SmartAsset: Interview With Michael Carvin, CEO

We had the opportunity to interview Michael Carvin, the co-founder and CEO of the new personal finance advising tool, SmartAsset. The company, founded in 2012, seeks to improve the lives of its users by making everyday financial advice easily accessible to them.

Q: Michael, can you tell us a bit about yourself and SmartAsset?

A: I am the CEO and cofounder of SmartAsset. Prior to SmartAsset I worked in private equity at Altima Partners. As a senior associate I managed a multi-billion dollar fund, and identified, analyzed, structured, executed and monitored Private Equity investments globally.

A: I am the CEO and cofounder of SmartAsset. Prior to SmartAsset I worked in private equity at Altima Partners. As a senior associate I managed a multi-billion dollar fund, and identified, analyzed, structured, executed and monitored Private Equity investments globally.

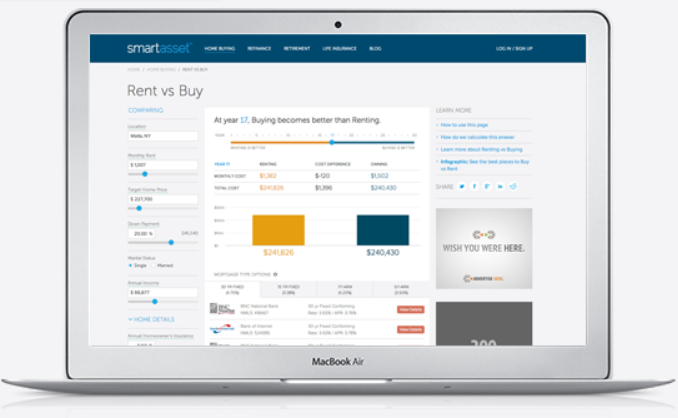

SmartAsset exists to deliver the best, customized, and accurate personal finance advice to as many people as possible, for free. What sets the company apart from competitors is its product-focused nature; all tools and resources are built-in house by a world-class team. As a result, users have access to comprehensive information and over 100 tools to help them make important financial decisions. SmartAsset is one of the biggest players in the personal finance advice space helping 40+ million people make important financial decisions each month.

Q: How did you get the idea for SmartAsset?

A: When I was in the market to buy a house, I found it difficult to find information online that was useful, and didn’t cost a lot of money. It seemed like everything I read online was dense, hard to understand and essentially useless… and I worked in finance. I could only imagine how people who were unfamiliar with the terms felt while navigating a similar decision. Then when the idea for SmartAsset was born.

Q: How will SmartAsset improve the lives of its users?

A: Big financial decisions are often associated with major milestones in our lives. At SmartAsset we want these milestones to be memorable, not for the headaches they can cause, but for the outcomes like being handed the keys to a new house and enjoying retirement comfortably. At SmartAsset people can use dependable resource they can trust and turn to when navigating important financial decisions. We give them the ability to learn and make an informed decision.

Q: When and how did you know that your company was going to be a success?

A: The day we launched we had 20,000 people visit our site. It was a big day for us and validated the need for a website to offer easy to understand and free personal finance advice. From there we took it day by day, and now we're reaching 40 million people each month!

Q: What was the final push that lead you to take the risk of creating your own company?

A: When my cofounder Philip and I were accepted into Y Combinator.

Q: Did you hit any roadblocks that almost caused you to throw in the towel?

A: We've been pretty fortunate along the way to experience the good with not too much of the bad. Though that being said we experienced a lot of difficult things most startups experience like fundraising and growing to accommodate demand!

Q: Where do you see the company in 5 years and how do you plan to get there?

A: Our goal is to be the go-to resource for all big personal finance decisions. Today, SmartAsset offers advice across a number of personal finance verticals, including: home buying, retirement planning, credit cards, life insurance, personal loans, student loans, loan refinance, taxes and investing. Over the next few years we plan to grow into the auto and health insurance verticals as well.

Q: Is there any advice you'd give to other aspiring entrepreneurs?

A: Surround yourself by the smartest people and learn as much as you can.

Q: How can interested readers get in touch/learn more?

A: Please visit smartasset.com for more information.

Good Job Khadija

@[Michael Carvin](user:38730), as an aspiring entrepreneur, what would it take for me to get accepted into the Y Combinator?

How do you plan to expand into the auto and health insurance verticals?

Interesting model, @[Michael Carvin](user:38730), but how do you guys generate revenue?