3 Safe REITs That Regularly Increase Their Dividends

After a third quarter the crushed the share prices of most stocks, a dividend increase will be a welcome boost in yield and should help prop up and increase share values. Each month I publish a report listing those real estate investment trusts (REITs) that should be announcing a dividend increase during the following month.

I maintain and track a database of about 130 REITs for yields and dividend growth rates. About 90 of the group have track records of dividend increases. Most REITs pay quarterly dividends with an increase coming once a year along with one of the quarterly payout announcements. The investing public seems to be generally unaware of the regular timing of the increases, so the announcement of higher dividends tend to have a positive impact on share prices. For November there are a three REITs that have historically raised the dividend rate paid to investors. Here is the list for your further research:

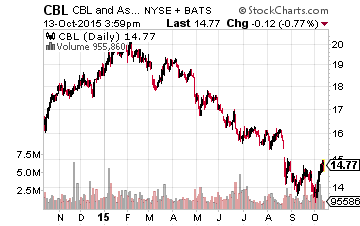

CBL & Associates Properties, Inc. (NYSE:CBL) owns and operates regional shopping malls, open-air centers, outlet centers, associated centers, community centers and office properties. The CBL dividend has been increased every year since 2010. Over the last several years, the increases have averaged about 6% to 8%. For the first half of 2015, adjusted funds from operations (FFO) per share were level compared to a year earlier. However, the FFO cash flow was double the current dividend rate. Expect a modest 2% to 3% dividend increase to keep the growth track-record intact. The new dividend rate will be announced in mid-November with an end of December record date and January payment date. CBL currently yields 7.2%.

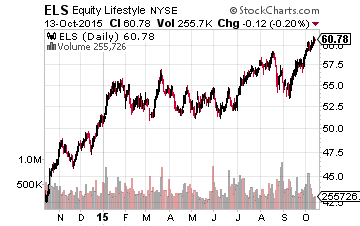

Equity Lifestyle Properties, Inc. (NYSE:ELS) owns manufactured home communities and RV resorts. The dividend from this REIT has been growing for over 10 years. The dividend growth rate has been above 10% every year for that entire decade. Last year the dividend was increased by a healthy 15.4%. The current dividend rate is 50% of the projected 2015 FFO per share, so there is a high probability of another double-digit payout boost. A new dividend rate for the following year is announced during the first week of November. Record date will be at the end of December for a January payment. ELS yields 2.5%.

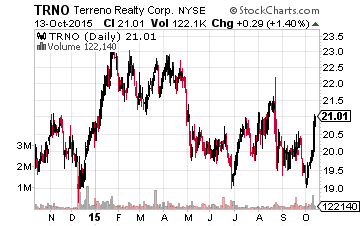

Terreno Realty Corporation (NYSE:TRNO) owns industrial properties in or near the coastal/port cities of Los Angeles, San Francisco, Seattle, Miami, Washington DC, and New York City. The company went public in 2010, started paying dividends in 2011, and has increased the dividend rate every year since. Last year the TRNO dividend was increased by 14.3%. Over the past year, Terreno has expanded dramatically by doubling the amount of shares outstanding. Adjusted FFO per share is down compared to the first half of 2014, so expect no more than a small dividend increase when a new dividend rate is announced in the first week of November. TRNO yields 3.1%.

The yields and dividend growth rates of all of the REITs discussed here cover a range of yield and growth outlooks. I find the potential for another double-digit increase from ELS to be the most interesting of the bunch.

Disclosure: more