to the spinoff: It increases the safety of HCP’s big dividend, it buys time for HCR ManorCare, and it create more options for HCR ManorCare.

1. Dividend Safety:

With regards to increasing the safety of HCP’s big dividend, the spinoff will accomplish this by shedding the risky skilled-nursing businesses (more on this risk later, but it basically has to do with past and future healthcare law changes). By dumping this business, shareholders (and the dividend) will be exposed to less uncertainty (a very good thing for income-focused investors).

The spinoff will also increase safety by improving HCP’s debt position. According to QCP’s Registration statement:

“In connection with the Spin-Off, we anticipate that we will raise approximately $___ billion in new debt pursuant to one or more financing arrangements… We expect that approximately $___ billion in cash from the proceeds of our borrowings will be transferred to HCP… and will be used to fund the repayment of a portion of HCP’s outstanding debt.”

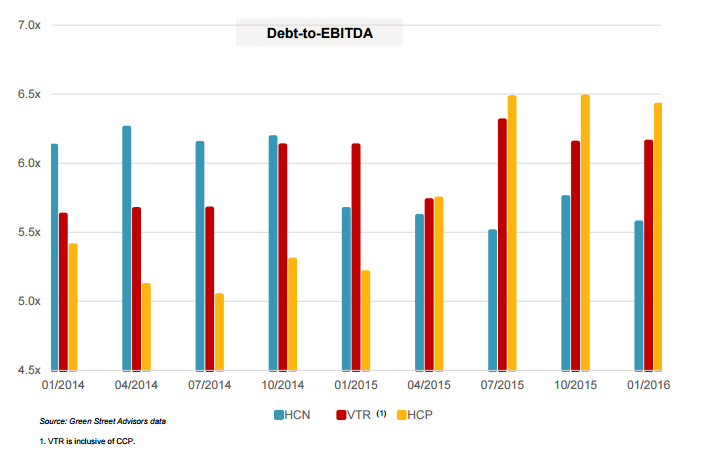

Essentially, the spinoff will help HCP improve its debt position, and this is very important for REITs (like HCP) that reply on borrowing to fund a significant portion of their business. For perspective, the following chart shows HCP’s debt-to-EBITDA relative to peers. HCP is an outlier (too much debt), but the spinoff will help address this ratio, and better enable HCP to achieve future success.

Thirdly, the spinoff will help HCP maintain its coveted “dividend aristocrat” status. A dividend aristocrat is an S&P 500 stock that has increased its dividend at least 25 years in a row (HCP has increased theirs for 31 years straight). And this strong dividend track record is what attracts many people to HCP in the first place. So how will the spin help maintain the status? Here’s what S&P has to say about dividend aristocrats and spinoffs:

“For spin-offs occurring after January 1, 2013, the yearly dividend increase history of the parent company is assigned to both the parent and spun-off company on the spin-off effective date. To determine annual dividend payments, the dividends of the parent and spun-off companies are combined until a full annual cycle of dividend payments is available for both post-spin-off companies. Subsequent dividend comparisons are based on the annual dividend amounts of each respective company.”

Essentially, this quote is saying that as long as the combined dividend of HCP and QCP increases in the first year following the spin, then both companies maintain dividend aristocrat status, and will be judged on their own individual dividends starting in year two and beyond. Based on HCP’s most recent dividend/FAD ratio, we see no reason to believe they cannot maintain the dividend the growing dividend track record for one year following the spin if they choose to do so.

2. Buys time for HCR ManorCare:

The second main benefit of the spinoff is that it buys time for management to figure out what to do with HCR ManorCare. For example, as mentioned previously, we see no reason for QCP to NOT maintain enough of a dividend for one year to help maintain the dividend aristocrat status, and this will also help prevent a mass selling exodus by risk averse shareholders on day one following the spin. According to QCP’s registration statement: “We will not have an investment grade rating immediately following the Spin-Off.”

Another deterrent to a mass selling exodus by risk averse shareholders on day one following the spin has to with how the spin is treated for tax purposes. According to QCP’s registration statement:

“The distribution of QCP common stock will not qualify as a tax-free spin-off. Nevertheless, for stockholders… that hold their HCP common stock for the entire taxable year of HCP in which the spin-off occurs, the net effect of the spin-off is that the distribution is expected to be treated as a return of capital not subject to tax.”

This is important because it will help prevent day one selling of QCP by risk averse investors. It essentially buys more time for management to figure out what to do with HCR ManorCare business while simultaneously giving some assurance to the low-risk, dividend-hungry HCP investors.

