Dillards: Undervalued Retailer. Get Paid To Wait

Overview:

We will examine the reasons why Dillard's stock is attractive and why value investors including, David Einhorn, have been buying.

Dillard's (NYSE: DDS ) encompasses numerous value metrics I require in an undervalued situation. Dillard's has ample liquidity, low debt, positive earnings, low p/e, strong balance sheet, a large stock buyback program, strong cash flows, and temporarily out of favor with investors.

Next, I will review various option strategies that will reduce risk and enhance returns in the position.

I will use valuation metrics to show the stock is undervalued and then utilize option strategies to show how best to initiate a position that limits risk, and enhances the total return.

The company:

Dillard's, Inc. ranks among the nation's largest fashion apparel, cosmetics and home furnishings retailers with annual sales exceeding $6.5 billion. The Company focuses on delivering style, service, and value to its shoppers by offering compelling apparel, cosmetics and home selections complemented by exceptional customer care. Dillard's stores offer a broad selection of merchandise and feature products from both national and exclusive brand sources. The Company operates 271 Dillard's locations and 23 clearance centers spanning 29 states plus an Internet store at www.dillards.com. (Source: Dillard's website:)

Recent Earnings and Sales:

Net sales for the 52 weeks ended:

January 28, 2017 were $6.257B

Total merchandise sales for the 52 week period ended January 28, 2017, were $6.07B

Sales in comparable stores for the period also decreased 5%.

During the year, the Company purchased $246.2 million of Class A Common Stock under its share repurchase authorization.

Share repurchases were accomplished entirely from available cash and operating cash flow

Dillard's Chief Executive Officer, William T. Dillard

"Our operating results reflect another quarter of mall traffic declines from continued retail industry challenges. In response, we are ramping up our efforts to bring more distinctive brand and service experiences to Dillard's, both in store and online. Our strong balance sheet provides us support in these challenging times, and during the year we returned $256 million to shareholders."

(data provided from Dillard's Feb 21 results).

(Einhorn picks DDS, Jan 17, 2017)

Its logical to assume that famed value investor, David Einhorn, recognizes the potential in Dillard's due to the attractive valuation we will examine next. However, each investor must do their own due diligence.

From the recent Greenlight Shareholder Letter ...

Long a variety of low-multiple, tax-paying, U.S. value stocks. Corporate tax cuts provide the most benefit to companies that have profits on which to pay taxes. AMERCO, CC, Dillard's, and DSW (NYSE:DSW) are all generally full federal tax-payers with healthy profits.

- David Einhorn/ Greenlight Capital Letter, January 17th, 2016 (source: Valuewalk)

Why Dillard's is attractive:

Balance Sheet Strength:

As a value investor, I tend to focus on current assets in evaluating a company. Liquid assets and cash are my favorites.

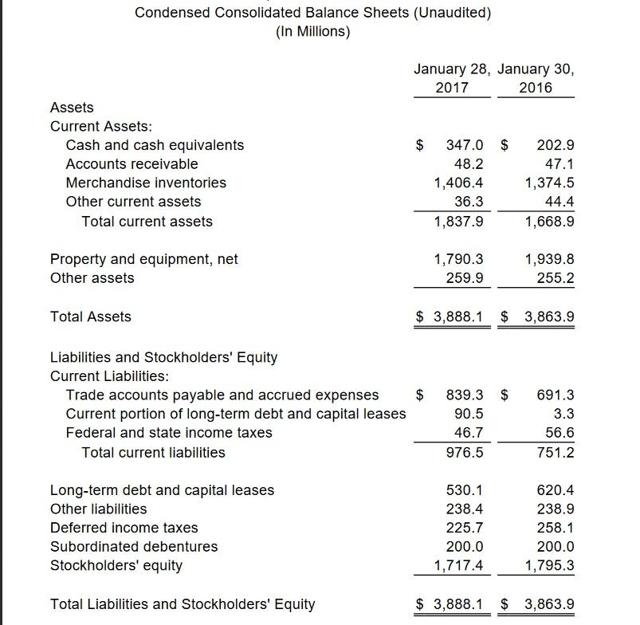

According to the recent company disclosures below, the current assets are $1.8B with $347M in cash and only $540M of debt. A Debt level of 31% is very attractive. Clearly, the company has the financial resources to survive this downturn.

(via Dillard's quarterly report)

Oversold and Out of Favor:

Dillard's stock has been hammered along with other retailers. From the chart, DDS, which traded above $140 in 2015 now languishes around $53. As a value investor, these are all positive factors in our search for out of favor situations.

