MGM Growth Properties LLC (MGP): Are Hedge Funds Right About This Stock?

Is MGM Growth Properties LLC (NYSE:MGP) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy league graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

MGM Growth Properties LLC has experienced an increase in activity from the world’s largest hedge funds recently. MGP was in 15 hedge funds’ portfolios at the end of the third quarter of 2018. There were 14 hedge funds in our database with MGP holdings at the end of the previous quarter. This wasn’t enough for the company to be considered as on of the 30 most popular stocks among ALL hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

MGM Resorts reported impressive results in the third quarter, with adjusted earnings of 24 cents trumping the consensus estimate of 18 cents. Including gains from the sale of Mandarin Oriental Las Vegas, the bottom line came in at 26 cents, flat over the year-ago period.

Total revenues of $3,029.3 million came ahead of the consensus mark of $2,911 million and rose 7% year over year, supported by higher revenues at MGM China.

Let’s view the fresh hedge fund action surrounding MGM Growth Properties LLC.

How are hedge funds trading MGM Growth Properties LLC?

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from one quarter earlier. By comparison, 20 hedge funds held shares or bullish call options in MGP heading into this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Joshua Kaufman and Craig Nerenberg’s Brenner West Capital Partners has the biggest position in MGM Growth Properties LLC, worth close to $37 million, comprising 4.6% of its total 13F portfolio. The second largest stake is held by Capital Growth Management, led by Ken Heebner, holding a $33.9 million position; 1.8% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors that are bullish include Greg Poole’s Echo Street Capital Management, Israel Englander’s Millennium Management and Ken Griffin’s Citadel Investment Group.

Consequently, specific money managers were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, established the biggest position in MGM Growth Properties LLC. Marshall Wace LLP had $12.9 million invested in the company at the end of the quarter. Noam Gottesman’s GLG Partners also initiated a $0.3 million position during the quarter. The only other fund with a new position in the stock is Paul Tudor Jones’s Tudor Investment Corp.

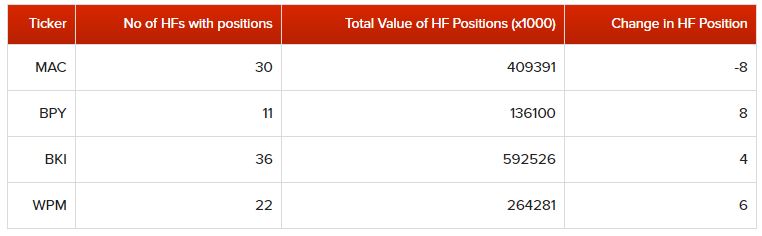

Let’s now take a look at hedge fund activity in other stocks similar to MGM Growth Properties LLC. We will take a look at Macerich Co (NYSE:MAC), Brookfield Property Partners LP (NYSE:BPY), Black Knight, Inc. (NYSE:BKI), and Wheaton Precious Metals Corp. (NYSE:WPM). All of these stocks’ market caps match MGP’s market cap.

As you can see these stocks had an average of 24.75 hedge funds with bullish positions and the average amount invested in these stocks was $351 million. That figure was $222 million in MGP’s case. Black Knight, Inc. (NYSE:BKI) is the most popular stock in this table. On the other hand Brookfield Property Partners LP (NYSE:BPY) is the least popular one with only 11 bullish hedge fund positions. MGM Growth Properties LLC (NYSE:MGP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BKI might be a better candidate to consider a long position

.

Disclosure: None.