Protecting Your Retirement From A Flattening Yield Curve

Protecting Your Retirement From a Flattening Yield Curve

If you're reading this, you're probably an investor in equities. There's a good chance you invest almost exclusively in stocks, via mutual funds and ETFs. If so, you might not have noticed one of the most important developments in finance recently: the yield curve has been flattening.

Taken a step further, as a stock investor, you may not even know what a yield curve is. So let's start there.

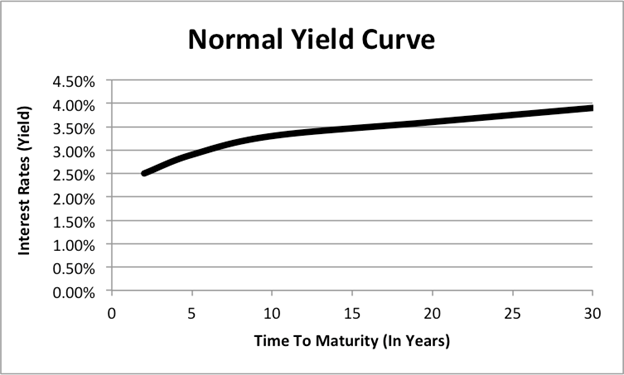

Usually, long-term interest rates will be higher than short-term rates. Graphically, this forms an upward-sloping curve. It might look something like this.

The further we go out into the future, the higher the interest investors require. This is to account for the risk of inflation (which would take a bite out of returns) and the general uncertainty that comes with, well, pretty much anything in the future extending beyond next week.

Lately, though, something has changed. The line in that image above is flatter. The left end of the curve is higher, creating more of a horizontal line.

Sometimes, the left side goes higher than the right side, creating a downward slope. This is called an inverted yield curve--and it is a pretty good predictor of recessions. Every recession of the past 60 years has been preceded by an inverted yield curve.

Long-term rates holding firm even as short-term rates move up can mean that bond markets are worried that long-term growth in the economy may pause for a while.

Some say an inverted yield curve, if and when it appears this time around, won't necessarily mean a recession is imminent. The circumstances are different: Long-term rates have been lower than normal because central banks bought trillions of dollars' worth of government bonds (quantitative easing). Meanwhile, the Federal Reserve has been boosting short-term rates for the last two and a half years or so, and more increases are probably on the way. With those forces at work, the yield curve conceivably had nowhere else to go, and the economy has had little to do with it.

None of this is ever clear except in hindsight, and we're not able to look back on this development just yet. For now, let's do a little hypothesizing on a retirement plan. What will happen when the bear market finally does come? What happens if rates continue to rise on the long end of the curve?

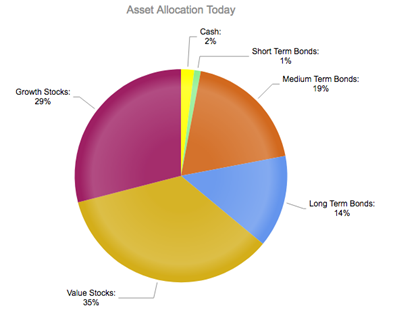

Let's look at a case study using the WealthTrace Online Retirement Planner. A couple in their 50s would like to retire in about seven years. They have $1.2 million in investments, and their spending, give or take, will be around $65,000 annually.

They are pretty well diversified in their financial plan. Some might say their portfolio is a bit aggressive for their age, with 64% of their investments in stocks.

