Better High-Yield REIT: W.P. Carey Or Realty Income?

Many income investors hold real estate investment trusts, or REITs, in high regard.

There is a good reason for this, because REITs are excellent sources of income. REITs typically provide dividend yields around twice as high as the S&P 500 Index—and even more in some cases.

W.P. Carey (WPC) and Realty Income (O) are two high-quality REITs. Both are Dividend Achievers, a group of 272 stocks with 10+ years of consecutive dividend increases.

You can see the full Dividend Achievers List here.

Realty Income is a legend among dividend stocks. It calls itself The Monthly Dividend Company, because it pays dividends each month, rather than the more traditional quarterly dividend schedule.

And, it has declared 556 consecutive common stock monthly dividends throughout its 47-year operating history. It has increased the dividend 88 times since its IPO in 1994.

But when it comes to dividends, W.P. Carey is no slouch. In fact, it has a much higher dividend yield than Realty Income, and a cheaper valuation as well.

These qualities could make W.P. Carey the better stock to buy between these two REIT Dividend Achievers.

Business Overview

Both W.P. Carey and Realty Income have strong business models, with high occupancy rates, diversified tenants, and long lease agreements.

W.P. Carey operates a diversified property portfolio across several industries which include retail, transportation, health care, and automotive. Its properties primarily include office, industrial, warehouse, and retail facilities.

Source: Third Quarter Earnings Presentation, page 12

The company operates in 19 countries around the world. Its geographic breakdown is as follows:

- U.S. (63% of assets)

- Europe (34% of assets)

- Other (3% of assets)

The ‘other’ geographic segment includes assets in Australia, Canada, Japan, Malaysia, Mexico, and Thailand.

In all, W.P. Carey owns $12 billion of assets under management, spread across more than 900 properties.

Meanwhile, Realty Income is a much larger REIT. It owns over 4,700 real estate properties, located in 49 U.S. states and Puerto Rico, also under long-term lease agreements.

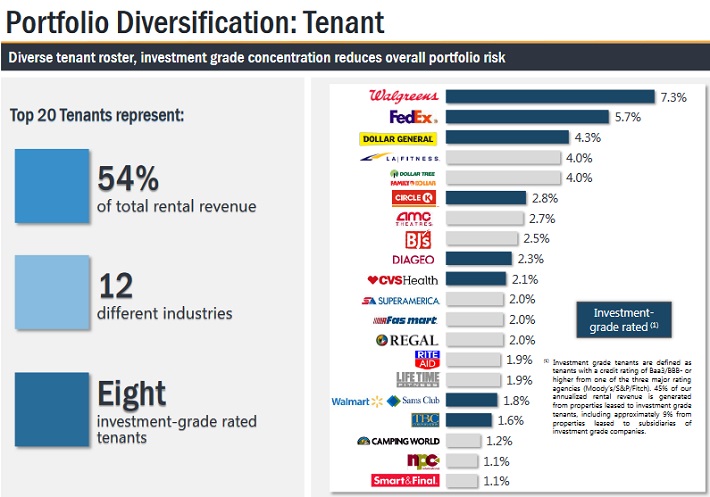

Its portfolio is also highly diversified across several industry categories, including retail, pharmacies, movie theatres, and fitness clubs.

Source: : Investor Presentation, page 14

Realty Income has 247 commercial tenants across 47 industries.

Their portfolios hold predominantly long-term leases, which helps lock in steady revenue and provides modest growth each year through rent increases.

