Outerwall: One Of The Best Free Cash Flow Margins Of Safety I Have Ever Seen

It's not every day when you can find an incredible bargain in the stock market, where a company's stock is oversold by investors just because they are very confused about its future growth prospects. Being so confused about it, they totally ignore the amazing free cash flow numbers that the company is reporting. Investors are not alone as the Analyst community is just as confused and have no idea what recommendation they should give the company (Buy, Hold or Sell). The name of the company causing all this confusion is Outerwall (OUTR) and recently it got downgraded and its stock price took a hit as a result.

Outerwall Inc (NASDAQ:OUTR) was downgraded by an analyst at Riley & Co. from a "buy" rating to a "neutral" rating. They now have a $76.00 price target on the stock, down previously from $100.00. 16.4% upside from the previous close of $65.31

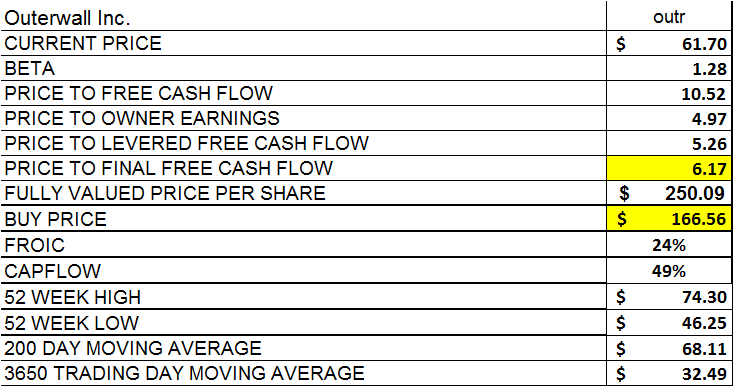

So today as a result the stock trades at $61.70 and took a -5.5% hit from this downgrade. Obviously the analyst at Riley & Co. is confused about the company's growth prospects and has been so for a while because to drop your price target by -24% means (in the business of analysis) that there is a bit of panic going in the analysts thinking process, in that he felt his past price target recommendation was too high. But despite his confusion he still thinks that the stock is worth $76 a share. So instead of a 16.4% upside an investor could make 23.17% return if the stock just gets back to his new target.

Here is more on the downgrade:

Outerwall sinks after downgrade on challenging revenue outlook

Shares of Outerwall (OUTR) are sinking after research firm B. Riley downgraded the stock, saying that the company may find it difficult to increase the revenue generated by its Redbox movie rental business. WHAT'S NEW: Shifts in consumer behavior and changes in the movie rental industry will increasingly impact Redbox going forward, creating obstacles for the business' revenue growth, B. Riley analyst Eric Wold wrote in a note to investors earlier today. Additionally, given Redbox's fixed costs and Wold's belief that any benefit to Outerwall from higher Redbox prices could prove temporary, the analyst warned that Outerwall may have trouble increasing its profit margin. Outerwall may never again be viewed as a growth story, according to the analyst, who cut his rating on the stock to Neutral from Buy and slashed his price target on the name to $76 from $100.

Well that is a lot to digest there but changes in the movie rental business are quite obvious as many consumers are moving to streaming, but despite that fact, there are a hell of a lot of people who do not have high speed wireless and cannot benefit from streaming, basically because they cannot afford it. Even with basic packages, high speed wireless at a minimum starts at around $40 a month. Then when you add in the $7.99 for NetFlix (NFLX) you have $48 + tax. There are millions of people in the US who just can't afford that. At the same time you can buy a cheap DVD player at Wal-Mart (WMT) for $30 and then just go to Outerwall's RedBox and for a few bucks rent "a just released on DVD" movie for the night. Its a real bargain and with 35 million customers Outerwall has quite a dominant market share and pretty impressive numbers as you can see from the table below:

With Blockbuster having switched to streaming and with Netflix concentrating more and more on streaming, means that Outerwall's market share could become even more dominant over time.

Now if I were to put my Qualitative Analyst hat on and go to Philip Fisher's "15 Points" I would find the following for point #2:

2. Does the management have a determination to continue to develop products or processes that will still further increase total sales potentials when the growth potentials of currently attractive product lines have largely been exploited?

Well if the analyst at Riley & Company is right and he sees little growth in Redbox going forward, he may have obviously missed that Outerwall has the following other growth engines rolling out.

1) EcoATM The ecoATM is a kiosk where customers can instantly trade mobile phones, tablets, and mp3 players for cash. These machines cost the company around $35,000 to develop, but return $100,000 to $120,000 in revenue per year.

The following is an amazing YouTube Video that shows you how the EcoATM Works

<

These days the only real other competition EcoATM will have will be Pawn Shops if you want to get cash for an old phone instead of credit.

