Trading Intel Volatility

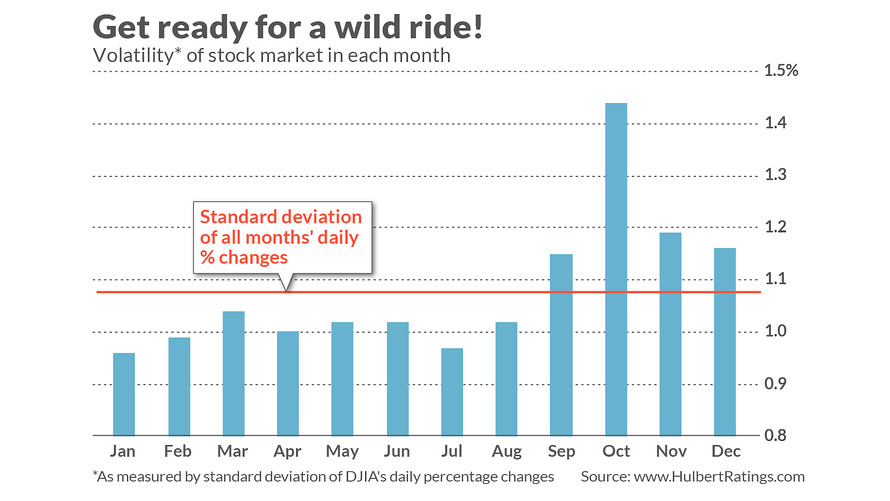

From CMLViz: October is historically the most volatile month of the year for stocks and 2018 is proving to be no different. On a stock specific note, Intel now has analysts strongly on two different sides — either it is making a comeback or it has lost ground forever to AMD. That may mean more volatility, but that has in fact created a pattern for Intel. Here is a nice look at historical volatility by Month for the Dow Jones Industrial Average:

Starting in September, peaking in October, and lasting through out the rest of the year, this has been a bumpy time for stocks. That volatility can be bottled and tested. Wed o so for Intel, and the results have been quite strong.

INTEL CORPORATION EARNINGS

In Intel Corporation (Nasdaq:INTC), irrespective of whether the earnings move was large or small, if we waited one-day after earnings and then back-tested going long a slightly out of the money strangle (buying an out of the money call and an out of the money put) using the options closest to two-weeks from expiration, the results were quite strong.

This back-test opens one-day after earnings were announced to try to find a stock that moves a lot after the earnings announcement.

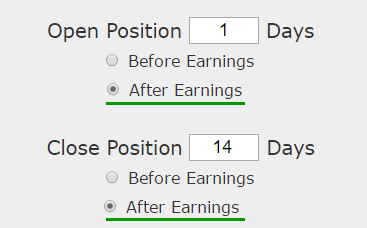

Simply owning options after earnings, blindly, is likely not a good trade, but hand-picking the times and the stocks to do it in can be useful. We can test this approach without bias with a custom option back-test. Here is the timing set-up around earnings:

Rules

* Open the long 40 delta (out of the money) strangle one-calendar day after earnings.

* Close the strangle 14 calendar days after earnings.

* Use the options closest to 14 days from expiration.

This is a straight down the middle volatility bet — this trade wins if the stock is volatile the week following earnings and it will stand to lose if the stock is not volatile. This is not a silver bullet — it’s a trade that needs to be carefully examined.

But, this is a stock direction neutral strategy, which is to say, it wins if the stock moves up or down — it just has to move.

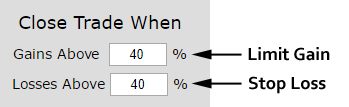

RISK CONTROL

Since blindly owning volatility can be a quick way to lose in the option market, we will apply a tight risk control to this analysis as well. We will add a 40% stop loss and a 40% limit gain.

In English, at the close of every trading day, if the strangle is up 40% from the price at the start of the trade, it gets sold for a profit. If it is down 40%, it gets sold for a loss. This also has the benefit of taking profits if there is volatility early in the week rather than waiting to close seven days later.

RESULTS

If we bought the out-of-the-money strangle in Intel Corporation over the last two-years but only held it after earnings we get these results:

| INTC Long 40 Delta Strangle |

|||

| % Wins: | 87.5% | ||

| Wins: 7 | Losses: 1 | ||

| % Return: | 236% | ||

The mechanics of the TradeMachine® are that it uses end of day prices for every back-test entry and exit (every trigger).

Looking at Averages

The overall return was 236%; but the trade statistics tell us more with average trade results:

- The average return per trade was 35% over 14-days.

- The average return per winning trade was 47.4% over 14-days.

- The average return per losing trade was -51.6% over 14-days.

Looking at the Last Year

While we just looked at a multi-year back-test, we can also hone in on the most recent year with the same test:

| INTC Long 40 Delta Strangle |

|||

| % Wins: | 75% | ||

| Wins: 3 | Losses: 1 | ||

| % Return: | 116% | ||

Now we see a 116% return over the last year and a 75% win-rate.

- The average return for the last year per trade was 34.3% over 14-days.

- The average return for the last year per winning trade was 62.9% over 14-days.

- The average return per losing trade was -51.6% over 14-days.

Disclosure: This is how people profit from the option market. Take a reasonable idea or hypothesis, test it, and apply lessons learned. more