Markets: Stability?

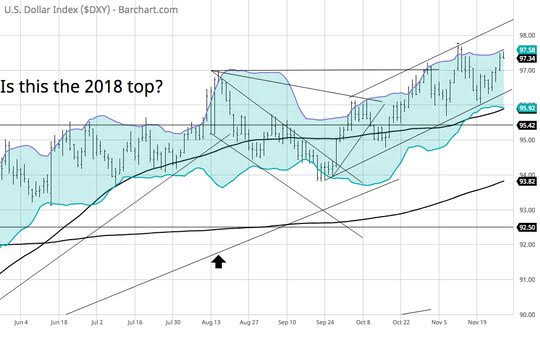

Waiting for Powell speech and more economic data. That is the excuse for the present stability where equities are bid, the USD holds near its 2018 highs and the oil market is wobbly waiting for US inventories. The bigger wait is for the Trump/Xi Saturday dinner with expectations for failure remaining high on the quick end to a prolonged trade war. On the other side of politics, UK May has won a bit of hope today as she allows for the Brexit deal to go to a vote in parliament with amendments and so potentially winning over some doubters, but also risking another referendum or impossible calls for a different deal. Italy is still talking with the EU officials about its budget and the Ukraine/Russia cold war continues but with less hand-wringing from Europe. There is a gloomy stability in today’s rally back in risk and one that seems to latch onto the hope that FOMC Chair Powell can somehow talk down his hiking plans without seemingly bowing to President Trump. There is plenty of rate noise potential in markets but the front-line of this stability comes from the USD where the 97.60 level looks as important as the 96.50 one does. This should help measure Powell and the stability of the market going into month-end.

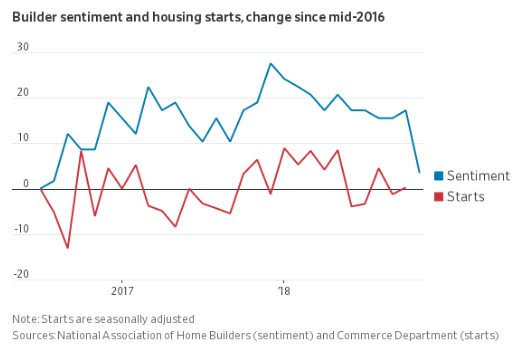

Question for the Day: Is it housing or oil that matters the most for growth into 2019? The drop in the future expectations for consumers matters – the “clock” of present vs. future expectations is troubling and matches the gloom of Europe.

The issue for Powell today is how he responds to the drop in confidence and whether this moves his thinking on core inflation. The inflation market is telling him to go slow if not pause.

Some of this is merely the drop back in oil prices, but some of it is also the hit to future expectations caused by politics, tariffs, and the slowing of global growth. The role of rates in the domestic growth front shows up most clearly in housing and the building of them is likely to be a problem for 2019.

What Happened?

- RBNZ financial stability review: Plans to ease loan-to-value ratio restrictions. As of Jan 2019, the RBNZ will allow 20% of new mortgage loans up from 15% to have deposits less than 20% for owner-occupiers, while 5% of new loans to property investors can have deposits less than 30% down from 35%. RBNZ announcement argued: “Risks to New Zealand’s financial system have eased over the past six months, but vulnerabilities persist. In particular, households remain exposed to financial shocks due to their large mortgage debt burden. However, both mortgage credit growth and house price inflation have eased to more sustainable rates, reducing the riskiness of banks’ new housing lending. In response, we are easing our loan-to-value ratio (LVR) restrictions on banks’ new mortgage loans. If banks’ lending standards are maintained we expect to further ease LVR restrictions over the next few years.