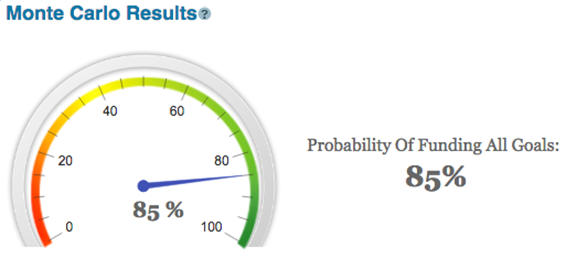

If we run a Monte Carlo analysis to calculate the probability of the couple never running out of money, things look pretty good for them:

There's always a "but," though. In this case, the "but" is that other 15%. With WealthTrace, we can run a bear-market scenario that simulates what would happen if a 2007-2008-style stockageddon hits their portfolio, say, two years from now--just five years from when they hope to retire. And it's not a pretty sight:

That big slug of stocks, which likely helped them amass as much as they have, can get cut down quickly in a bear market.

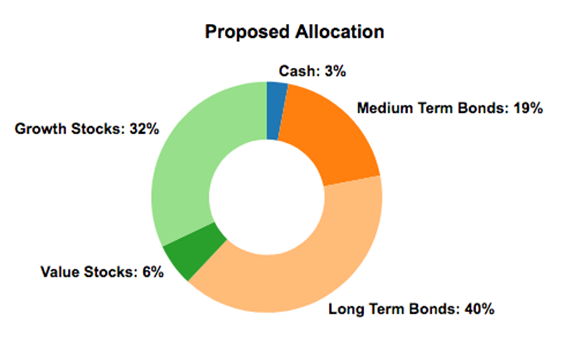

First, we'll give them a portfolio makeover, mainly bumping up long-term bonds and cutting value stocks as a percentage of the portfolio.

We'll also assume long-term rates go up by 50 basis points, more toward where they have been historically.

The result: Even changing the allocation so drastically, the probability of success stays about the same--and their returns will almost surely be less volatile due to the move to bonds.

Dividends Can Shoulder The Burden

In an ideal world, retirees would not need to speculate about the direction of interest rates. But we play the hand we're dealt, and right now, we've been dealt a hand of low rates and uncertainty about where they'll go.

So staying toward the lower-end of the curve could make sense for a lot of investors. Vanguard's Intermediate-Term Bond Index Fund (VBIIX) is a good choice. Treasury bonds are more than half of its portfolio, with the rest being investment-grade corporates. With this fund, you get better returns than you would with cash, and interest-rate-risk protection too. The fund's SEC yield (which is the net investment income per share divided by the maximum offering price per share over a 30-day period) is 3.3%, and it features the low fees Vanguard is known for.

Mostly, though, we are still of the mind that dividend stocks should make up the lion's share of a retirement portfolio. Dividend income looks to us like the closest thing to certain for a decent level of income in retirement.

If we continue to see higher interest rates, dividend- and distribution-paying stocks might stumble. That's just the nature of the game, as fixed-income instruments become more attractive relative to equities. It doesn't necessarily reflect poorer prospects for the companies, though their borrowing costs could be higher.

If you're mainly interested in the payout rather than taking capital gains, market gyrations should not matter much. A portfolio made up of (1) companies that have consistently increased their dividend payments over a long period regardless of recessions or bear markets, and (2) companies that haven't been in the dividend game for a long time but have been boosting their dividends rapidly can be very effective.

|

Company |

Yield (%) |

Consecutive Dividend Increases (Years) |

Five-Year Dividend Growth (%) |

|

Cardinal Health CAH |

3.9 |

21 |

15 |

|

Chevron CVX |

3.6 |

31 |

4.2 |

|

Kohl's KSS |

3.4 |

8 |

11.4 |

|

Pfizer PFE |

3.6 |

8 |

7.8 |

|

Simon Property Group SPG |

4.6 |

9 |

13 |

|

Southern Company SO |

5.0 |

18 |

3.4 |

|

Starbucks SBUX |

2.8 |

8 |

24 |

|

Verizon VZ |

4.6 |

13 |

2.9 |

In the end, it largely comes down to your tolerance for volatility. These stocks will likely go up in the good times and down in the bad, but the income should mostly keep coming regardless. But if market volatility has you biting your nails, an increased allocation to bond index funds could help--at the expense of potential returns, of course.