A High Yield And High Growth REIT For Every Income Investor

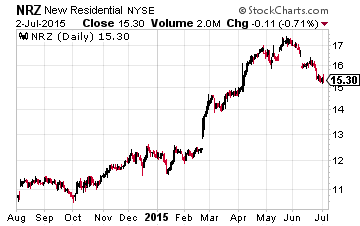

I first recommended New Residential Investment Corp. (NYSE:NRZ) in the August 2014 issue of The Dividend Hunter. At that point in time, NRZ had been recently spun-off by another finance REIT, was very undiscovered by the income investing community, and sported a yield over 11%. Now, about 10 months later, the company has made some bold moves, the stock has been discovered and the share price is up sharply, but dividend increases have kept the yield above 10%. When you look at the 55% total return since I added NRZ to The Dividend Hunter recommendations list, you may think you have missed the boat on this one. I am covering this stock again to let you know that NRZ is still a great income and share price growth story and remains a good initial investment or a stock where you want to add to your position.

A Unique Niche in Real Estate Finance

New Residential invests primarily in the mortgage servicing rights niche of the residential mortgage business. A bank or other financial company that services mortgages receives a portion of the interest payments on the home loans as its fees to handle payment collections and distribution of the payments to the appropriate parties, such as local governments for property taxes and investors that own mortgage backed securities. New Residential does not service mortgages, but does provide financing solutions to large, non-bank servicers. There are two ways that NRZ makes money in the servicing business:

Excess MSRs: Mortgage servicing rights are the portion of interest paid on a mortgage that the servicer earns as its fees. Typical MSR rates are 0.25% or 25 basis points (bps). Often the actual servicing costs 8 to 10 bps, leaving the balance as profit for the servicer. The servicing company can also sell future MSRs to get that money up front, instead of collecting MSRs over many years. New Residential invests in these excess MSRs. Since a pool of mortgages that supports future MSR payments is a depleting asset due to principal payoff and refinancing, the proper pricing of MSR investments is an art. New Residential targets a 15% to 20% average annual return on its excess MSR investments and has actually earned 26% to date. About 55% of the NRZ investment portfolio is in excess MSRs.

Servicer Advances: A mortgage servicer is not earning its servicing fees on any mortgages it manages that are in default or foreclosure. However, the MSRs on these loans accrue and the servicer will get the accrued fees when a home is finally sold or refinanced. New Residential makes loans to servicers that get repaid when the servicing company is able to collect servicing rights that have built up. NRZ targets 20% to 25% returns on these loans and has actually generated annual returns greater than 30%. About 20% of the portfolio is in servicer advances.

Opportunistic Investments: The remaining 25% or so of the New Residential portfolio is in opportunistic investments that the management team finds and believes will meet the company’s target of at least 15% annual returns. For example, the company has invested in non-agency mortgage backed securities by purchasing call rights on the securities. The call rights allow NRZ to purchase underlying bonds at a discount which are paid off at par at the call. Expected returns are in excess of 20% annually.

In February, New Residential made a deal to acquire the only publicly traded competitor in the excess MSR space, Home Loan Servicing Solutions (Nasdaq: HLSS) for $1.3 billion. The acquisition made NRZ as the excess MSR and servicer advance funder for the two largest non-bank mortgage servicing companies in the country. Once the deal was completed, NRZ was able to increase its quarterly dividend by 18% to the current $0.45 per share.

Prior to the merger agreement, New Residential had already increased its dividend by 8.5% in December 2014. The December dividend increase, the HLSS acquisition announcement, and the next, large dividend increase have all propelled the NRZ share price from around $12 last fall to the current $17 range, a 41% increase.

Investment Potential

With the significant dividend growth, NRZ currently yields 10.4%. The company has demonstrated the ability to find very profitable specialty investments and should be able to continue to grow the dividend rate. The market still needs to bring the NRZ yield in line with other high-quality, dividend growth finance REITs. To match its peers, NRZ should yield closer to 8% rather than 10%. To get the yield down to 8%, the share price needs to increase another 30% to $22.50. Any dividend increases would push that target price even higher.

High yield / high dividend growth MLPs comprise a significant portion of the core portfolio of The Dividend Hunter and are used as part of the Monthly ...

more