Market Briefing For Monday, June 11

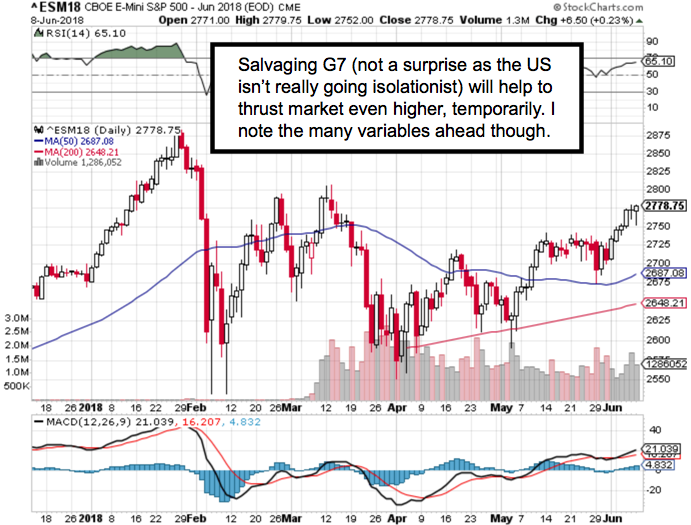

Precarious technical factors are not exactly lined up, but gleaned just offstage waiting for the right time to make their presence known. Since we gave the Bulls some room to lasso back market control above key levels a trader would monitor, we've felt it would rebuild into an overbought status, one more time.

We're working into that; but not so jammed that it can't extend a bit more. That changes little with respect to investing (valuations generally too high), but more importantly argued recent against shorting or fading too strongly, as it didn't (and still doesn't) have quite the feel we had in late January.

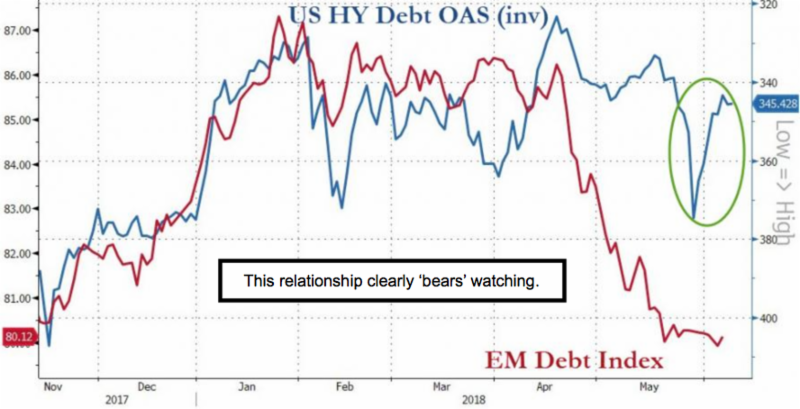

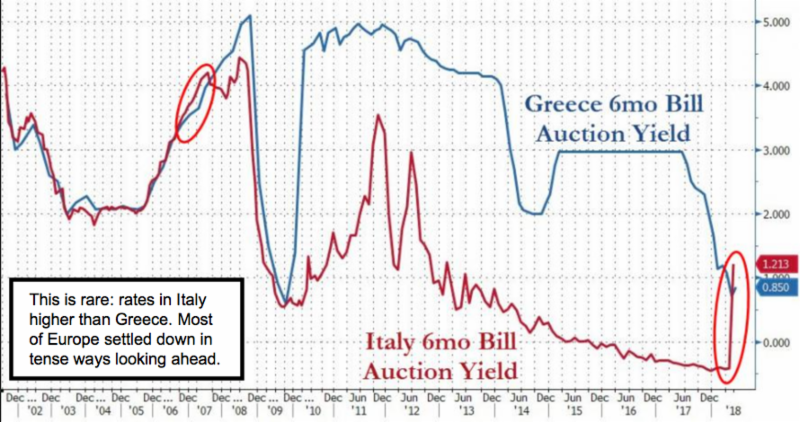

I say stay-tuned for that, as the sense remains a volatile time is forthcoming. In the interim everyone is flailing opinions around regarding everything one can contemplate, from success or failure in Quebec, to the Fed Meeting, to the Singapore Summit. And even to whether the AT&T / Time Warner merger gets blocked by the efforts of a vehement antitrust US Attorney.

None of this has fazed the stock market; and that's exactly where we have wanted it, ahead of all of this issues for the week ahead. Essentially that's the week where things can go all the market's way; all against; or mixed.

In sum: it's a 'yin-and-yang' week ahead, as we've pointed out and won't belabor now. And we have thought Quebec won't be quite so disastrous as some believed, oddly not only because it's negotiating of course; but may I add with a traditional closet-globalist Economic Advisor (Kudlow), you actually have a force talking the game; but nudging Trump to a compromise on this and other issues. (He proclaims conservatism at the same time we all know the history; including trying to comfort investors during the Bear Stearns 'daze' back in 2007 when I was warning about the coming 'Epic Debacle', and so many were really just hand-holding clients.)

Speaking of that, you now have Quants rationalizing the proportions Apple or other FANG stocks are to the total market capitalization; which worries me a bit more. Actually they remain extreme influences as you know; and so the primary reason you would hear such explanations to minimize their S&P influence, might be by those trying to forestall a grasping of risk.

Bottom line: as G-7 leaders frantically salvage some sort of consensus, I suspect we emerge OK in this; and the US is still in the driver's seat, even if some 'partners' don't like their diminished preferential trade treatment. A face-saving compromise is the expectation.