UK Inflation Beats With 1.6% Y/Y – GBP/USD Wobbles

UK inflation rises more than expected: 0.5% month over month, 1.6% year over year and also core inflation accelerates to 1.6% y/y, the highest since 2014. The Retail Price Index (RPI) is up 0.6% m/m against 0.4% predicted. The HPI is up 6.7^, also beating predictions. The Producer Price Index is a miss with 1.8% against 2.2% projected.

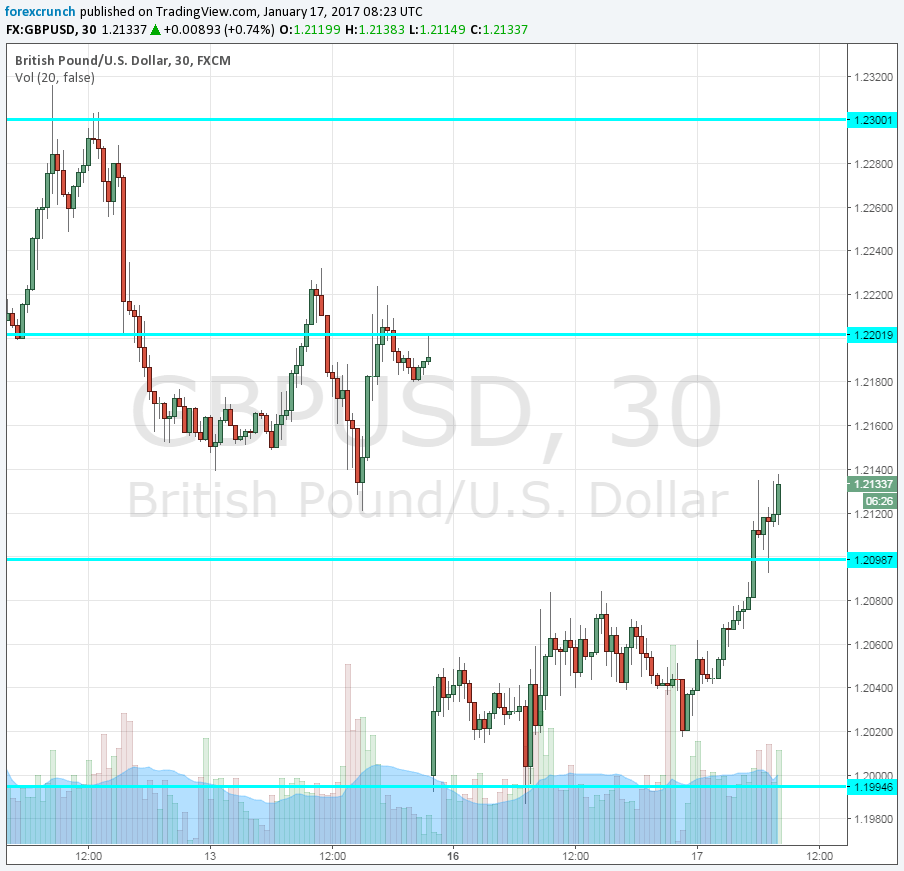

GBP/USD, which was already running higher, nears the round 1.22 level .Is it already “selling the fact” regarding May’s Brexit speech? Update:after the initial run, GBP/USD slides back to 1.2160. Volatility is high.

The British Consumer Price Index was expected to rise by 0.3% m/m in December after 0.2% in November. Year over year, inflation was predicted to advance from 1.2% to 1.4%. A weaker exchange rate, as well as rising oil prices, were expected to fuel the growth. Core CPI carried expectations for an advance from 1.4% to 1.5%.

GBP/USD was recovering ahead of the publication, trading around 1.2170. Sterling was hit hard ahead of the speech by UK Theresa May. In her speech scheduled for later today, she is projected to accept a departure from the single market. However, cable managed to recover as the US dollar resumed its falls, mostly due to the Donald Disappointment.

Here is how recent developments look on the pound/dollar chart. Note the dramatic weekend gap.

More: GBP: More Downside On Article 50 Activation; Staying Short – Goldman Sachs

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more