PBOC Wastes No Time Proving Desperation

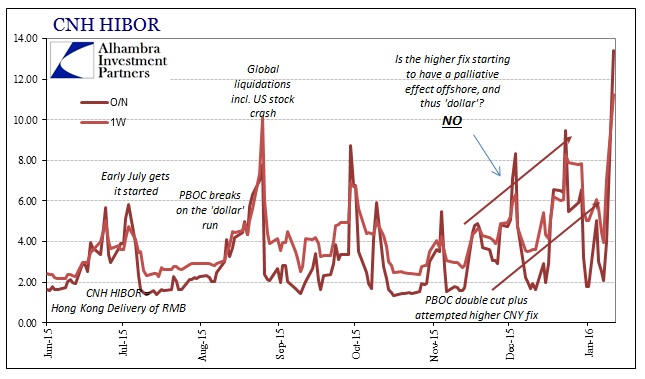

The PBOC wasted no time this week showing that it was serious about its desperation last week. The central bank fixed the CNY reference contrarily upward to 6.583 this morning from Friday’s 6.600. As we have been documenting during this unabated “dollar” problem, whenever the PBOC attempts a contrary maneuver with the fix it typically sets off enormous fireworks. Sure enough:

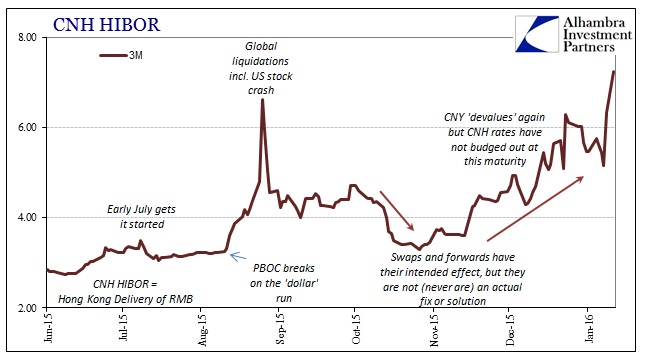

Offshore, HIBOR rates surpassed all prior indications of stress, hitting new highs almost across the curve. The overnight rate jumped from 4% Friday to 13.396%, while the one-week rate shot past 11%. The more important (and usually more stable) 3-month HIBOR rate fixed just shy of 7.25%, itself a record.

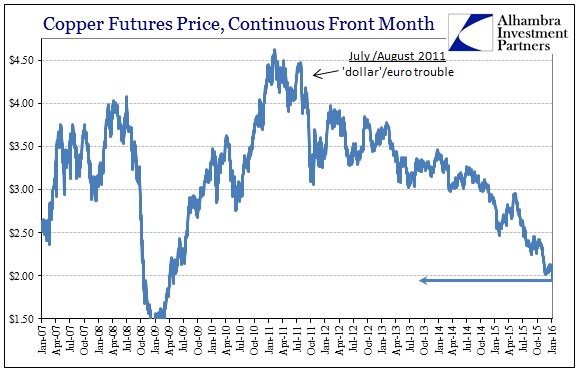

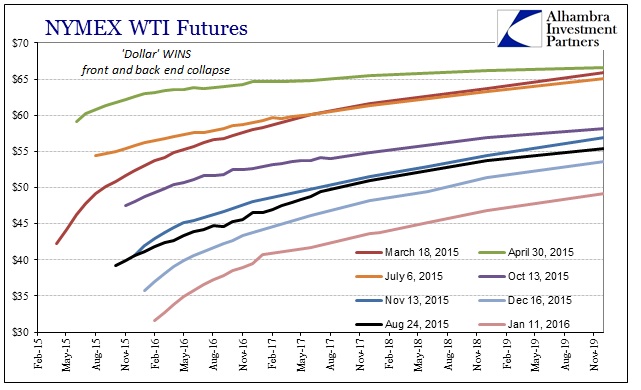

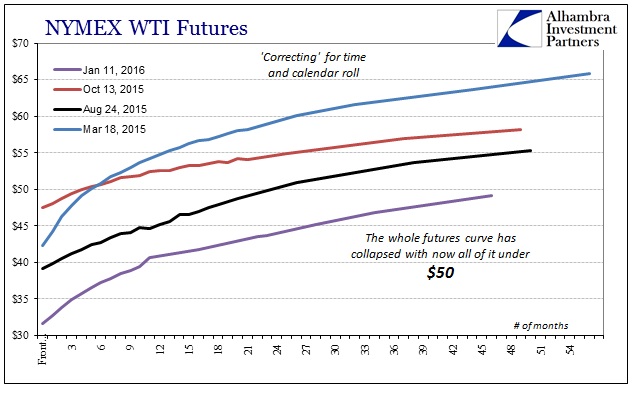

Commodities are being heavily sold including and especially crude oil in WTI, which has the direct effect of getting the attention of “nervous” stock traders many of whom are still fixed on the undoubted economic boom scheduled for any day now. The above charts are supposed to be China and only China, yet the symmetry with oil and so many other financial indications globally demand disprove the suggestion; that includes the curious fixations of “dollar” money markets that are no stranger to any of this as I explained here (subscription required).

