5 Stocks To Buy Since The Fed Didn’t Raise Rates

I have been investing in the stock market since I was a teenager and I am coming up on the Big 50 this September. I have lived through the go-go 80s and 90s where double-digit annual equity returns seemed like a given most years. Thanks to pro-growth policies and some good fortune, the domestic economy churned out three, four, and even five percent GDP increases like clockwork.

That does not mean there were not shocks to the market like the 1987 October crash, the Mexican Peso crisis of 1994, the Asian crisis of 1997/1998, or the Internet Bust of 2000. However, these seem mild to what has occurred over the past decade. The financial crisis was the worst economic shock since the Great Depression and we have been stuck in the weakest post-war recovery on record since the recession “officially” ended in June 2009. The last time the economy grew at a three percent or better clip was 2005, which seems a lifetime ago.

No major economy seems to have a found a way to accelerate economic growth; although, the huge increases in economic regulations imposed worldwide are certainly a key factor of why business formation and growth are so tepid. Key structural and labor reforms, as well as large and overdue infrastructure programs, have largely been ignored or have failed to be implemented both here, in Japan, and in Europe.

This has left the heavy lifting of trying to boost economic growth to the major central banks. Despite their best efforts, these monetary policies have largely failed to boost growth, however, these same policies have been a boon to asset values such as real estate, art, and of course global stock markets until recently. This has been a key factor in the acceleration of wealth inequality which has become a fashionable election year topic. These initiatives have also resulted in some numbers I never thought I would see in my lifetime.

The ten-year treasury currently yields 1.55%, within shouting distance of its all-time low of 1.39%. You only have to look at the chart below to see the downward trajectory the yield has followed over the last three years. The current yield on the US Treasury bond even looks generous compared to what is available overseas. The ten year German Bund actually went under zero percent last week. The Swiss yield curve is negative all the way out to the 30-year bond and the 10-year British Gilt hovers at just over 1.1% despite the U.K. being on the brink of voting to leave the European Union which would bring about a large economic disruption. Over $8 trillion, yes trillion with a T, of European sovereign debt now carries a negative interest rate. Both the European and Japanese central banks are in uncharted territory with their current negative interest rate policies.

An investor who parachuted in from a decade ago would think he had landed in a Twilight Zone episode. This is the madness that has been brought about by well-intentioned but in my opinion, quite ineffective central bank policies across the globe.

So what is an investor to do in this environment? Given the state of Europe and the divergent policies of the Federal Reserve and the European Central Bank, it is most likely the dollar continues to rise against the Euro. This will continue to be a headwind for the earnings of large multi-nationals and it is a key reason earnings within the S&P 500 are about to post their fifth straight quarter of year-over-year profit declines when second quarter earnings start to come in early next month. I continue to be underweight large companies such as IBM Corporation (NYSE: IBM) that get a good portion of their earnings from overseas, especially from Europe.

Small cap stocks focused on the domestic economy are much less exposed to overseas headwinds and that is a primary reason the Russell 2000 has outperformed the S&P 500 over the past three months. The small cap sector had been a laggard since late 2014 when the Federal Reserve ended its last quantitative easing program so valuations are better in this sector as well.

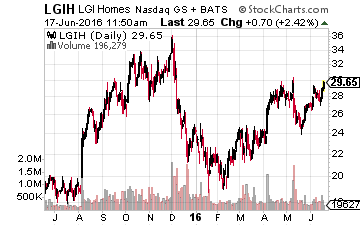

One also has to like home building stocks as lower yields mean rock-bottom mortgage rates. Combined with decent job growth, loosening credit underwriting, and pent-up demand, the housing market should be solid for at least a couple of years outside a significant domestic recession. I continue to like LGI Homes (NASDAQ:LGIH) and Taylor Morrison Home Corporation (NYSE:TMHC), which I have profiled several times on these pages, as my two favorite home building stocks. Both companies are seeing impressive revenue and earnings growth and sell at large discounts to the overall market multiple.

Anything with a safe and solid dividend yield selling at a reasonable valuation should also hold up well as investors scrounge for income in the low yield world we currently live in right now.

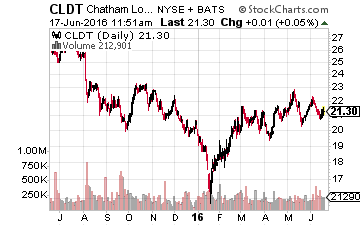

Chatham Lodging Trust (NASDAQ:CLDT)

continues to be my top pick in the lodging real estate investment trust space. I have held this REIT for almost four years now and both the stock price and dividend payout have doubled over that time period. Chatham yields just over six and a quarter percent after raising its monthly dividend payout again earlier this year.

Diamondrock Hospitality (NYSE:DRH) and Hospitality Properties Trust (NYSE:HPT) are two other holdings I have in this high-yielding subsector of the REIT space.

It will be interesting how historians look back a decade from now on the monetary policies currently being engaged by the world’s largest central banks. Somehow I don’t think they will be viewed kindly at that point, but for the sake of the global economy and markets I do hope I am wrong in that assessment.

Disclosure: Positions: Long CLDT, DRH, HPT, ...

more