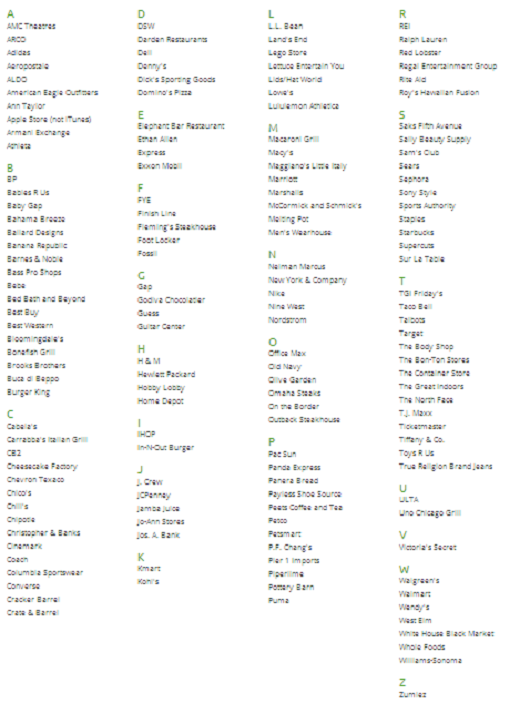

2) Coinstar Exchange This is a machine that allows you to exchange gift cards from the following locations into cash:

3) RedBox Instant To keep those RedBox's busy, Outerwall has teamed up with a 900 pound gorilla in Verizon (VZ) to take on Netflix (NFLX) and Amazon (AMZN) by offering this:

So as you can clearly see Outerwall has a lot of growth left and I am sure there are millions of people like me out there that have a couple of old gadgets and cellphones in their desk, with no place to get rid of them. Outerwall basically uses Kiosk technology to provide services for people and makes their lives easier. Not only that but each Kiosk takes up only about 6 feet of floor space, so they can be placed anywhere and act as billboards for the company like Coca-Cola (KO) and Pepsi (PEP) machines have done successfully for decades. Plus those Coinstar change machines are still very profitable and Outerwall charges an 8.9% fee for saving customers from wasting the hours needed to put all their accumulated pocket change in wrappers and then take them to the bank. You may not think that exchanging loose change for people is a good business, but last year Outerwall's Coinstar change kiosks had revenue of about $300 million and profit of $68.5 million, making those change machines have an "Income from continuing operations before income taxes" of 22.8% and that compares to 12.5% for its RedBox machines. As for new ventures, 2013 revenues were about $32 million and that is up from $350 thousand in 2012. The new ventures only contributed 1.4% of total 2013 revenue, but I expect them to be a serious growth engine going forward as Outerwall is making a serious push in installing EcoATM's all over the US.

Since we are talking numbers, let us now move to Outerwall's Free Cash Flow numbers.

On a per share basis for 2013, Outerwall had

Free Cash Flow Per Share of $5.86 a share

Owner Earnings Per Share of $12.46 a share

Levered Free Cash Flow of $11.72 a share

So if we add them all up and divide by three we get final free cash flow of $10 a share.

These numbers per share should stay in the double digits per share from now on as Outerwall is proving itself to be one of the most shareholder friendly companies out there, as it has used its tremendous free cash flow to buy back hares its company's stock at an incredible rate.

In 2010 the company had 31.5 million shares outstanding and now have 19.68 million shares outstanding. Value Line estimates that Outerwall by 2017-2019 will have 17.5 million shares outstanding, so in just 7-9 years management will have retired 44.44% of its shares. Now that should give us $9 a share in earnings in 2017-2019 which means that the stock is a real bargain for the long term investor. It is inexpensive now because the company is able to depreciate all those DVD's and kiosks and for 2013 that depreciation number alone came in at $207.2 million, which was much more than its earnings, which came in at $174.8. When figuring out simple Free Cash Flow, one basically just adds Net Income + Depreciation together and then subtracts Capital Spending. If you get more complex then you add a few more things in and you get Cash Flow from Operations which in Outerwall's case was $324 million in 2013 and free cash flow was $166 million, as Capital Spending was $157 million. But if you go HERE you will get an introduction to my work on Levered Free Cash Flow and Owner Earnings (Warren Buffett's Formula for FCF) and there you will also find my analysis of Apple (AAPL).

Therefore if we just grow Outerwall's final free cash flow by 5% going forward and use our Two Stage Dividend Discount Model, we get the following results based on Outerwall's current price;

My results might seem way off the mark, but if you go do the Levered Free Cash Flow, Free Cash Flow and Owner Earnings Analysis you will get

Owner Earnings Per Share of $12.46 a share

Levered Free Cash Flow of $11.72 a share

I can't dream up those numbers or make them up. Those are the real results from analyzing Outerwall's 2013 cash flow statement.

So as you can clearly see we have a tremendous amount of margin of safety in this stock and even though Outerwall trades at a total market capitalization of $1.21 billion, its revenues in 2013 were $2.33 billion and as a result it has a price to sales result of 0.51%.

While Netflix for example had Revenue of $4.6 billion in 2013 and sells for $26.44 billion, for a price to sales number of 575% or eleven times that of Outerwall. At the same time Netflix had a free cash flow loss of $-22 million in 2013 while Outerwall earned $166 million in free cash flow.

So in conclusion if you take the time to actually crunch the numbers, you can clearly see why Wall Street and many from its Analyst community are truly out of touch with reality. I have researched Outerwall and can not find anything that would cause me concern. I proudly hold shares in it for my clients. In fact, out of all my holdings it is the worst performer, but it is the one I least worry about, because it has one of the greatest margins of safety when analyzed from a multiple free cash flow ratio point of view.

Always remember that these are the results of our research based on the methodology that I have outlined above and in other articles previously published. This research is provided as an ...

more