XLE Underperforming Crude Oil - Divergence To End Soon?

Generally speaking, crude oil and the energy exchange traded fund XLE have a pretty high correlation. Since mid-February, that correlation has been breaking down.

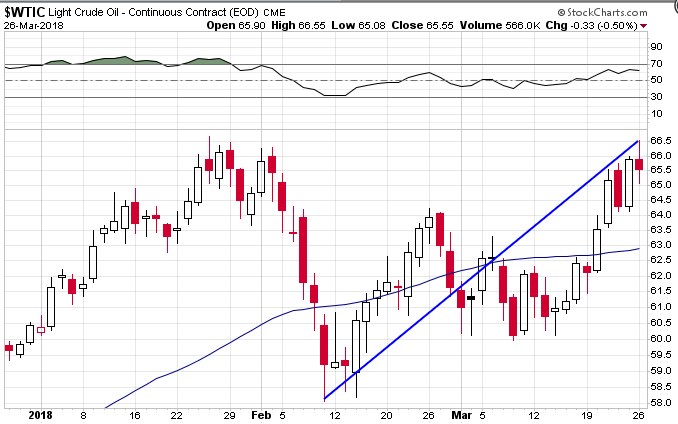

In mid-February, Light Crude Oil (WTIC) hit a low of $58.07 while XLE dropped to $63.99.

Since then, WTIC has rallied 12.88% to $65.55 while XLE has only rallied 6.22% to $67.97.

There could be one of two things going on here. Either the market doesn’t buy the global growth story and WTIC will fall back in line with XLE; or, XLE will play catch up and rally strongly to get back in line with the rally in crude.

Exxon Mobil (XOM) has also been particularly hard hit during this time, dropping just under 1% despite the nearly 13% rally in crude oil.

There is also some divergence starting to appear on the chart of XOM, with the stock trending lower, but the RSI indicator starting to trend higher. Sometimes, this can be a catalyst for higher stock prices.

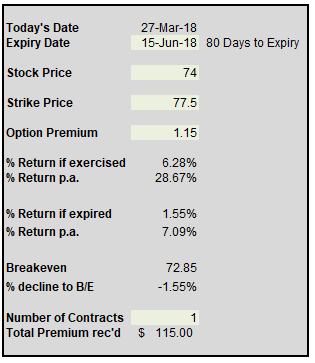

XOM currently yields over 4% and covered calls can further increase the yield for income-oriented investors.

A June 15th $77.50 call currently increases the yield by over 7% p.a. while also allowing for nearly 5% upside in price.

Covered calls are a great way to increase the yield on a stock position, however they do not give the investor much downside protection.

Counting against XOM at the moment is the fact that it is below both the 50 and 200 day moving averages and the 50 recently crossed below the 200 in what is know as a Death Cross.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more

I remain stead fast believer that U.S energy stocks will make a comeback with #oil prices but many are over leveraged and thats certainly not what investors want right now. I like the idea of using covered calls on $XOM I am trying to learn how to use options more effectively.

What steps are you using to learn more about options and covered calls?

Talking to professionals and my own trial and error.