Investor Sentiment Dips In Yale Confidence Surveys

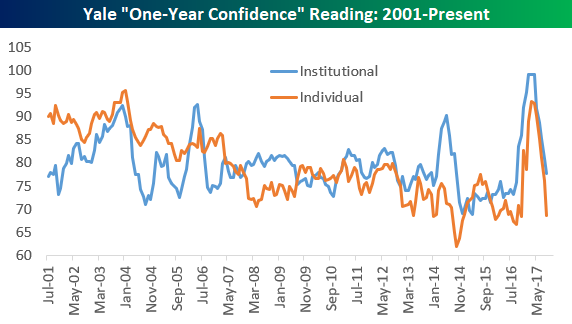

The Yale School of Management runs a monthly sentiment survey on both individual and institutional investors. Four questions are asked of investors, and below we provide charts showing the historical results through September 2017. The first chart shows the results for Yale’s “One-Year Confidence” reading which asked respondents how confident they are that the stock market will be higher a year from now.

As you can see, this reading amazingly spiked to nearly 100% in mid-2017 for institutional investors, and it got above 90% for individual investors. Over the last few months, however, bullish sentiment towards the stock market has dropped dramatically, and at this point investors surveyed are less optimistic towards stocks than they were just prior to last November’s Presidential Election.

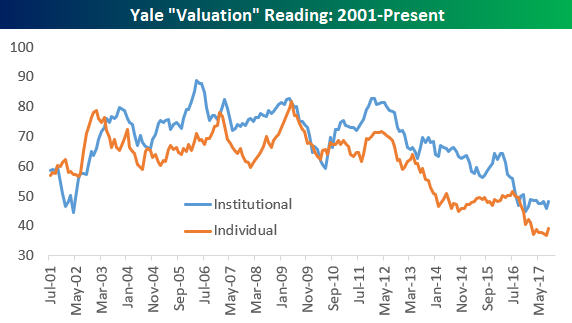

The second question covers investor confidence in the valuation of the stock market. High readings mean investors like the valuation of the market, and vice versa for low readings. As shown, both institutional and individual investors think valuations are as unattractive as they’ve been in the history of the survey dating back to 2001.

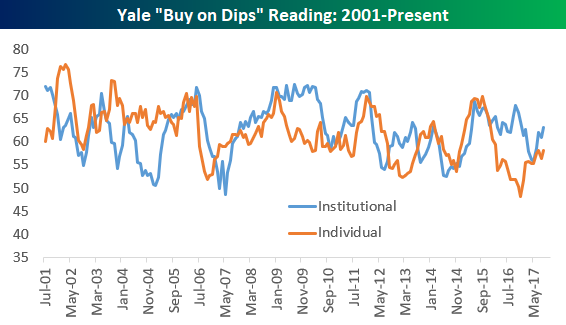

The “Buy on Dips” question asks investors how eager they are to buy stocks after the market experiences a big decline. This reading is in the middle of its historical range right now for both individual and institutional investors, but it has picked up a bit in recent months.

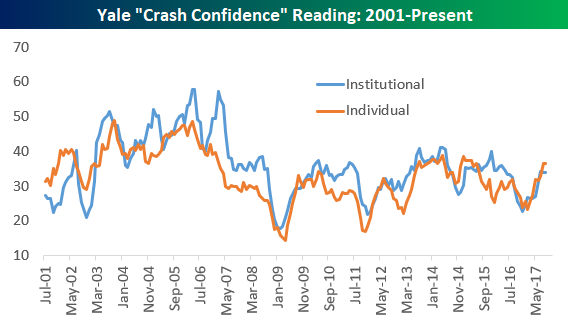

The last question asks investors how confident they are that there WILL NOT be a stock market crash in the next six months. A high reading means investors aren’t worried about a crash, which would be indicative of excess complacency in the market. While this sentiment measure has been rising slowly over the last year, it’s not elevated compared to historical readings by any means.

Earlier this week we published a more in-depth analysis of Yale’s sentiment survey including an update to our “Irrational Exuberance” indicator. more