July Producer Price Index: Final Demand Down

Today's release of the July Producer Price Index (PPI) for Final Demand came in at -0.1% month-over-month seasonally adjusted, down from last month's 0.1%. It is at 1.9% year-over-year, down from 2.0% last month, on a non-seasonally adjusted basis. Core Final Demand (less food and energy) also came in at -0.1% MoM, down from 0.1% the previous month and is up 1.8% YoY. Investing.com MoM consensus forecasts were for 0.1% headline and 0.2% core.

Here is the summary of the news release on Final Demand:

The Producer Price Index for final demand declined 0.1 percent in July, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices inched up 0.1 percent in June and were unchanged in May. (See table A.) On an unadjusted basis, the final demand index increased 1.9 percent for the 12 months ended in July.

Over 80 percent of the July decrease in final demand prices is attributable to the index for final demand services, which fell 0.2 percent. Prices for final demand goods edged down 0.1 percent.

The index for final demand less foods, energy, and trade services was unchanged in July following a 0.2-percent advance in June. For the 12 months ended in July, prices for final demand less foods, energy, and trade services rose 1.9 percent. More…

Finished Goods: Headline and Core

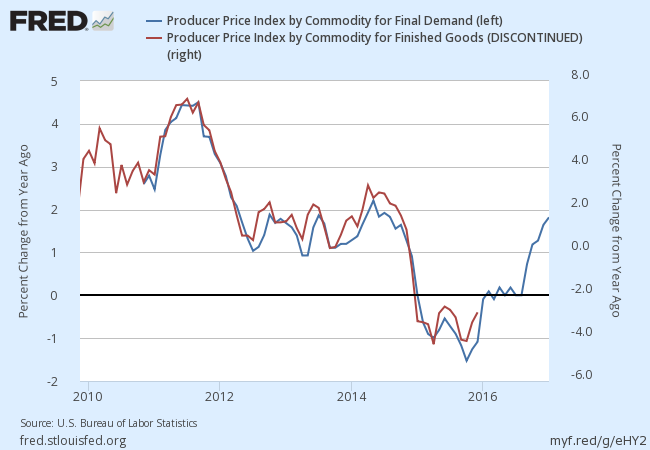

The BLS shifted its focus to its new "Final Demand" series in 2014, a shift we support. However, the data for these series are only constructed back to November 2009 for Headline and April 2010 for Core. Since our focus is on longer-term trends, we continue to track the legacy Producer Price Index for Finished Goods, which the BLS also includes in their monthly updates.

As this overlay illustrates, the Final Demand and Finished Goods indexes are highly correlated.

FRED® Graphs ©Federal Reserve Bank of St. Louis. All rights reserved.

Now let's visualize the numbers with an overlay of the Headline and Core (ex-food and energy) PPI for finished goodssince 2000, seasonally adjusted. The plunge that began in mid-2014 in headline PPI is, of course, energy related. It is now off its interim low set in April of 2015. Year-over-year Core PPI, now at 1.8%, has trended lower from its 2.3% interim high also set in 2015.

(Click on image to enlarge)

As the next chart shows, the Core Producer Price Index is far more volatile than the Core Consumer Price Index. For example, during the last recession producers were unable to pass cost increases to the consumer.

(Click on image to enlarge)

Disclosure: None.