3. The spinoff creates more options for HCR ManorCare

The third main benefit of the spinoff is that it creates value by giving management more options in dealing with HCR ManorCare. Specifically, it allows QCP to do things HCP shareholders wouldn’t tolerate. For example, the shareholder letter in the QCP registration statement describes this well as follows:

“HCP’s board of directors believes that separating the QCP business and assets from the remainder of HCP’s businesses and assets is in the best interests of HCP and its stockholders [because it] better positions QCP to realize the long-term value creation potential of the HCRMC Properties in a manner that would not be consistent with HCP’s business model.”

Basically, QCP can take on risks that HCP shareholders would not tolerate. And this adds value because not only does it give QCP more options, but it also may potentially increase the investor base by appealing to higher risk investors that would not invest in lower-risk HCP. Also interesting to note, management explains in the registration statement that “While QCP intends to qualify as a REIT, it will have the flexibility to change its business model and/or corporate structure to suit the optimal long-term solution for the HCRMC Properties.” This suggests, that perhaps after a year of operating as a standalone REIT, QCP could benefit by changing its corporate structure in a way that HCP investors simply would not tolerate.

Valuation:

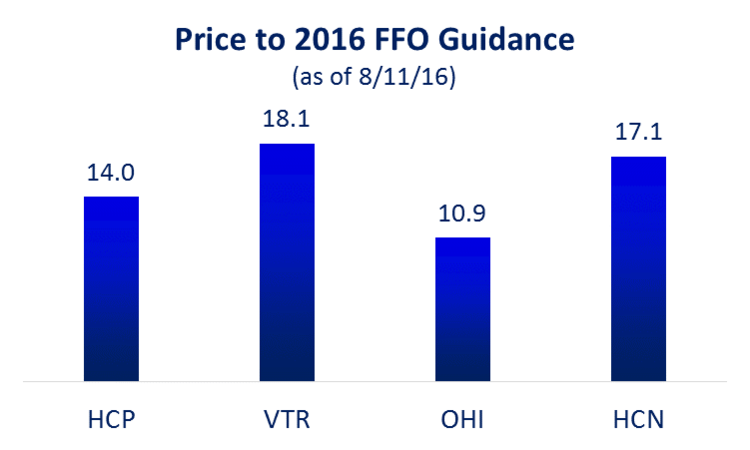

With all the focus on the upcoming spin, it’s important to not lose sight of HCP’s value. For example, the following chart shows HCP’s current price to expected 2016 full-year funds-from-operations (FFO) (ignoring the impacts of the spin) relative to other healthcare REIT peers.

The first thing to point out is that not all of these healthcare REITs are the same, particularly with regards to their exposure to skilled nursing. Specifically, Omega Healthcare (OHI) is focused on skilled nursing (and assisted living), whereas Ventas (VTR) already spun off its skilled nursing, and Welltower (HCN) and HCP still have some exposure to skilled nursing. The point is that skilled nursing is perceived to be riskier, and therefore commands a lower price to FFO ratio, and this is reflected in the graph. Also important, based on its current business mix, HCP is not particularly overpriced.

Another valuation ratio to consider is funds available for distribution (FAD). In its second quarter earnings release, HCP forecast full year 2016 FAD to range between $2.68 and $2.74. This implies that HCP’s dividend (currently $0.575 per share quarterly) is not excessive relative to its expected FAD.

Risks:

Certainly, HCP faces a variety of significant risks. One of the more significant risks is continuing healthcare reform, particularly changes to Medicare and Medicaid. For example, 26% of HCP’s operating income comes from skilled nursing (as shown in an earlier chart), and this segment is particularly sensitive to changing Medicare and Medicaid laws. In particular, Medicare Advantage laws have resulted in lower reimbursement rates and shorter stays. And any additional changes to these laws could weaken HCP’s profitability. Worth noting, the rate of expansion of Medicare Advantage may be slowing (a good thing for healthcare REITs).

Legal considerations are another risk factor for HCP. For example, the Department of Justice has been investigating multiple skilled nursing facilities (including HCR ManorCare) with regards to overbilling practices.

Rising interest rates pose a risk for HCP. Currently, low interest rates have forced many income investors out of traditional fixed income and into higher yielding equities such as REITs. If interest rates were to rise significantly this could cause massive REIT sales by risk averse investors. This scenario seems unlikely within the next few years, but it is possible. Additionally, rising interest rates pose a risk because (like other REITs) HCP relies on debt to fund a significant portion of its business. If rates were to rise, it could result in more challenging funding and growth.

Conclusion:

We like HCP. In fact, we like it so much that we’ve ranked it #6 on our list of top 10 Big-Yield Low-Risk Investments Worth Considering because of its tremendous long-term growth opportunities and its relatively attractive valuation. We see no immediate reason for income-focused investors to sell their shares out of fear as the spinoff transaction approaches. HCR ManorCare risks are already baked into the price, and the QCP spin only increases management’s ability to deliver results. If you are a long-term income-focused investor, we believe HCP is worth considering.

Disclosure: None.