The Season For Consolidation

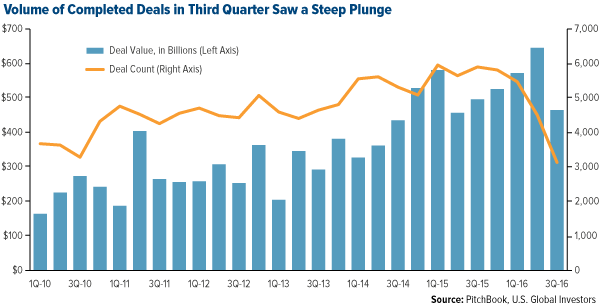

Last year saw a record number of mergers and acquisitions (M&As), altogether valued at a monumental $4.78 trillion worldwide.

Since then, M&A activity has sharply declined overall, with deals limited mostly to larger, multinational corporations. According to M&A database group PitchBook—itself to be acquired by Morningstar—there were 31 deals with estimated values of at least $10 billion in the third quarter alone, more than the entirety of 2015.

Despite tightening regulatory and antitrust hurdles, more of these monster-size deals are on their way, including stalwart American brands.

Reach Out and Touch Someone

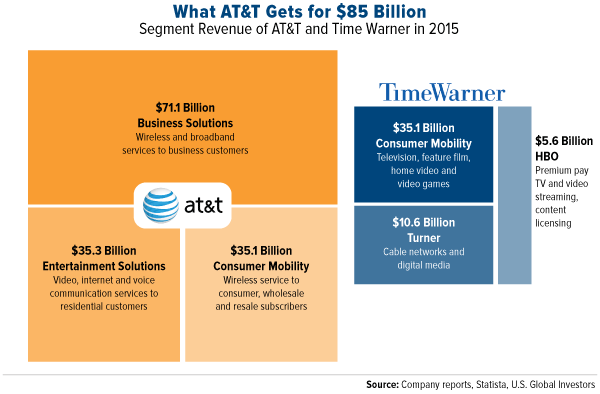

No doubt you’ve heard by now that AT&T (T) is about to get into the movie and television business. The Dallas-based telecommunications giant announced last week that it would be purchasing Time Warner (TWX), the world’s largest media empire, whose vast portfolio includes CNN, TNT and HBO, as well as reliable cash cows Harry Potter and DC Comics, home to Superman and Batman.

Barring any antitrust obstacles—which AT&T is no stranger to—the $85.4 billion deal is expected to close by the end of 2017.

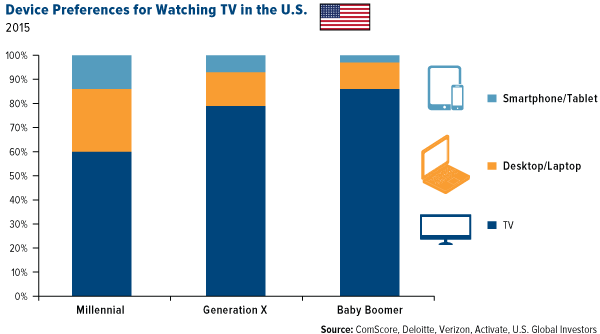

The deal makes a lot of sense. People’s viewing preferences are changing such that they’re just as likely now to get their programming on WiFi-enabled devices as they are via cable and satellite. Traditional TV still plays an overwhelmingly huge role in most of our lives, but with online streaming services such as Netflix and Amazon Prime adding subscribers every day, more and more of the content we consume is migrating to laptops, smartphones and other non-TV screens.

According to Pew Research, as many as one in four American adults now report being either a cord-cutter or so-called “cord-never”—someone who’s never subscribed to cable or satellite.

This trend is turning up even in National Football League (NFL) ratings. Once believed to be immune to changing viewing habits, professional football viewership is actually down about 10 percent from last season. Part of this has to do with presidential election coverage, but it’s also a function of games being streamed live on Twitter and other online channels, which takes market share away from TV networks.

This is all bad news for traditional cable and satellite providers, good news for AT&T, which is betting hard that people’s tastes will increasingly favor online content and distribution. The company is set to roll out a 100-channel, $35-a-month package called DirecTV Now, which will be delivered to you over the internet—no cable box or satellite dish needed.

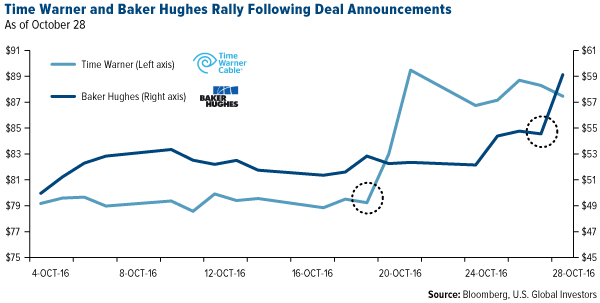

The AT&T-Time Warner deal was followed by news that General Electric would be combining its oil and gas business with Houston-based Baker Hughes.

The resultant company—62 percent owned by GE, 37 percent by Baker Hughes—is expected to give GE a more cost-efficient way to take advantage of a recovery in the energy space. It will also put it in a better position to compete against industry giants Schlumberger and Halliburton.

Both Time Warner and Baker Hughes stock (BHI) saw significant pops following the announcements.

A Record Number of Failed U.S. Deals

These gargantuan deals follow a relatively tepid first half of the year. In the U.S. alone, 59 deals worth a combined $463 billion crashed and burned in the first half, the most ever for that period, according to Fox Business.

One of the biggest failed deals involved U.S. drug maker Pfizer (PFE), whose attempted $160 billion acquisition of Ireland-based Allergan (AGN) was scuttled by the Obama administration’s anti-inversion regulators in April. Halliburton and Baker Hughes were likewise prevented from realizing their $35 billion deal, announced back in November 2014. Antitrust concerns also squashed the $6 billion merger between office supply rivals Staples and Office Depot.

Other factors that could have influenced M&A activity include geopolitical uncertainty—specifically, Brexit and the upcoming U.S. presidential election. A recent report from Chicago-based law firm Baker & McKenzie estimates that the global M&A market could see a deficit of up to $1.6 trillion in lost dealmaking opportunities “unless an orderly and swift Brexit process is followed.” We already know the divorce proceedings will take two years. How “orderly” they will prove to be is anyone’s guess at this point.

And then there’s the U.S. election. Historically, M&A activity has slowed during election years, especially when both parties nominate non-incumbent candidates, as is the case this year. Companies have tended to put deals on ice until after it’s known who will end up in office and what his or her policies will be.

But as we all know, this year has been anything but typical. That AT&T, GE and others are willing to move ahead with their plans so close to the election shows how strong the need for consolidation is right now.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) ...

more