Economic News Hints At Another Rate Hike

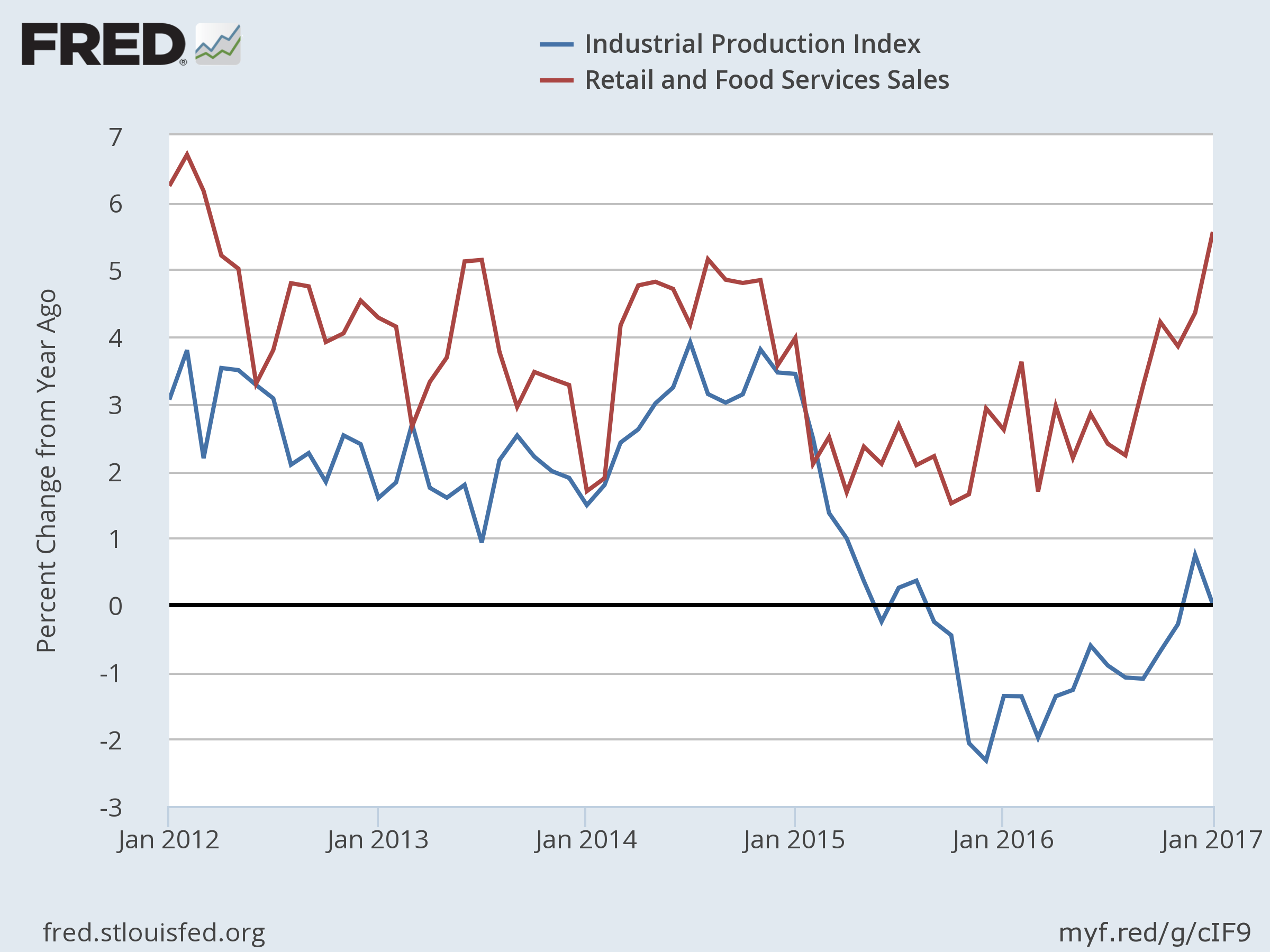

Yesterday’s numbers on economic activity in the retail and industrial sectors is a tale of two trends through January. Consumer spending accelerated to the fastest annual pace in five years while industrial production was flat vs. the year-earlier level. Given the greater influence of consumption for the US economy, the retail data will probably have more sway at the Federal Reserve, which remains on track to continue raising interest rates this year. Another factor that suggests the central bank will continue to tighten policy: consumer inflation at the headline level in January increased to the highest year-over-year rate since 2012.

