Morning Call For Oct. 24, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 -0.35%) this morning are down -0.33% and European stocks are down -0.44% as Amazon.com dropped 10% in pre-market trading after lowering Q4 revenue guidance and as BASF SE is down nearly 3% after it cut profit targets and abandoned its sales goal for next year. Travel and leisure companies are also on the defensive after a New York City doctor tested positive for the Ebola virus after returning from aid work in West Africa. The Russian ruble fell to a record low of 41.99 per dollar on speculation that Standard & Poor's will cut Russia's credit rating later today. Asian stocks closed mixed: Japan +1.01%, Hong Kong -0.13%, China -0.22%, Taiwan -0.97%, Australia +0.54%, Singapore -0.43%, South Korea -0.19%. Japan's Nikkei Stock Index rose to a 2-week high amid optimism for U.S. earnings and European growth, while China's Shanghai Stock Index fell to a 1-month low after China new home prices last month fell in 69 of 70 cities tracked by the government, the most on record and a sign that the slump in China's property market continues. Commodity prices are mixed. Dec crude oil (CLZ14 -0.83%) is down -0.89%. Dec gasoline (RBZ14 -0.86%) is down-0.94%. Dec gold (GCZ14 +0.28%) is up +0.21%. Dec copper (HGZ14 +0.26%) is down -0.10% on signs of increased supplies after LME copper inventories rose +2,050 MT to 159,550 MT, a 3-1/4 month high. Agriculture and livestock prices are mostly higher. The dollar index (DXY00 -0.04%) is down -0.03%. EUR/USD (^EURUSD) is up +0.05%. USD/JPY (^USDJPY) is down -0.10%. Dec T-note prices (ZNZ14 +0.21%) are up +6.5 ticks.

China Sep new home prices fell in 69 of 70 cities tracked by the government, the most since Jan 2011 and a sign that the downturn in China's property market continues.

The German Nov GfK consumer confidence unexpectedly rose +0.1 to 8.5, better than expectations of -0.3 to 8.0.

UK Q3 GDP rose +0.7% q/q and +3.0% y/y, right on expectations and down from the Q2 increase of +0.9% q/q and +3.2% y/y.

The UK Aug index of services was unch m/m and up +0.8% 3-mo/3-mo, less than expectations of +0.3% m/m and +0.9% 3-mo/3-mo.

U.S. STOCK PREVIEW

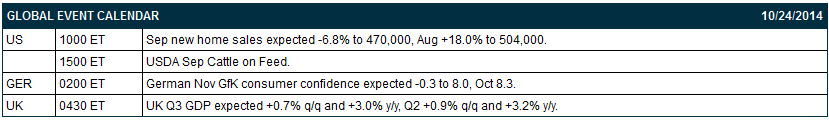

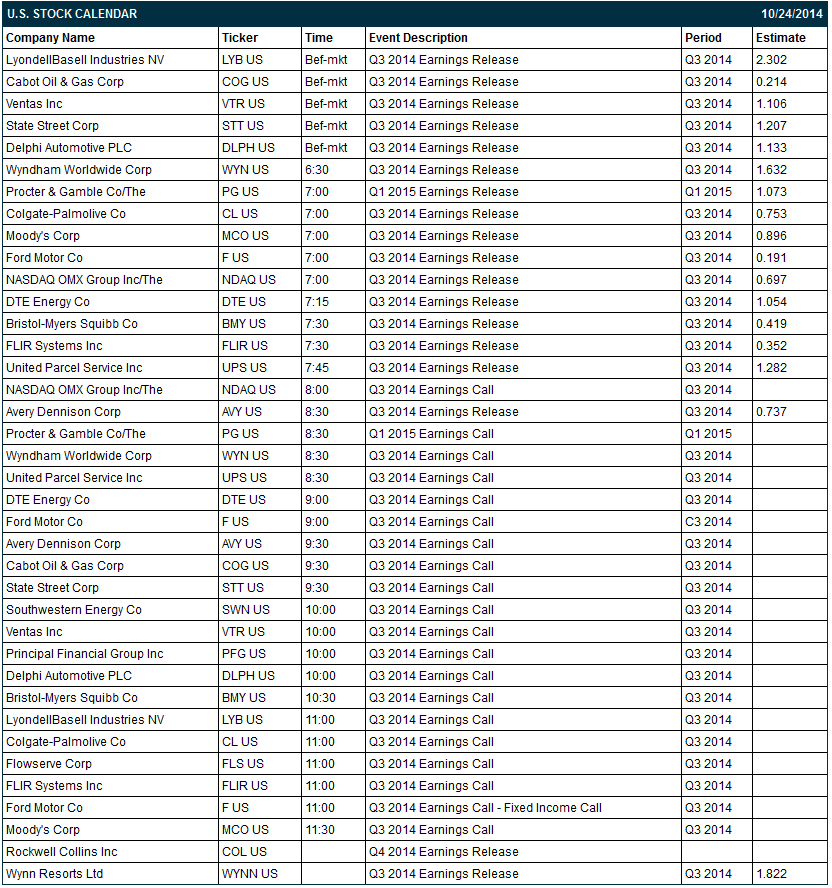

Today’s Sep new home sales report is expected to fall by -6.8% to 470,000 units, which would not be surprising given the +18.0% surge to the 6-1/3 year high of 504,000 seen in August. There are 17 of the S&P 500 companies that report earnings today with notable reports including: UPS (consensus $1.28), State Street (1.21), Procter & Gamble (1.07), Moody's (0.90), Ford (0.19), Nasdaq (0.70), and Wynn Resorts (1.82). There are no equity conferences today.