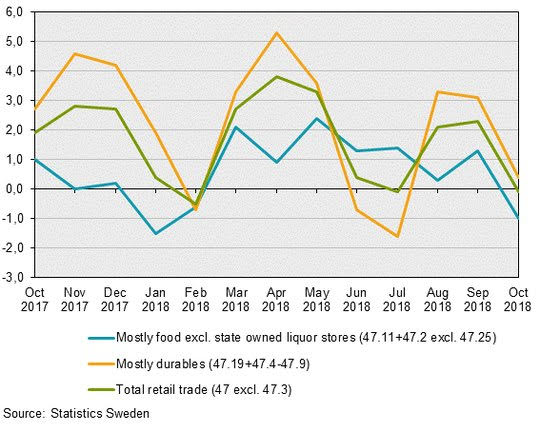

- Sweden November consumer confidence 97.5 from 98.5 revised – weaker than 99 expected. The business confidence drops to 104.8 from 106.0 revised (from 106.3) – also weaker than 106 expected. Inflation expectations rise to 3.3% from 3.2%. The economic tendency indicator fell to 107.6 from 106.7 but the confidence indicator for manufacturing rose while services fell.

- Sweden October retail sales -1.1% m/m, -0.1% y/y after +0.5% m/m, 2.3% y/y – weaker than +0.2% m/m expected. Sales dropped for textiles, clothing & footwear (-2.2 percent from 2 percent in September) and home furniture (-2.4 percent from 4.5 percent). Additionally, sales via mail order houses or via internet went down 15.1 percent, following a 11.8 percent decrease in September.

- ECB October M3 money supply growth up 3.9% y/y from 3.6% y/y revised (from 3.5% y/y) – more than 3.5% y/y expected. The private loan growth steady at 3.2% y/y as expected.

Market Recap:

Equities: The S&P500 futures are up 0.2% after a 0.33% gain yesterday. The Stoxx Europe 600 is up 0.2%. The MSCI Asia Pacific Index rose 1% while the EM index rose 0.8% - best in a week.

- Japan Nikkei up 1.02% to 22,177.02

- Korea Kospi up 0.42% to 2,108.22

- Hong Kong Hang Seng up 1.33% to 26,682.56

- China Shanghai Composite up 1.05% to 2,601.74

- Australia ASX off 0.05% to 5,800.10

- India NSE50 up 0.40% to 10,728.85

- UK FTSE so far off 0.15% to 7,006

- German DAX so far up 0.1% to 11,322

- French CAC40 so far up 0.35% to 5,000

- Italian FTSE so far off 0.1% to 19,126

Fixed Income: UK Brexit continues to dominate along with Italy budget talks, German auction soggy, risk mood into Powell speech positive – German 10Y Bund yields off 1bps to 0.34%, French OATs off 0.5bps to 0.72%, UK Gilts off 2bps to 1.37% while the periphery mixed – Italy off 3.7bps to 3.25%, Spain off 0.5bps to 1.545%, Portugal off 0.5bps to 1.87% and Greece off 0.5bps to 4.305%.

- Italy sold E6.5bn of 6M bills at 0.163% with 1.6 cover– previously 0.159% with 1.6 cover.

- Germany sold E1.683bn of 10Y 0.25% Bunds at 0.34% with 1.6 cover after Bundesbank holdings – previously 0.42% with 1.4 cover. Target was for E2bn sale.

- US Bonds are bid waiting for Powell– 2Y off 0.2bps to 2.831%, 5Y off 0.5bps to 2.88%, 10Y off 0.7bps to 3.05% and 30Y off 1.2bps to 3.306%.

- Japan JGBs lower with equity rally – curve steeper. 2Y up 0.2bps to -0.145%, 5Y up 1bps to -0.10%, 10Y up 0.8bps to 0.09% and 30Y up 1.7bps to 0.818%. BOJ keeps buying unchanged in 1-3Y and 3-5Y, but focus is on next month’s longer-dated buying plans.

- Australian bonds rally with commodity focus– 3Y off 0.5bps to 2.035%, 10Y off 1.5bps to 2.615%.

- China PBOC skips open market operations for 24th day, keeps liquidity neutral. Short term rates remain mixed – O/N repo off 4bps to 2.51%, 7-day up 1bps to 2.65%. 1Y swaps flat at 2.77% and 10Y bonds off 1bp to 3.39%.

