Tricida Could Topple With Lock-Up Expiration

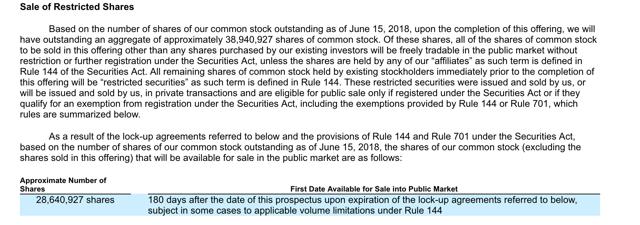

The 180-day lock-up period for Tricida Inc. (TCDA) ends on December 25, 2018. When this period ends, the company's pre-IPO shareholders and insiders may opt to sell their shares in the secondary market. More than 28 million shares of TCDA are subject to lock-up agreements - versus the initial offering of 11.7 million shares. Any significant sales of restricted shares once the lock-up expires could flood the secondary market for TCDA and cause a sharp, short-term downturn in share price.

We believe that these pre-IPO shareholders and company insiders will be eager to cash in on gains. TCDA had a first-day return of 36.8% and the stock currently has a return from IPO of 47.4%.

Business Overview: Pharmaceutical Company Developing Treatment for Metabolic Acidosis

Tricida is a late-stage pharmaceutical company that is developing its drug candidate, TRC101, which is a non-absorbed polymer. It works to treat metabolic acidosis by binding and eliminating acid from the gastrointestinal tract. Metabolic acidosis affects primarily patients with chronic kidney disease (CKD).

(Source: Tricida website)

The company has completed a double-blind, placebo-controlled Phase 3 clinical trial with 217 patients with metabolic acidosis. In its SEC filings, Tricida notes that the drug candidate met its primary and secondary endpoints and was well tolerated. Both the active and placebo patients had low rates of adverse effects and low discontinuation rates. The company is continuing with a 40-week blinded safety trial, which is expected to be completed within the first half of 2019.

Tricida expects to submit a New Drug Application with the FDA in late 2019. The company will submit the application through the Accelerated Approval Program.

Tricida estimates that nearly 3 million CKD patients will experience metabolic acidosis in the United States. It expects to market its treatment initially in the United States with a sales force that will focus on the nephrology sector of the medical industry. For international sales, Tricida will seek partnerships with companies that have experience selling in target markets. Tricida believes its intellectual property estate will give patent protection through at least 2034 in the United States, China, India, Japan, the European Union, and other markets.

Company information sourced from S-1/A and company website.

Financial Highlights

Tricida reported the following financial highlights for the third quarter ended September 30, 2018:

- Research and development incurred $25.2 million in expenses for 2018 versus $7.7 million in 2017. Tricida indicates the increase comes from increased activities relating to their clinical development program for its drug candidate, TRC101.

- General and administrative expenses were $4.2 million in 2018 versus $3.1 million in 2017.

- Net loss was $29.1 million for the third quarter versus $10.8 in 2017. Net loss per basic and diluted share was $0.71 for 2018 and $4.81 for 2017.

- For the third quarter of 2018, cash, cash equivalents, and short-term investments were $260.5 million.

Financial highlights sourced from company website.

Management Team

President and CEO Dr. Gerrit Klaener has been with Tricida since 2013. He founded Relypsa and co-founded LLypsa. He also served at Symyx Technologies. Dr. Klaerner received his Ph.D. from the Max-Planck-Institute for Polymer Research in Mainz, Germany. He completed postdoctoral research at Stanford University and the IBM Almaden Research Center.

CFO and SVP Geoffrey Parker has been with Tricida since April 2017. His previous experience comes from positions at Anacor Pharmaceuticals, InteKrin Therapeutics, Goldman Sachs, and Feibusch & Co. Mr. Parker holds a degree in Economics and Engineering Science from Dartmouth College and an MBA from Stanford University.

Management bios sourced from company website.

Competition: No Direct Competition Currently Approved by FDA

In its SEC filings, Tricida notes that no current treatments for metabolic acidosis exist on the market in the United States. The FDA has approved certain treatments such as a generic IV sodium bicarbonate solution for metabolic acidosis resulting from uncontrolled diabetes, severe renal disease, and other disorders. These are used for short-term, hospital-based treatment.

Early Market Performance

The underwriters for Tricida priced its IPO at $19, above its expected price range of $16 to $18 per share. The stock reached a high of $39.35 on September 9. Shares of TCDA have a return from IPO of 47.4%.

Conclusion: TCDA a short ahead of December 26th Trading Session

When the TCDA IPO lock-up expires, more than 28 million shares of TCDA will be eligible for trading for the first time. With just 11.7 million shares trading subject to the IPO, any significant sales of currently-restricted TCDA stock could flood the secondary market and cause a sharp, short-term downturn in TCDA's share price.

Aggressive, risk-tolerant investors should consider shorting shares ahead of TCDA's December 25th lock-up expiration. Interested investors should cover positions either late in the trading session on December 26th or over the course of the December 27th trading session.

I am short TCDA.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock ...

more