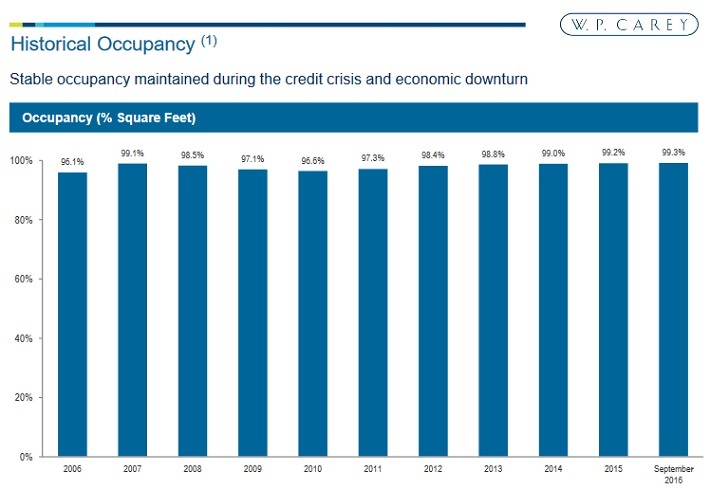

W.P. Carey’s average lease term is 9.4 years, with a 99.1% occupancy rate. It enjoyed high occupancy, even during the Great Recession.

Source: Third Quarter Earnings Presentation, page 16

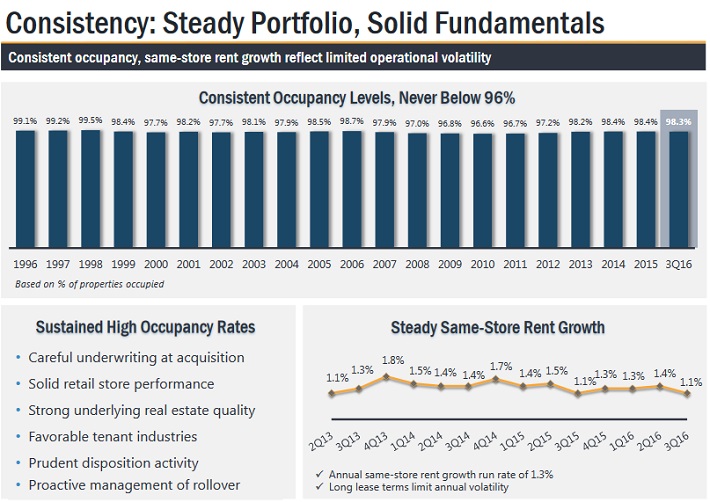

Similarly, Realty Income holds a 98.3% occupancy. Its occupancy rate has never fallen below 96%.

Source: Investor Presentation, page 11

To generate growth, REITs rely on a combination of internal cash flow and externally-raised capital to purchase new properties.

W.P. Carey invested $386 million in property acquisitions over the first nine months of 2016.

Source: Third Quarter Earnings Presentation, page 17

Realty Income invested $1.1 billion over the same period, in 236 new properties.

This has helped both companies produce consistent growth in funds from operation, or FFO. Instead of using earnings-per-share, REITs typically report financial results in the context of FFO, which adds back non-cash charges like depreciation.

W.P. Carey grew adjusted FFO-per-share by 4.6% over the first three quartersof 2016, from the same period in 2015.

The company’s forecast calls for 2.2% growth for the full year.

Over the first nine months of 2016, Realty Income’s adjusted FFO-per-share increased 3.9% year over year. The company realized 1.1% growth from higher rents.

Realty Income expects adjusted 2016 FFO to increase 4.7%-5.5% from 2015.

Valuation

Rather than utilize the traditional price-to-earnings ratio, it is more appropriate to evaluate REITs based on price-to-FFO as a valuation measure.

From this perspective, W.P. Carey trades for a price-to-FFO ratio of 12, based on 2016 results.

For its part, Realty Income trades for a price-to-FFO ratio of 21.

Realty Income’s higher valuation is due mostly to its larger size.

Source: Investor Presentation, page 31

It has a $15.6 billion market capitalization, versus a $6.7 billion market cap for W.P. Carey. This provides Realty Income with greater economies of scale.

In the past five years, Realty Income’s share increased 65%, compared to a 40% increase for W.P. Carey. Realty Income’s stock price rally has elevated its valuation far above W.P. Carey’s.

Realty Income fits the bill of a great company, with a not-so-great valuation.

It has developed a high reputation for its stability. The problem is that investors have to pay a steep price for this.

