Should You Consider Social Trading CopyFunds?

Every online trader wants to strike it big in the market, yet according to data, the vast majority quit just months after joining this lucrative world of online trading. So, why is that? And is there an antidote to failure? Conventional wisdom dictates that a cautious approach is the best way to do it.

If you are planning on joining the online trading market, then you should be prepared to make substantial losses as you would expect, profits. Nonetheless, most traders only choose to see one side of the coin while completely ignoring the other.

While most traders continue to lose money, the online trading market is still the most active market in the world overseeing trillions of US dollars’ worth of daily transactions. One of the main reasons behind its unrelenting success is the ability to introduce new technologies that seek to make online trading easy. Here we are talking about Algo-trading systems, Expert Advisers, signal service providers, and of course, the rapidly growing social trading platforms.

The aspect of social trading is no longer just about forex—it has stretched its wings to provide access to diverse markets including stocks, commodities, CFDs, ETFs, and Indices, among others. While many players have joined social trading marketplace, eToro is seen by market experts as the pioneer of the industry—and according to this eToro review, it is now a globally recognized brand in the world of social trading.

So, how does social trading work?

Social trading has transcended from just another alternative way of engaging in the financial markets to one of the most disruptive forms of trading. This rapid growth has been aided by the advances in technology witnessed over the last decade, with mobile trading being one of the key catalysts in the retail market.

In truth, you can barely do conclusive market analysis on a mobile device. However, you can easily copy the trades of others via mobile trading platforms. And with nearly every online trader in the world presumably owning a smartphone, this has benefited traders who do not otherwise, have the necessary experience and expertise to analyze the markets.

Social trading has given them, what you would call—a shortcut to a successful involvement in online trading. All they have to do is follow and copy the trades of expert traders who have experienced success over a given period.

Ideally, traders can follow multiple experts and their trades, or they can choose to follow a few of their trades over a given time. The social trading market has also evolved over the last few years to allow social traders to follow/copy various pools of assets dubbed as CopyFunds.

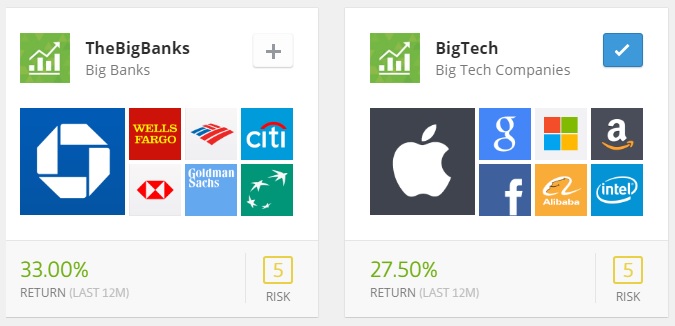

For instance, eToro allows traders to invest in a technology pool of stocks (TheBigTech CopyFund), which according to their stats, is up 27.5% over the last twelve months. Traders can also invest in TheBigBanks CopyFund which has gained 33% over the same period. Therefore, it is correct to say that with this type of copy trading, traders are basically investing in mini-funds.

These CopyFunds are nowhere close to what you would get when you choose to invest in funds like Vanguard Star Fund (VGSTX) (up 3.93% over the last 12 months) or the Vanguard Wellesley Income Investor (VWINX) (up 1.72% over the last 12 months). These have several assets that provide the required balance to hedge against risk. However, while the CopyFunds seem to have edged the mutual funds in terms of returns, they are considerably risky and can result in massive losses when things go against the few stocks selected.

In this case, the risk might not be worth the differential in return for risk-averse investors. For instance, in the two examples above, the risk levels for the CopyFunds are rated five, which based on other copy trading alternatives on the eToro platform is very high. There are copy trading alternatives with risk a rating of two while the most common for minimal risk investors is a rating of three.

However, one major advantage is the ease of joining and pulling out of a CopyFund compared to the process of investing in a mutual fund. Just like the way social trading allows traders to copy and stop copying the trades of other expert traders, they can easily stop copying a CopyFund thereby, instantly pulling out their profits at any given time.

On the contrary, the process might be a bit longer and discomforting when investors decide to pull out their funds from a mutual fund.

Conclusion

Social trading appears to have become the preference of many beginner traders who wish to join the online trading market. However, while some of the copied expert traders have demonstrated significant success, data also indicates that the list of the top ranking copied traders keeps on changing. This indicates some level of inconsistency.

Nonetheless, given the ease of following and unfollowing traders and CopyFunds, it is correct to say that this flexibility allows traders to control their own money according to their risk appetites.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor ...

more