OVERNIGHT U.S. STOCK MOVERS

Amazon.com (AMZN +0.07%) fell 10% in pre-market trading after it reported a Q3 EPS loss of -95 cents, a bigger loss than consensus of -74 cents, and then lowered guidance on Q4 revenue to $27.3 billion-$30.3 billion, below consensus of $30.89 billion.

Microsoft (MSFT +1.44%) climbed over 3% in pre-market trading after it reported Q1 EPS of 54 cents, higher than consensus of 49 cents.

Ford Motor (F +1.91%) reported Q3 EPS of 24 cents, better than consensus of 19 cents.

Cabot Oil & Gas (COG +3.12%) reported Q3 EPS of 20 cents, less than consensus of 21 cents.

Colgate-Palmolive (CL -0.41%) reported Q3 EPS of 76 cents, higher than consensus of 75 cents.

Flowserve (FLS +3.25%) reported Q3 EPS of 93 cents, below consensus of $1.00.

Chubb (CB +0.12%) reported Q3 operating EPS of $2.17, stronger than consensus of $1.95, and then raised guidance on fiscal 2014 operating EPS view to $7.35-$7.45 from $6.75-$6.95, above consensus of $7.17.

Edwards Lifesciences (EW -0.07%) reported Q3 EPS of 80 cents, better than consensus of 73 cents.

Hub Group (HUBG +1.59%) reported Q3 EPS of 49 cents, weaker than consensus of 54 cents.

Juniper (JNPR +3.25%) rose 1% in after-hours trading after it reported Q3 EPS of 36 cents, above consensus of 35 cents, and then announced a +$1.1 billion increase in the company's share repurchase program.

NCR Corp. (NCR -0.36%) reported Q3 EPS of 67 cents, below consensus of 70 cents, and then lowered guidance on fiscal 2014 EPS to $2.60-$2.70 from $3.00-$3.10, well below consensus of $2.88.

Chicago Bridge & Iron (CBI +4.19%) reported Q3 adjusted EPS of $1.51, stronger than consensus of $1.41.

Swift Transport (SWFT -0.18%) rose over 5% in after-hours trading after it reported Q3 adjusted EPS of 39 cents, better than consensus of 35 cents, and hen raised guidance on fiscal 2014 adjusted EPS to $1.29-$1.33, above consensus of $1.27.

W. R. Berkley (WRB +0.81%) reported Q3 EPS of $1.42, well above consensus of 90 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 -0.35%) this morning are down -6.50 points (-0.33%). The S&P 500 index on Thursday climbed to a 2-week high and closed higher: S&P 500 +1.23%, Dow Jones +1.32%, Nasdaq +1.59%. Bullish factors included (1) stellar Q3 stock earnings results with 80% of reporting S&P 500 companies beating estimates, and (2) reduced global economic concerns after the China Oct HSBC manufacturing PMI unexpectedly climbed +0.2 to 50.4, stronger than expectations of unchanged at 50.2, and after the Eurozone Oct Markit manufacturing PMI unexpectedly rose +0.4 to 50.7, stronger than expectations of -0.4 to 49.9.

Dec 10-year T-notes (ZNZ14 +0.21%) this morning are up +6.5 ticks. Dec 10-year T-note futures prices on Thursday fell to a 1-1/2 week low and closed lower. Closes: TYZ4 -13.00, FVZ4 -7.50. Bearish factors included (1) signs of strength in the U.S. labor market after weekly continuing unemployment claims fell to a 13-3/4 year low, and (2) the rally in the S&P 500 to a 2-week high, which curbed safe-haven demand for T-notes.

The dollar index (DXY00 -0.04%) this morning is down -0.024 (-0.03%). EUR/USD (^EURUSD) is up +0.0006 (+0.05%). USD/JPY (^USDJPY) is down-0.11 (-0.10%). The dollar index on Thursday rose to a 1-week high and closed higher. Closes: Dollar index +0.102 (+0.12%), EUR/USD -0.00017(-0.01%), USD/JPY +1.124 (+1.05%). Supportive factors for the dollar included (1) signs of strength in the U.S. economy that dampened speculation the Fed will delay raising interest rates after U.S weekly continuing unemployment claims fell to a 13-3/4 year low, and (2) a rally in USD/JPY to a 2-week high as strength in stocks reduced the safe-haven demand for the yen.

Dec WTI crude oil (CLZ14 -0.83%) this morning is down -73 cents (-0.89%) and Dec gasoline (RBZ14 -0.86%) is down -0.0203 (-0.94%). Dec crude and Dec gasoline on Thursday closed higher. Closes: CLZ4 +1.57 (+1.95%), RBZ4 +0.0505 (+2.39%). Bullish factors included (1) signs of strength in the U.S. economy after Sep leading indicators rose more than expected, and (2) reduced global economic concerns after both the China Oct HSBC manufacturing PMI and the Eurozone Oct Markit manufacturing PMI unexpectedly rose.

Disclosure: None