Muni Closed End Funds - Finding Value In The Ninth Inning Of The Great Bond Rally

"It is impossible to produce superior performance unless you do something different from the majority." - John Templeton

In the conclusion of our earlier article titled “What deadly summers, Sandy Koufax and lucky golfers can tell us about bonds” we wrote:

“Deflationary forces around the globe are legion. Despite the battalion of seemingly gargantuan efforts by central bankers to prop up inflation and restart growth, those stated objectives remain elusively out of reach. Ignoring the truth of these circumstances will not diminish their impact on U.S. yields.”

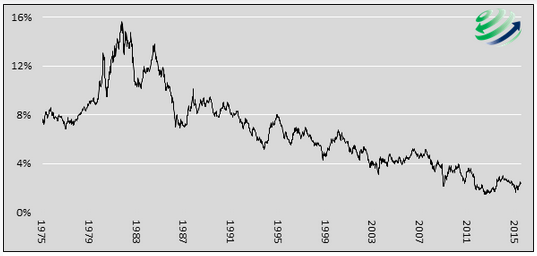

In that article we proposed that a sluggish economy and ongoing deflationary pressures would continue to drive U.S. interest rates lower. Since we published the article in late March, yields (U.S. and German) have risen despite weaker economic activity and further deflationary signals. The Federal Reserve’s perceived stalling of rate increases, pronounced illiquidity and bouts of foreign central bank selling are three of the chief justifications behind the recent increase in yields. Since the great bull market in interest rates started in October 1981, we have seen numerous short term counter trend increases in rates. The result each time was curtailed lending, slower growth and a re-emergence of deflationary forces. Ironically, higher yields ultimately resulted in lower yields each time. Despite the low absolute level of interest rates currently, we do not think the down trend in yield is over this time either.

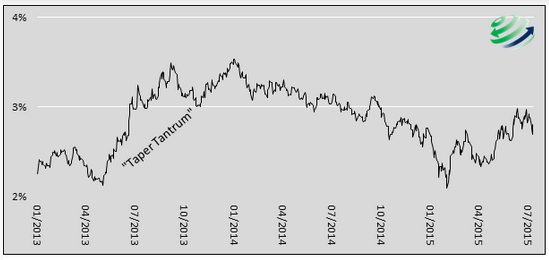

This current bond market sell-off has many of the markings of the so called “taper tantrum” sell-off in mid to late 2013. As in 2013, bond bears are coming out of the woodwork to declare an end to the 30+ year rally. In 2013 the bears believed the end of quantitative easing (QE3) would break the back of the bull market in bond yields. In early 2014, despite QE3 ending and a distinctly bearish bond market tone, bond prices not only completely reversed the losses of the prior 7 months but went on to achieve new lows in yields. There are many factors that lead us to believe the current move higher in yield is a short-term retracement similar to the taper tantrum and other prior counter trend sell-offs. We suggest this instance will once again result in what technicians call a “lower low” in yields.

10 Year U.S. Treasury Yields (Long-Term Bull Market)

Data Courtesy: Bloomberg

10 Year U.S. Treasury Yields (Short-Term)

Data Courtesy: Bloomberg

For investors with a similar short-term (6 months to 1 year) opinion, there are a wide selection of fixed income securities to choose from that can profit from a decrease in yields. In this analysis we present a type of security that most investors tend to overlook, municipal bond-backed closed end mutual funds (M-CEFs). In a bullish bond market, M-CEFs benefit from lower yields and tightening spreads like most fixed income products, however they currently also offer an opportunity to indirectly purchase municipal bonds at a discount to their price. M-CEFs priced at a discount offer value in a world where there is very little to be found.

What are CEFs?

Closed End Funds (CEFs) are mutual funds with a fixed number of shares, unlike most other mutual funds whose share count fluctuates daily with investor interest. Also differentiating CEFs from open ended mutual funds is the fact that CEF shares are bought or sold on exchanges, not via direct transactions with the associated mutual fund company. It is this unique feature that results in CEFs trading at a premium or discount to their net asset value (NAV).