Will the softer trend in the industrial sector give the Fed pause on deciding to squeeze monetary possible? Maybe not. The main reason that output weakened in January is due to a sharp decline in utility production, which appears to be related to unusually warm weather. Bloomberg advises that January was the 18th warmest month in more than a century according to the National Oceanic and Atmospheric Administration. Keep in mind, too, that manufacturing activity in January was firmer compared with the headline industrial figures. Output among manufacturers increased 0.3% last month vs. a year ago. Although that’s a weak gain by historical standards, it marks the third straight month of positive year-over-year readings.

Meanwhile, headline consumer price inflation increased to a five-year high last month, rising 2.5% in annual terms – the most since March 2012 and above the Fed’s 2% target. Yet the core CPI (less food and energy) still looks stable. Although this measure of inflation’s annual rate ticked up in January to 2.3%, the trend looks contained relative to numbers posted over the past year.The Fed tends to pay more attention to core measures of inflation and so the relatively steady change in this data will take some of the pressure off the Fed to raise rates at next month’s monetary policy meeting.

The probability that the central bank will announce a rate hike in the March 15 policy statement is 31%, based on Fed funds futures (as Feb. 15) via CME data. Nonetheless, Fed Chair Janet Yellen yesterday reaffirmed that higher rates are expected in the months ahead if the economic data remains encouraging. “At our upcoming meetings, the Fed will evaluate whether employment and inflation are continuing to evolve in line with…expectations, in which case a further adjustment of the federal funds rate would likely be appropriate,” she said in Senate testimony on Wednesday. She also noted that “waiting too long to remove accommodation would be unwise.”

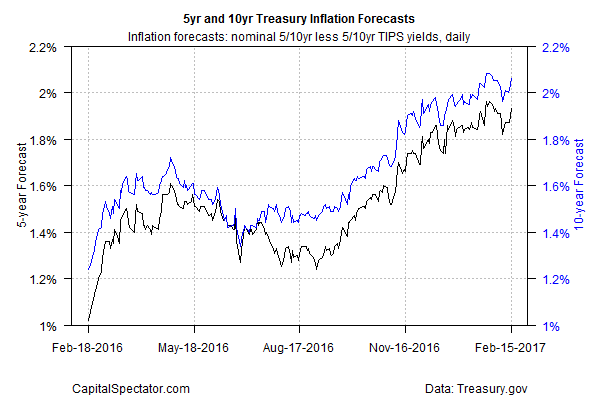

As for the inflation factor, the Treasury market continues to anticipate a mild reflationary trend. The implied inflation forecast via the yield spread on the nominal 10-year Note less its inflation-indexed counterpart rose to 2.06% yesterday (Feb 15), close to the highest rate since late-2014.

Meanwhile, the Fed continues the lay the groundwork for tighter policy by squeezing the M0 money supply, also known as the monetary base and high-powered money. M0’s year-over-year trend was negative again in January, sliding 7.3% — the 11th consecutive month of red ink for the annual comparison.

Some analysts warn that the US economy is still too weak to sustain more rate hikes without taking a toll on growth. Supporters of this view can point to yesterday’s downgraded estimate of first-quarter GDP growth via the Atlanta Fed. The bank cut the outlook to a 2.2% rise via the GDPNow model, close to the sluggish 1.9% increase reported for last year’s Q4.

But economic minds differ about the risk of more rate hikes. “I don’t think the small rate hikes that I believe the Fed is contemplating will significantly slow the economy’s growth,” writes Jared Bernstein, a former chief economist to Vice President Biden, although “the rationale for them remains somewhat elusive.”

But with inflation trending higher these days, and retail sales strengthening, the Fed will find it harder to stand pat if the incoming data continues to skew positive.

“All things consumer show the economy is starting the year off with a bang,” says Chris Rupkey, chief economist at MUFG Union Bank. “Interest rates are too low and with an economy this strong rates need to be put on a preset course higher.”

Disclosure: None.

Maybe tightening the monetary policy can stabilize economic growth. The current trend looks like a demand-pull inflation, given the increase in retail and expected increase in CPI. Nonetheless, it would suite the FED to increase money supply in order to keep a low interest rate. However, inflation needs to be controlled so as not to upset the CPI and to keep unemployment low.