November 2018 Asset Class Total Returns

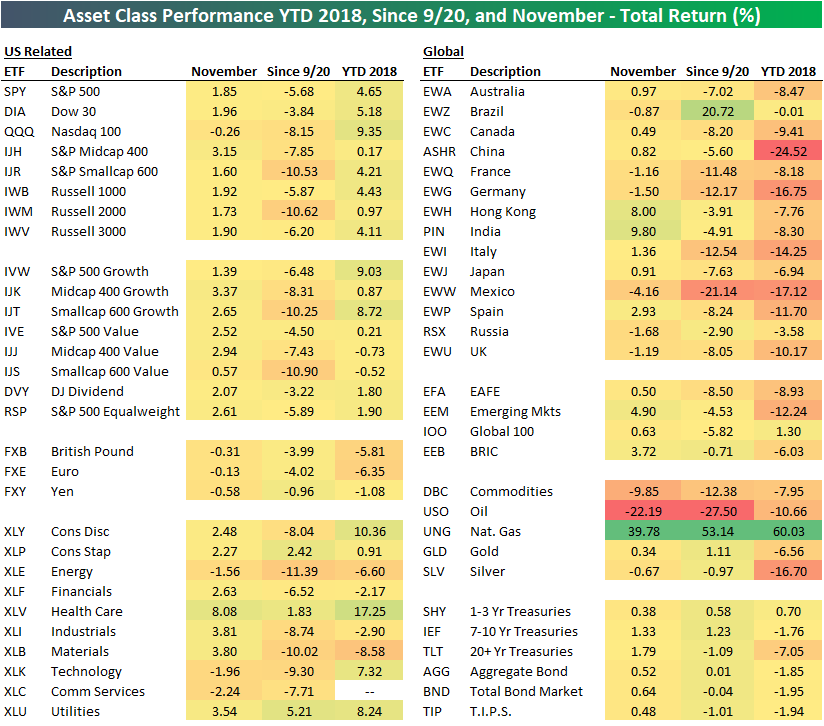

Below is a look at the performance of various asset classes in November using our key ETF matrix. Along with November total returns, we also include returns since the 9/20 high for the S&P 500 as well as year-to-date.

Both the S&P 500 (SPY) and the Dow 30 (DIA) gained just under 2% in November, while the Tech-heavy Nasdaq 100 (QQQ) finished in the red. The Technology (XLK), Energy (XLE), and Communication Services (XLC) sectors were all down in November, while Health Care (XLV) was up huge at +8%. With gains of 3.8%, Industrials (XLI) and Materials (XLB) were the next best performing sectors behind Health Care.

Outside of the US, the best performing countries were Hong Kong (EWH) and India (PIN) with gains of 8% and 9.8%, respectively. On the flip side, Mexico (EWW) was the worst performing country with a decline of 4.16%.

The real action in November came in the commodities space. The broad commodities ETF (DBC) fell 9.85% on the month, which was due to oil’s (USO) dramatic drop of 22.19%. Natural gas, on the other hand, caught a massive bid and gained 39.78% on the month! Nat gas is now up 60% on the year.

Treasury ETFs were slightly higher in November as rates pulled back a bit.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more