The three biggest factors which determine why a CEF might trade at a premium or discount to its NAV are:

- Strong demand and/or low supply of the fund may result in a premium, while weak demand and/or excess supply will frequently result in a discount

- Quality of the fund management team

- The liquidity of the underlying fund holdings

The change in the premium or discount to NAV is just one return factor determining total return for CEFs. The table below highlights all of the factors influencing the total return for M-CEF’s.

|

Total Return Factor |

Comment |

|

Underlying municipal bond yields |

As yields decrease, prices increase helping total return. The opposite occurs when yields increase. |

|

Dividend (coupon)/Yield |

Most of the CEF’s we researched have a yield in the ranging from 6 to 8%. |

|

Discount divergence from NAV |

As the discount normalizes towards zero, the price of the M-CEF increases. If the discount widens, the price falls. |

|

Leverage |

Leverage used by the M-CEFs amplify price changes (gains and losses) and dividends. |

|

Expense ratio |

The fee that the fund manager extracts from the M-CEF’s return. Higher fees erode returns. |

Selecting the right M-CEF

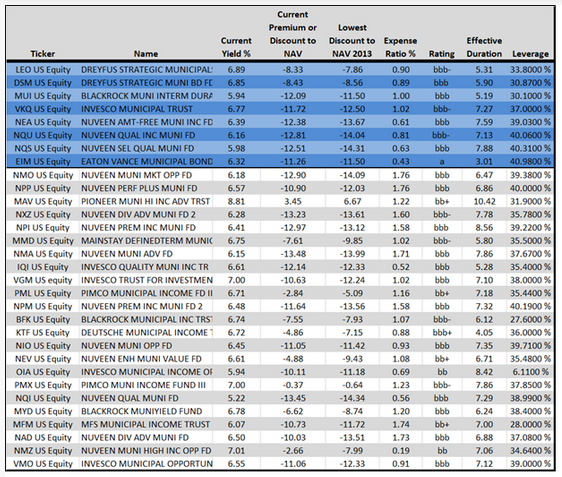

We analyzed 50 M-CEFs taking into account the following attributes: current discount to NAV, 2013/2014 performance, expense ratio, underlying bond ratings, specific holdings, duration, and leverage. The table below shows some of the funds we analyzed and a sampling of the statistics used in our analysis. The 8 M-CEFs highlighted in blue offer what we deem the best value based upon certain self-imposed factors and risk constraints.

Data Courtesy: Bloomberg, Morningstar and various fund prospectuses

Listed below are considerations for investing in M-CEFs:

- M-CEFs should represent a piece of a fixed income allocation and not the entire allocation. While the yield and potential price return are alluring, they also introduce a unique level of risk. Diversifying within the fixed income arena will mitigate specific risks of holding M-CEFs and in particular municipal bonds. Given the current news regarding Puerto Rico and worsening fiscal problems of other states and municipalities, diversification should not be taken lightly.

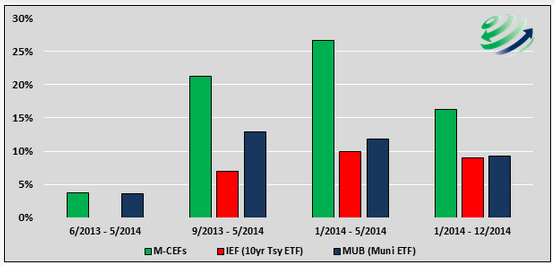

- Market timing is very hard. Investors in M-CEFs should scale into purchases over time. Investors that bought M-CEFs 3-4 months before the rally began in 2013 still profited handsomely from their decisions (shown in the chart below).

- Diversify amongst M-CEFs. Different managers and funds provide access to a wider array of underlying bonds which limits the potential difficulties that one manager or a certain bond can cause.

- Liquidity can be an issue. It is common for less than 150,000 shares of M-CEFs to trade in a given day. As a result, bid-offer spreads may be a little wider than those to which one may be accustomed. Buying over time with discipline makes it harder for market makers to take advantage of a buyer.

- Monitor the discount. As the discount normalizes one should consider re-allocating a portion of M-CEF holdings to deeper discounted M-CEFs or to other traditional fixed income products.

- Many CEFs have tax advantages. Consider each client's need for tax efficiency and be sure to analyze returns on an after-tax basis.

Comparable performance 2013/2014

The chart below contrasts the selected M-CEFs (those shaded in blue in table above) to a comparable U.S Treasury ETF and municipal bond ETF over different time frames including the 2013 swoon and the 2014 rally. As noted earlier, investors in M-CEFs that were 3-4 months early in 2013 still profited handsomely from their decisions (see the September 2013 – May 2014 time frame below). For reference purposes the “temper tantrum” occurred from April through December of 2013. During this period 10- year yields increased 1.35%. Starting in January of 2014, yields reversed course and fell 1.43% over the following 13 months.

Annualized Returns – M-CEFs vs U.S. Treasuries and Municipal Bonds

Data Courtesy: Bloomberg

If the recent bond rise in bond yields is in fact a counter trend that ultimately results in lower yields, M-CEFs offer unique value. A normalization of the CEF discounts in such an environment has the potential to make a good bond call a great trade.

Disclosure: Opinions expressed herein are current opinions as of the date appearing ...

more