Ongoing Dryness Vs. Yield Reports Has The Crop Ideas Little Changed

Market Analysis

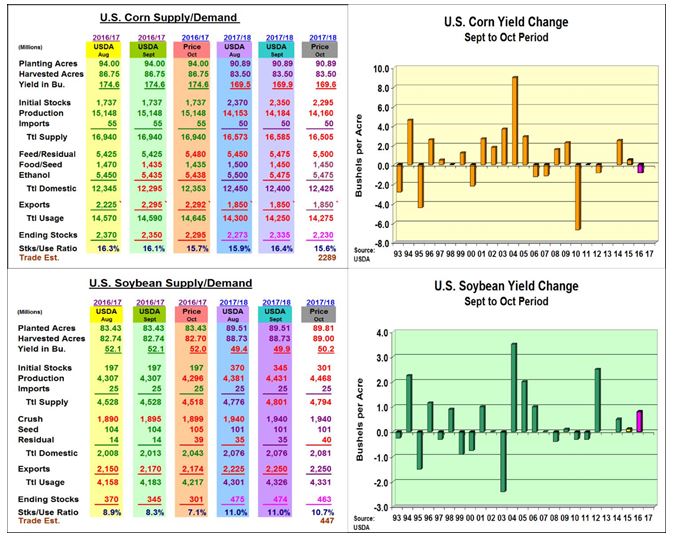

Despite this year’s late-season dryness continuing across much of the Eastern US (except Florida) over the past 4-6 weeks, early season soybean and corn yields from the ECB have been better-than-expected limiting much change on the upcoming USDA US corn and soybean crop revisions on October 12. Last month’s slightly smaller final corn and soybean ending stocks of 55 and 44 million bushels, respectively, could also compensate for some minor yield increases leaving both crops 2017/18 stocks little changed from last month, too.

In corn, last year’s smaller ending stocks will likely mean a bump in corn’s feed and residual for 2016/17 year while recent August industrial and shipping updates will likely up ethanol use by 3 million bu. while cutting exports by 3 million bu. 2017’s corn harvest has been off to a slow start. Eastern producers have been waiting to reduce their drying costs while rains west of Interstate 35 have curtailed any type of harvesting over the past 10-15 days. Because of reduced field updates, particularly in the west, a slight 0.4 bu drop in the US yield to 169.5 bu. is anticipated. This follows the modest changes in Octo-ber corn yields since 2011 (only 2014 wider) suggesting this week’s 2017/18 corn stocks could decline to 2.230 billion bu. with a rise in corn’s feed demand and smaller beginning supplies and crop this month.

In soybeans, a lower than expected 2016/17 ending stocks were the combination of an 11 million smaller crop and stronger crush and exports. August updates raised both demands by 4 million. However, last year’s residual also jumped to 39 million. With some W. Midwest areas’ catching some August rains & solid Eastern yields so far, a 0.3 bu. rise to 50.2 is expected this month. This follows modest Oct yield changes 8 out of the last 10 years. Our larger crop partially compensates for 16/17’s 44 smaller crops leaving October’s stocks at 463 million bu.

What’s Ahead

With the Western Corn Belt’s harvest stalled for the past 10-15 days, our 2017 field knowledge has been curtailed. This region’s harvest needs to pick up quickly or this year’s export activity could be delayed and possibly reduced. However, yields from this region will also be a determiner of 2017’s harvest sizes. Live-stock corn and meal buyers should now have your needs covered thru November on setbacks.

Disclaimer – The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of ...

more