Foreign Exchange: The US dollar index is flat at 97.35 with 97.32-97.53 range. In emerging markets, USD is mixed – EMEA: ZAR off 0.25% to 13.957, TRY up 0.25% to 5.2540, RUB of 0.3% to 67.26; ASIA: TWD flat at 30.895, KRW up 0.25% to 1126.5 and INR up 0.25% to 70.62.

- EUR: 1.1285 flat. Range 1.1267-1.1301 with EUR on ropes with 1.13 pivotal resistance for a risk to 1.1186 again

- JPY: 113.80 flat. Range 113.72-113.90 with EUR/JPY 128.40 flat – with equities bid opening 114 barrier test again – but 112 seems still in play.

- GBP: 1.2795 up 0.4%. Range 1.2733-1.2806 with EUR/GBP .8815 off 0.5% - another day where UK May wins brings 1.27-1.30 breakout risk

- AUD: .7240 up 0.2%. Range .7491-.7515 with NZD .6795 up 0.1% - all about China holding, commodities holding with .7150-.7300 story.

- CAD: 1.3315 up 0.15%. Range 1.3292-1.3332 with oil and growth in focus with data ahead – 1.3250-1.3400 in play.

- CHF: .9995 up 0.1%. Range .9982-1.0003 with EUR/CHF 1.1275 flat – Italy/UK/China and Ukraine all matter but aren’t moving with 1.00 tent for $.

- CNY: 6.9500 fixed 0.05% weaker from 6.9463, trades flat at 6.9535 with 6.9477-6.9609 range.

Commodities: Oil lower, Gold flat, Copper up 0.35%.

- Oil: $51.47 off 0.2%. Range $51.36-$52.56. Brent off 0.4% to $59.98 – API report a 3.453mn build in crude when a 0.769mb build was expected. Prices were steady into Asia on better equities, trade hopes, flip lower in Europe with OPEC and EIA key drivers as well. The $60 in Brent is the pivot with $58-$62 consolidation.

- Gold: $1214.60 flat. Range $1213-$1217. Focus is on $1209 and $1200 support with USD and Powell key. Silver up 0.15% to $14.17 with $14 next target. Platinum off 0.2% to $832 and Palladium up 0.7% to $1163.

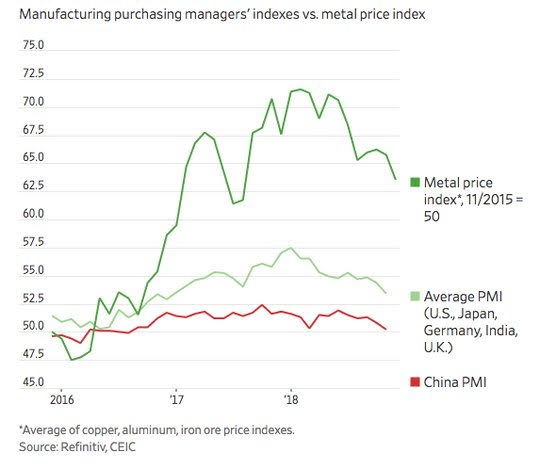

Conclusions: Is it Dr. Copper that matters the most? The housing and China stories are still very much in play today with the focus on trade and data along with the FOMC Chair Powell speech on regulation but with Q/A from the New York Economic Club. The chart to consider is that about industrial metals and growth. The drop in copper, iron ore and aluminum are troublesome.

Economic Calendar:

- 0830 am US 3Q revised GDP 3.5%p 3.5%e/ price index 1.4%p 1.4%e

- 0830 am US Oct wholesale inventories 0.4%p 0.3%e

- 0830 am US Oct goods trade deficit $76.04b p $76.70b e

- 0830 am US 3Q core PCE spending 1.6%p 1.6%e / prices 1.6%p 1.6%e

- 1000 am US Oct new home sales (m/m) -5.5%p +4.3%e / 0.553m p 0.575m e

- 1000 am US Nov Richmond Fed Manufacturing 15p 16e

- 1030 am US weekly EIA oil inventory 4.851m p 2.5mb e

- 1130 am US $18bn 2Y FRN sale

- 1200 pm Fed Chair Powell speech

- 0100 pm US $32bn 7Y note saleGfK consumer confidence 10.6p 10.5e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

Good review.