3 Deeply Undervalued Stocks With Great Dividends

The brutal month of January is now mercifully over. Stocks have not had such a monthly drubbing since February 2009 just as equities were finding their nadir in the equity debacle triggered by the financial crisis. Europe, Japan, and China entered official bear market territory during the month and are down 20% or more from previous highs. Many sectors of the domestic market also entered bear markets including small caps, biotech, and transports. Energy and commodities, which have long been clawed by the bear, had another dismal month.

Despite increased concerns about China, worldwide growth, the strong dollar, the current “profit recession”, volatility in the high-yield market, and a litany of other concerns, it does not appear the domestic economy is going to go into a contraction in 2016. Housing had its best showing in 2015 since 2007 and domestic auto sales set all-time records with low gasoline prices driving impressive sales gains for trucks and SUVs. Job gains remain solid and wage growth even crept up past two percent in the back half of the year.

So, if like me, you believe the domestic economy will continue to muddle along at around the same two percent growth rate that has been the hallmark of what continues to be the weakest post-war recovery on record, this is where you can find some deep bargains in the stock.

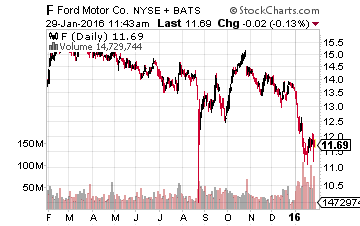

Outside a global recession Ford (NYSE: F) looks incredibly cheap at right around $12.00 a share. Despite the hugely successful roll out of its high margin all-aluminum bodied F-150 truck series and record domestic vehicle sales in 2015, shares lost some 25% during the just completed year. The domestic market might be starting to peak but low gasoline prices will continue to tilt the company’s sales mix to trucks and SUVs, where it makes much higher profit margins than on small or mid-size cars.

In addition, the company continues to gain market share in the critical Chinese auto market where it is now producing nearly 100,000 vehicles a month through joint ventures. Ford just reported quarterly numbers that easily beat both top and bottom line expectations. The stock is just much too cheap at under six times earnings especially given its dividend yield is almost five percent at current levels.

The collapse of oil and natural gas prices have caused a spike in the high yield credit markets where energy debt makes up approximately 20% of the $1.3 trillion domestic market. This spike has triggered a sell-off in just about every small and mid-cap concern that carries a decent amount of debt on the books. One sector that has been very unfairly hit by this rise in volatility is the real estate investment trust (REIT) space. Usually, REITs do very well when the economy is growing and treasury yields are low. This is the case now with both indicators right at the two percent level.

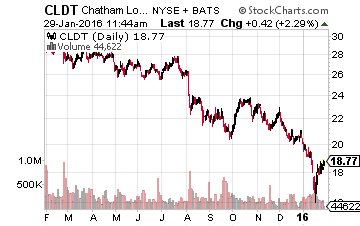

However, many high-quality REITs have sold off 20%, 30% or even 40% giving long-suffering income investors some great long term entry points. Some of the lodging REITs right now look too good to pass up at current prices. Late in January, I gave a shoutout to one of my favorite plays in this area, Chatham Lodging Trust (Nasdaq: CLDT).

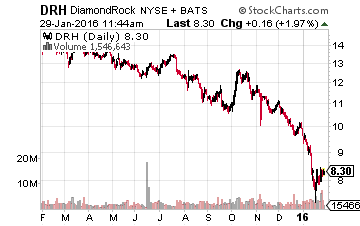

Today let’s look at another name in this industry I have been slowly and incrementally building a significant stake in. The REIT is called Diamondrock Hospitality (NYSE: DRH). As the name implies Diamondrock Hospitality operates hotels under the Hilton, Marriott, and Westin brand names in New York, Los Angeles, Chicago, Boston, Atlanta, and in destination resort locations, such as the United States Virgin Islands and Colorado. It has approximately 12,000 rooms overall.

The shares have lost 30% of their value since their highs this summer as the market is overly concerned about a slowdown from overseas visitors due to a strong dollar. This REIT looks set to keep pumping out 10% to 15% annual FFO (Funds from Operations) increases on the back of yearly revenue gains in the high mid-single digits. The shares provide a robust six percent yield after their recent decline and based on history another dividend increase should be announced in the next few months. The REIT is too cheap at just over seven times this year’s projected FFO.

All of these stocks are cheap and their high dividend yields should put a floor under any further significant declines. An investor also gets paid a nice little stipend while waiting for the market to stabilize and eventually recognize the intrinsic value of these cheap stocks.

Position: Long CLDT, DRH, and F