Business Values Hit Record Highs In Lower Middle Market

Written by John Slater

Recently GF Data® reported that middle-market valuation multiples eclipsed previous highs in Q3 with an average TEV/Adjusted EBITDA multiple of 7.5x on $10-250mm deals.

GF Data’s proprietary transaction data from over 200 lower middle market PE firms saw continued strength in all deal sizes, but Q3 was the first quarter to show averages in the lower $10-25mm space topping at a 6.3x average valuation.

We’ve never before seen such market valuations for lower middle market companies. And many owners are electing to take advantage of the opportunity to sell at record valuations. FOCUS will end the year with a record number of closed transactions and we see no sign that the current strong market is ready to end.

But even such heady valuations pale by comparison with the red-hot photonics sector as you will see from the report below recently published by Brent Costello, Photonics and Optics Practice leader for the FOCUS Advanced Manufacturing & Automation Team. In Brent’s world, recent valuations can be measured not in multiples of profit, but in multiples of revenue!

Acquisition Objectives in Photonics Company M&A Transactions

Obtaining a high purchase price multiple for a company is dependent on the existence of a good strategic fit between the buyer and the company.

A great example of strategic fit between a buyer and seller in the Photonics industry is the recent acquisition of Energetiq Technology, Inc., a privately-owned company headquartered in Massachusetts, by Hamamatsu Photonics KK, a publicly traded Japanese corporation. The transaction closed on September 22, 2017 with a purchase price of $42,000,000. Energetiq is a manufacturer of laser driven light sources and extreme ultraviolet light sources. Hamamatsu manufactures photomultiplier tubes, imaging devices, light sources, opto-semiconductors, and imaging and analyzing systems.

The demand for light sources with high brightness in the ultraviolet region is growing because such light sources can be used to quickly and accurately inspect semiconductor wafers for properties such as thickness and pattern accuracy. Energetiq’s light sources are perfect for this application. The buyer Hamamatsu has a long history of developing and marketing light sources for semiconductor inspection. The addition of Energetiq’s technology and production ability will help to expand Hamamatsu’s capabilities and product offerings in this area.

Although neither the revenue nor profit of Energetiq has been disclosed publicly, we can make an educated guess as to the multiple of revenue which the $42M purchase price represents. Energetiq has been reported to have 24 employees. According to a study published by SPIE (the international society for optics and photonics) in 2015, the global average sales/employee in the Photonics sector was $211,093 in 2014 and $230,380 in 2012. If we assume that the current average sales/employee at Energetiq is $220,000, and multiply that amount by the 24 employees, we come up with a revenue amount for Energetiq of approximately $5,280,000. The $42M purchase price for Energetiq would therefore be equivalent to a whopping 8 x revenue, clearly demonstrating that buyers in the Photonics space are willing to pay premium prices for companies where there is a good strategic fit.

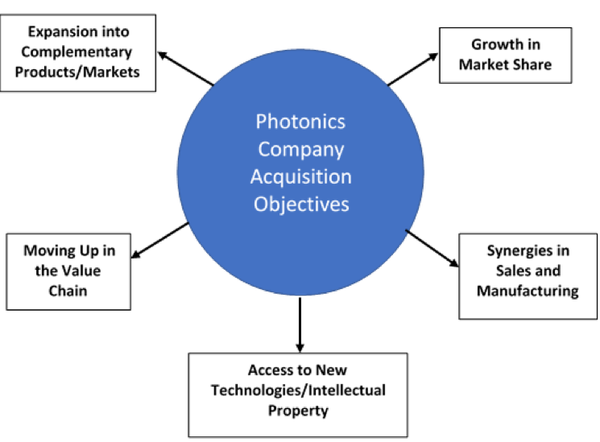

We examined 2017 Photonics Sector M&A transactions closed year to date to see what objectives the buyers were trying to achieve by making the acquisitions. Below is a chart showing the rationales given by the buyers for the acquisitions. Many of the acquisitions were predicated on achieving multiple objectives and the objectives often overlap, but there are common themes.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only. The reader is solely responsible for determining whether any ...

more