3 REITs Increasing Dividends In May

Investing in an accelerating dividend is one of the best ways to consistently increase your wealth over the long-term. With these three stocks expected to increase their dividends in May, now is a great time to add them to your portfolio.

My investing strategies for dividend stocks all focus on finding, owning, and trading dividend paying stocks that regularly, or irregularly, increase their dividend rate. You can put some extra pop into your brokerage account values by purchasing shares of growing dividend stocks before they come out with their next dividend increase announcement.

The real estate investment trust (REIT) sector includes a large number of companies that pay growing dividends combined with enticing yields. Most REITs announce a new, higher dividend rate once a year and then pay the new rate for the next four quarters. I maintain a REIT database that includes when the companies typically announce dividend increases as one of the data points.

A month to six weeks before the next dividend announcement is often a good time to buy or add shares of a REIT that you expect to announce a higher dividend payment for the next quarterly payout. When the market sees the higher rate, the share price often moves higher, and it can be a significant gain to the upside. You can use this information to either buy shares to hold for the longer-term at a lower price or as an intermediate term trade with the goal of making a profit on the typical high single-digit to low double-digit share price gain that often comes with a higher dividend announcement. In many cases the share price will continue to appreciate until just before the next ex-dividend date.

The first three months of the year and the final three are the periods when dividend increase activity is highest. However, there are REITs that announce new rates almost every month of the year, with only a few increase announcements in the summer months of June and July. For May, my database has three REITs that have historically announced new, higher dividend rates.

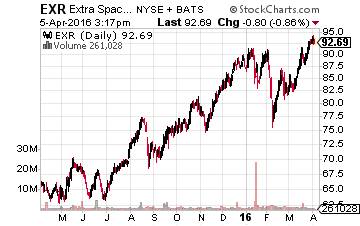

Extra Space Storage, Inc. (NYSE: EXR) is one of the best total return stories in the entire REIT universe. Since its August 2014 IPO, the stock has generated an average annual compounded return of 24.3%. That growth would have turned $1,000 into $12,580 today, including dividends. The returns from EXR have been driven by the dividend growth, which has averaged a 9.4% increase over the last 10 years, 41% for the last five years, and a 25.5% increase last year.

Adjusted funds from operations (AFFO) per share was up 20% in 2015 compared to 2014, so I am looking for a 20% dividend increase this year. Historically, the new dividend rate is announced at the end of May with June ex-dividend and payment dates. Extra Space Storage will also announce first quarter earnings on April 27, which could give a boost to the share price. EXR currently yields 2.5%.

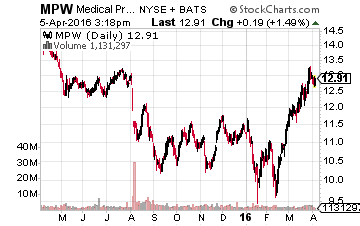

Medical Properties Trust, Inc. (NYSE: MPW) primarily owns hospital properties, which are leased by healthcare facility operators. The company has an irregular history of dividend increases, and in February announced its fifth consecutive $0.22 per share quarter. The previous dividend rate was paid for five quarters until the current rate was announced in February 2015. In March, Medical Properties Trust announced a merger of a hospital group it controls into another hospital group, with the net result of a $550 million payment to the Medical Properties Trust. Management has stated the proceeds will be used to pay down debt and strengthen the company’s balance sheet.

Normalized FFO per share grew by 19% in 2015 and management is forecasting about 4% FFO growth in 2016 after the merger is completed. With a stronger balance sheet, Medical Properties Trust could proceed with a dividend increase in the next quarterly payout announcement in mid-May. The next payment will go ex-dividend in June with the dividend paid in July. A strong, upper-single-digit dividend increase is possible and would be quite the positive surprise to the market. MPW yields 6.9%.

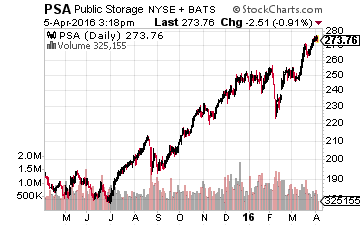

With its $48 billion market cap, Public Storage (NYSE:PSA) is one of the largest companies in the entire REIT universe. In spite of its size, Public Storage has been no slouch in the growth department, producing an average 19.7% annual total return over the same period Extra Space Storage has been a publicly traded REIT. PSA has been available to investors since its 1980 IPO. Last year, the company increased its quarterly dividend by 21%.

For the full year 2015, FFO per share increased by 10%, so I expect the company to announce a similar dividend increase in May, which would be in line with Public Storage’s long-term 9.7% annual dividend growth rate. The next dividend announcement should come in early May along with the first quarter earnings results. Public Storage’s ex-dividend date and payment date are both in June. PSA yields 2.5%.

Disclosure: There are currently over twenty of these stocks to choose from in my more