Even with copper trading solidly below $2, the scale of the disaster in oil is hard to fathom though importantly it should be more appreciated because of this connection between global “dollar” finance and the global economy including our increasingly distressed domestic component (manufacturing first).

The crude curve has just collapsed, especially since the rebound after China’s Golden Week reprieve ended around October 15. Now the entirefutures curve is under $50, an upsetting commentary on everything from US “demand” to long-term implications and especially those that are derived from economists’ somehow continued insistence that this is all just “transitory.” There is no such thing in the oil curve, which is exactly where it should be.

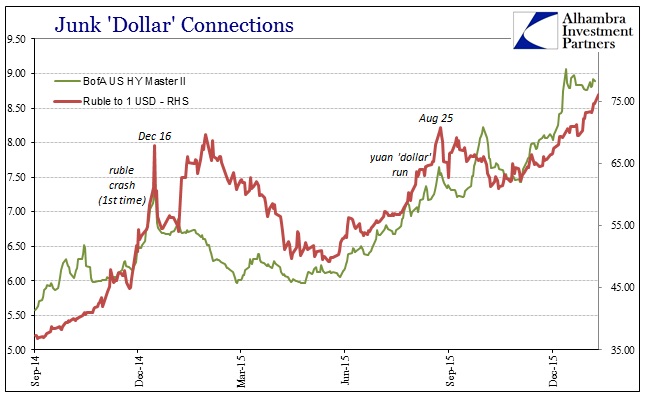

In fact, the “dollar” continues to build (or un-build) in what I termed durable correlations. These relationships, such as the “dollar” tasking on both CNY and WTI shown above, are really just risk resetting in global fashion, taking money cues increasingly as the baseline setting. For instance, we see the Russian ruble now falling below 77 in many ways mirroring the junk bond reset (credit cycle risks) in BofAML’s Master II High Yield Index effective yield.

In other words, the fact that there is an obvious risk correlation related to the “dollar’s” effects globally helps explain why there was no bargain hunting in US junk after the latest and most intense selloff to mid-December. It is, as I have noted before, an unmistakable escalation in financial position and perhaps prohibition more broadly – a highly precarious state that further and further cements that what we are seeing is not temporary but paradigm altering.

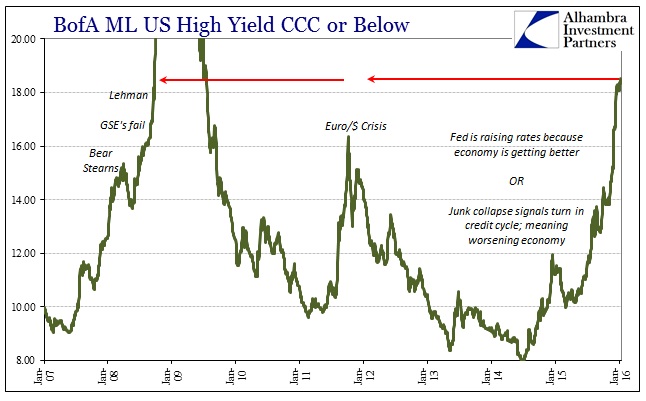

Now the CCC component of junk is again selling off (with absolutely nobuying interest in the past few weeks after the extreme violence of the last selloff) which provides nothing but further ominous interpretations since triple-hooks have been leading throughout the past year and a half.

All that brings us back to China and the PBOC as a matter of reactive attempts and intentions. When the central bank gets to being bold (as a reaction from desperation) it has shown the ability to make it all worse; when passive it all gets worse anyway, though maybe not in so much of a straight line. In short, China’s problems are not Chinese. If the credit cycle is resetting here and the RMB “cycle” is persistently ruining China’s liquidity, with oil sticking in both, then financial and money markets are increasingly adamant that there is no recovery, there isn’t likely to be one for a good long time, and that then downside possibility is both increasingly probable and at the same time drastic.

Disclosure: None.

That HIBOR graph is terrifying.