Profit On Genworth Deal Uncertainty

Thesis: Substantial pessimism of the completion of the Genworth (NYSE:GNW) deal to be acquired by China Oceanwide presents an opportunity for the smart investor.

Risk/Reward

The shares have a deal premium priced into them. They could lose that premium quickly if the deal is renegotiated. The potential acquirer can renegotiate the deal because they have so much leverage in the situation. The company is performing poorly and there are no other known bidders or indications of interest.

Overview

The shares have been a poor performer due to a lack of earnings, and the inability of the company to take proactive steps for shareholders i.e. stock buybacks or dividends.

Book Value

It is possible to say, based on book value, that the shares are undervalued. However, looking at the performance of the shares, one could have made that case for the past decade, with only losses to show for it.

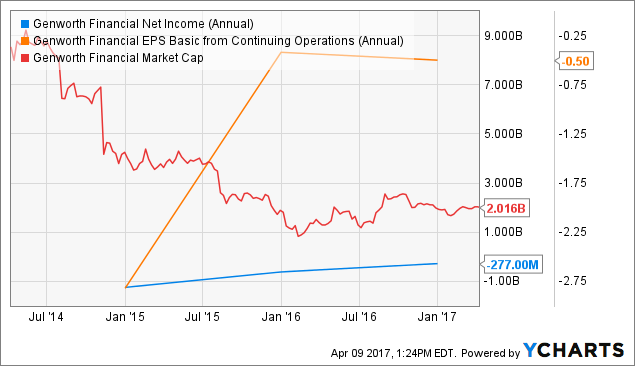

GNW data by YCharts

Earnings and Cash

Obviously, the shares have been incredibly disappointing for shareholders. And here we see that the cash generated by the company has been steadily declining with the shares.

Cash would have provided the ability for the company to undertake some steps to create value for shareholders like a dividend or buyback.

GNW data by YCharts

Catalysts

Again we see the potential for the shares to be considered undervalued, but there appear to be few catalysts on the horizon for the underlying company. Hoping for a higher bid (or for the current bid to be honored) or for another bidder is wishful thinking, but it is optimistic speculation.

Deal Risk

The real risk to shareholders is if the current deal is renegotiated or the offer is lowered.

GNW data by YCharts

Virtually no deal arbitrage

In a normal deal situation, the shares would be trading at a much closer value to the proposed deal price. Genworth shares trade at $4 and the offer price is $5.43. Obviously, there is substantial skepticism that the deal will go through at that level, or possibly at all. Analysts have already voiced their opinions that the deal will be re-negotiated. This is already known. And the share price and options reflect this uncertainty.

No other bidders

The other reason the shares should be higher is the possibility of another offer emerging. The share price and lack of option premium tells you that this is not a real possibility either.

Valuation: Real world vs. theoretical

Analysts have frequently tried to explain how Genworth is "undervalued." And have been doing so for nearly a decade. One bullish analyst has a $9 "sum of the parts" valuation on the shares. Another analyst sees the sum of the parts value of the shares at $4.23 but warns the shares could trade below $1 if this deal falls apart.

Bullish analysts usually point to the low price to book value (between .60-.13) which is very low, but hides serious problems with the businesses. Bearish analysts point to the problems with the businesses, earnings, and the potential liabilities.

GNW Net Income (Annual) data by YCharts

History: Problem Businesses

Huge liabilities in the LTC business, low earnings, strange mix of businesses, chargeoffs, liquidity issues.

Continuing problems at the business:

more troubles at Genworth's long-term care unit, with the company saying it would increase LTC claim reserves by $400M-$450M after an annual review, resulting in an after-tax Q3 charge of $260M-$300M. The company will also book a non-cash charge of $275M-$325M related to deferred tax assets that are now not expected to be used prior to expiration.

The shares have lagged the overall market by a huge margin as hopeful investors hope for any transaction to unlock value.

However, I still see opportunities to make substantial profits in Genworth.

Sell Deal Risk

Sell the Sept. 15 $3.50 Puts at .45

At $3.50, a return of 14.75% return for 162 days and better than 25.6% annually.

Less Risk for Shareholders:

An investor who acquires 100 shares via selling a put at a cost basis of $3.05 has less risk than a shareholder who owns 100 shares at $4. So, selling a put entails less risk.

The upside from here for shareholders in the best case scenario is only $1.43 or 35%. Based on the delta for the January $5 calls, the options market gives a share price above $5 only a 32% probability

Downside for shareholders: The downside of a deal being renegotiated and the shares trading to $3.50 is a loss of .50 for current shareholders or a 12.5% loss from current levels.

Who does this make sense for:

- Current shareholders who realize the risk/reward for the current deal is unattractive.

- Investors who like Genworth and would be happy to own it at $3.05 or below.

- Or as a conservative speculation, since the strategy assumes that a deal is re-negotiated.

Risk

The risk is that a deal is definitively called off. And there is no ongoing negotiation. Genworth is left with a struggling business and must try to collect a breakup fee with a company based in China. I see this as only a 10% probability, as China Oceanwide has already invested a large amount of time to making this transaction happen. The most-likely scenario is a renegotiation.

Conclusion

Deal risk in Genworth presents an opportunity for investors and traders to profit via an approach of selling the deal risk. This is much less risky than owning the shares at $4 and gives the bullish investor a chance to profit in multiple scenarios.

Options involve risk. Investors should consider their risk tolerance. Trade ideas are for educational purposes

Buying any investment based on a potential buyout is extremely risky. Perhaps one option is to track the pre-market buying activity as a sign of an imminent buyout event. Keeping a eye out for huge volume shifts in pre or post market for a stock is a method some use to see the direction of the stock prior to market opening.

Thx joe.

The recommendation wasn't to buy the stock. The buyout has already been announced.

Good luck to you

But the deal hasn't gone through yet? Quoting from your article:

"....there is substantial skepticism that the deal will go through at that level, or possibly at all."

If that's the case, there may well be considerable volatility ahead for the stock.

Thank you Susan, Kurt, and Gary. Appreciate it. 👍

Looking forward to more by you!

Excellent read and worthy addition to the site.

That is an interesting piece of funda analysis and strategy. Specifically "sell the deal risk".