The stock appears to be overvalued, given that it trades above its historical average valuation.

W.P. Carey’s future expected returns could be significantly higher than Realty Income’s, due to its cheaper valuation and higher dividend yield.

Dividend Analysis

Realty Income pays an annualized dividend of $2.53 per share. Based on its current share price, this results in a 4.2% dividend yield.

This is still more than double the 2% average yield of the S&P 500 Index, but Realty Income’s dividend yield has come down significantly over the past several years.

As a stock price rises, the dividend yield declines.

By contrast, W.P. Carey recently increased its quarterly dividend to $0.99 per share. On an annualized basis, this works out to a $3.96 per share dividend payout.

W.P. Carey has a 6.3% dividend yield.

Importantly, both companies have effectively managed their balance sheets.

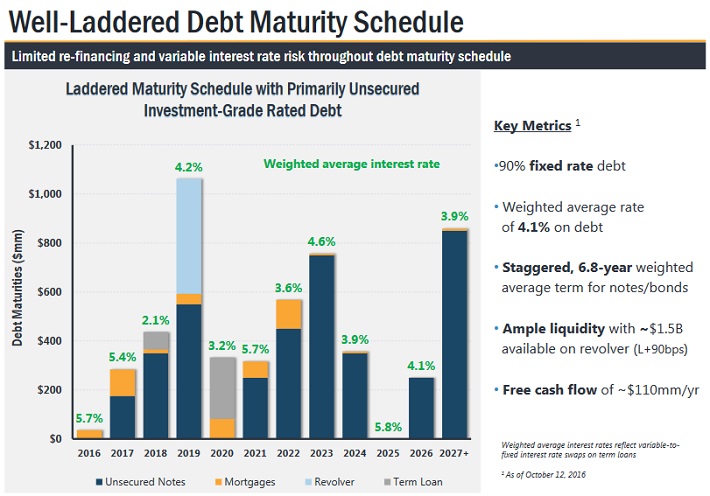

Realty Income has a 4.1% weighted average interest rate on its debt, 90% of which is fixed rate.

Source: Investor Presentation, page 30

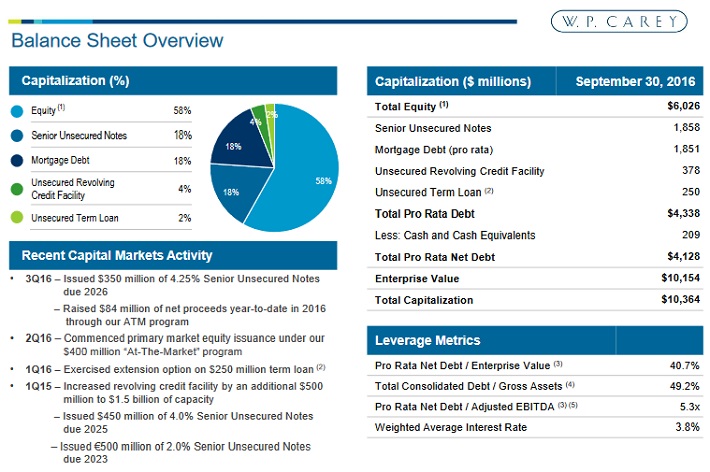

W.P. Carey has a slightly lower cost of debt—its weighted average interest rate is 3.8%.

Source: Third Quarter Earnings Presentation, page 21

W.P. Carey has a BBB credit rating from Standard & Poor’s, while Realty Income’s credit rating is a notch higher, at BBB+.

Final Thoughts

REITs are known for very high dividend yields. But some REITs that have rallied in share price—like Realty Income—aren’t nearly as high-yielding as they used to be.

Both W.P. Carey and Realty Income have high-quality property portfolios, with diverse tenant bases and the ability to raise rents regularly.

And, their balance sheets are strong enough to withstand higher interest rates moving forward.

However, due to valuation and a much higher dividend yield, W.P. Carey appears to be the more attractive REIT right now.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more

Thanks for sharing