The retail sector has a relative strength of 1, which makes it the lowest ranked group over the last 6 months. Dillard's has a Relative Strength of 6, meaning that Dillard's has underperformed 94% of all stocks over the past year on a technical basis. (via Marketsmith)

There seems to be lots of support for the stock in the $50 range going back to its breakout in 2010-2011. And with a RSI this low, it is definitely oversold in the near-term.

However, as a value investor, we need the comfort of earnings, balance sheet, liquidity, and buybacks to make us more confident that our risk to the downside is limited.

Earnings & Low P/E:

The Trailing 12-month p/e is just above 10 versus a historical p/e of about 15. This discount represents the negative sentiment of the retail sector and uncertainty. When the stock was trading at $144, the p/e was close to 20. Wall Street makes you pay dearly for certainty.

The company could easily return to a normal p/e once the sentiment improves from its oversold status. A modest 12 p/e on $5 in earnings takes us to $60- a 20% return. And there is much more upside at a p/e of 15. Predicting Wall Street sentiment is difficult, so we avoid it. We do know based on the technicals, that the group and stock are significantly oversold.

The company trades right around current book value of about $50. Dillard's has had consistent earnings between $8.50 - $5.60 in the last 5 years. (via Marketsmith)

Cash flow/ Private Equity:

(via Feb 21 quarterly earnings report)

As we can see, Dillard's is still producing large cash flows. From the latest earnings above, we see Dillard's produced net cash of $517M last year and $450M the year before. With 33M shares outstanding, that's an average cash flow per share of $14.65 over the two years.

That's attractive for any private equity shop on Wall Street. It gives them plenty of time to bring in a retail expert who can tweak the merchandising mix while they get paid large dividends from the cash flow and low debt. I invest in undervalued companies based solely on valuation and do not invest based on expectations for a buyout alone. But, the company is an interesting target due to the valuation.

Liquidity and Stock Buybacks:

Current Assets near $2B and cash of over $340M. During the year, the Company purchased $246.2 million of Class A Common Stock under its share repurchase authorization.

(via Dillard's Feb 21 results).

Concerns:

Amazon (Nasdaq: AMZN ) as a competitive threat: risk vs. reward

As a value investor, we seek opportunities where an industry is out of favor. In this case, the fear of Amazon has been so overpriced by investors, that it allows one to purchase Dillard's at a very attractive price based on the fundamentals of the company. We are aware that same-store sales slipped 5% in the recent quarter, however, we believe the pessimistic view is priced into the shares at current levels.

I require the valuation to be so attractive that a flaw in the business analysis would be priced in by a margin of safety in the valuation. DDS is sufficiently attractive based on the fundamentals at the present time, despite the threat posed by Amazon.

2. different ways to make money in this situation:

Most Attractive Scenario: Get Paid to Wait

Sell a put:

Why its attractive: selling a put allows us to profit even if the stock stays where it is. Also, it allows us to acquire shares below the current price and thus, at a discount. This allows us to increase returns while reducing risk.

1. Sell a 30 day put: DDS is at $53, so we're selling the put below the market. (May 19 $50 at $1.58)

We are selling the right to be put Dillard's stock at $50 And for selling this right, we receive $1.58 today.

This gives you a potential profit of $1.58 if the stock stays at this level. The put proceeds return 3.16% for the 30 days and annualized returns of about 37.92%

If the stock trades below our $50 strike, the cost basis would be $48.42 (we would then own the stock at an 8.6% discount from today's price).

This is my preferred method in a situation like this. The shares are undervalued, but there is not an imminent catalyst. They could remain undervalued and trade sideways. Either I will profit in the position or I will receive the shares at a more attractive valuation. Win/ Win.

Buy the stock

I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

2. Purchase the shares today. We're looking for a rebound in the shares to a typical valuation of 12X and a share price over $62. (a return of 17%).

Conclusion:

Dillard's is attractive based on all of the important metrics that smart value investors like David Einhorn look for: earnings, low p/e, stock buybacks, solid free cash flow, in a stock and sector that is temporarily out of favor with investors.

Simply because a stock is undervalued currently provides no guarantee of profit. Therefore, to add an extra layer of safety, we look to initiate a position either by selling a put or buying stock This allows the investor to profit in many different scenarios, enhancing total returns and reducing the overall risk.

However, as a value investor, we need the comfort of earnings, balance sheet, liquidity, and buybacks to make us more confident that our risk to the downside is limited.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.