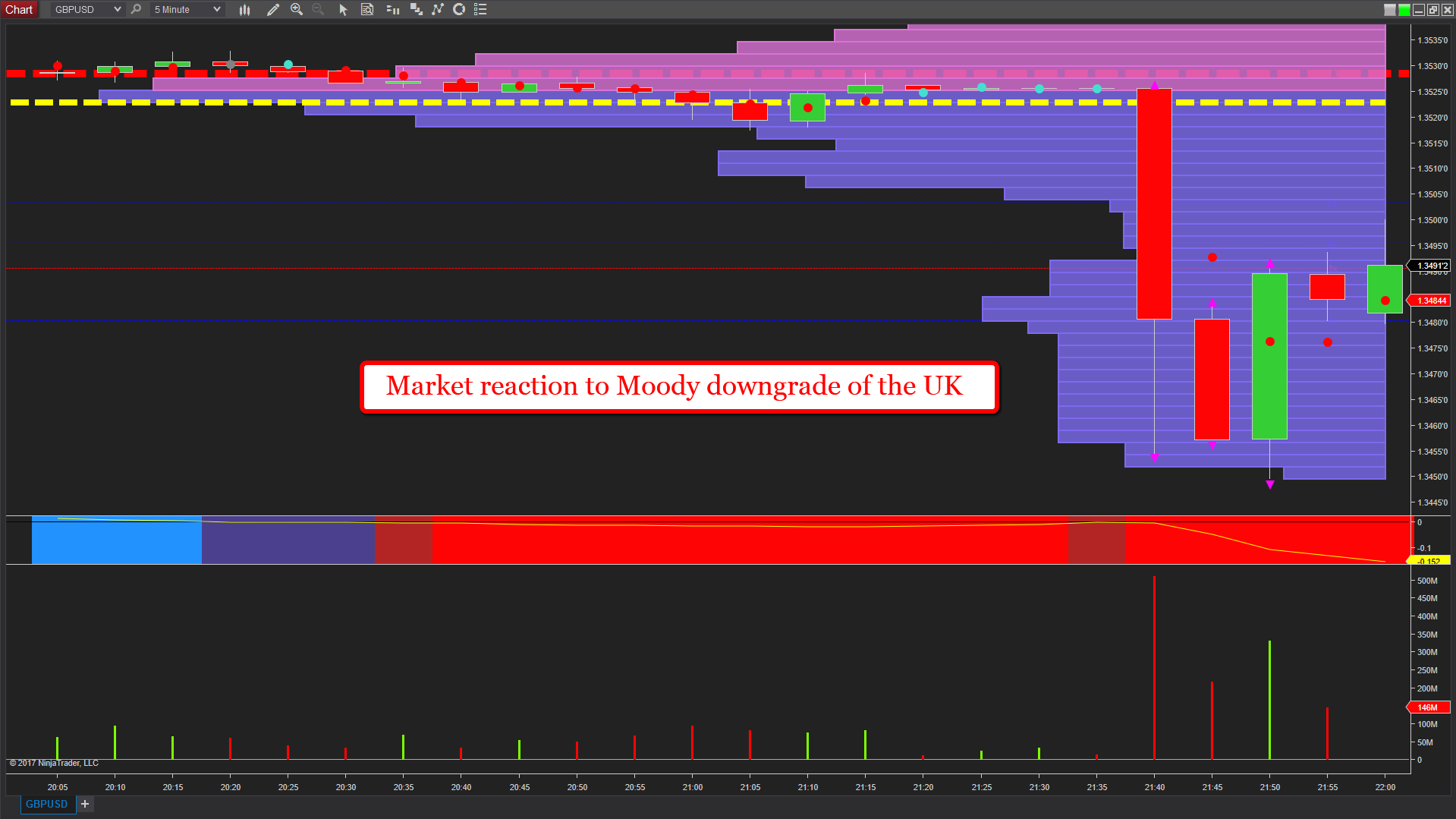

Flash Crash In The Pound Following Moody’s Downgrade Of UK

Last Friday, with most traders already having wound down for the evening, and headed home for the weekend, Moody’s decided it was time to spook the market with a downgrade for the British pound which came shortly after the close of the US session. The downgrade moved the UK from Aa1 to Aa2, and cited ongoing concerns over Brexit as the primary reason for the move and causing a flash crash in the pound as a result. This appeared across the entire GBP complex of currencies and likely to follow through as markets get underway on Monday. To quote from the Moody’s statement:

“The outlook for the UK’s public finances has weakened significantly since the negative outlook on the Aa1 rating was assigned, with the government’s fiscal consolidation plans increasingly in question and the debt burden expected to continue to rise.”

They then went on to say they expect the budget deficit to remain at 3% to 3.5% of GDP in the coming years and against the government’s plan of a gradual reduction to below 1% in 2021/22.

“Fiscal pressures will be exacerbated by the erosion of the UK’s medium-term economic strength that is likely to result from the manner of its departure from the European Union, and by the increasingly apparent challenges to policy-making given the complexity of Brexit negotiations and associated domestic political dynamics”

It will be interesting to see whether forex markets open gapped down, but remember as always gaps get filled.

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more