Gold Bugs Hopes Hinge On These Head & Shoulders Patterns

Last week I pointed out a potential top on the US Dollar/Gold ratio. That would be bullish for gold bugs. This week, I have another potentially bullish setup to show you.

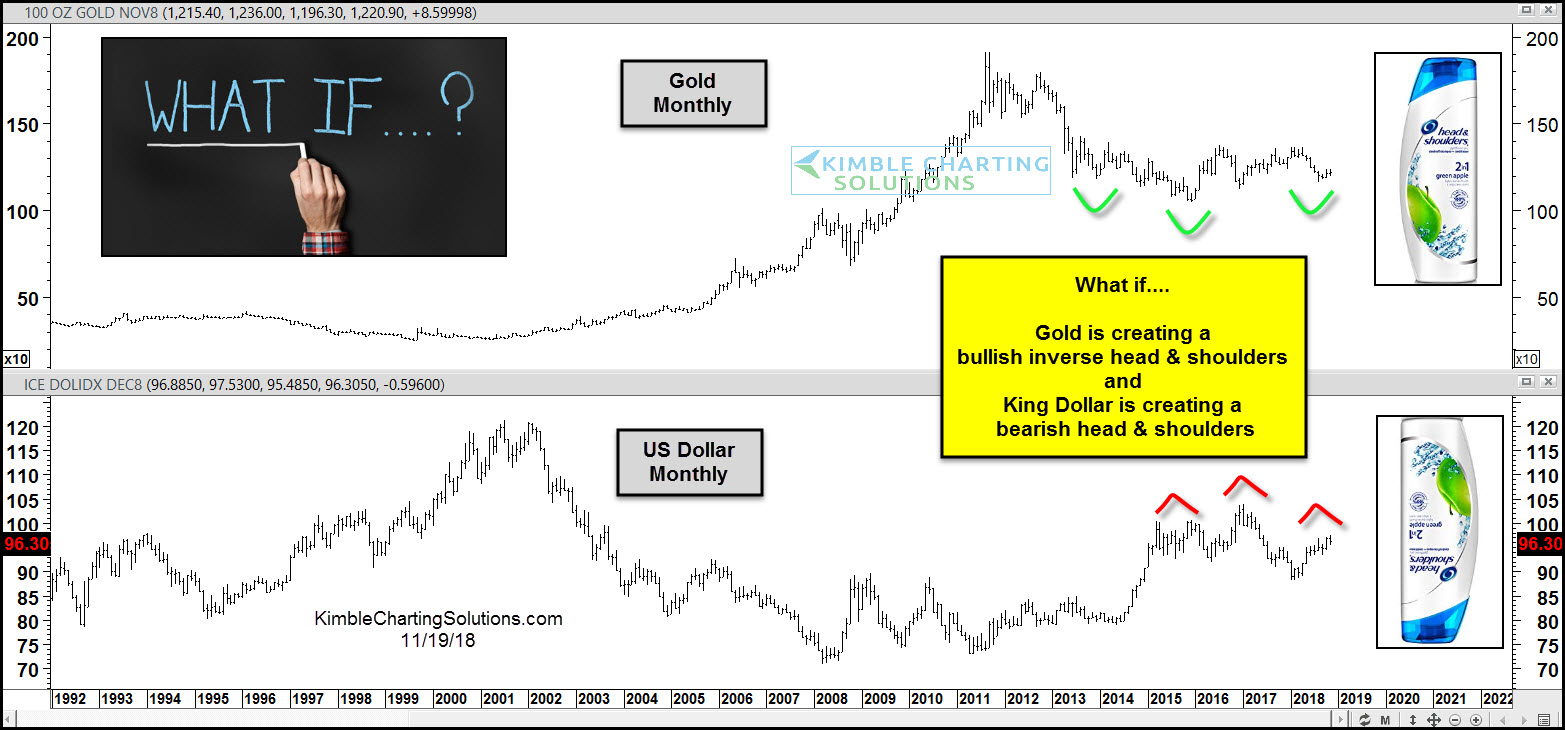

As most of you are aware, any weakness in the US Dollar is good for gold prices. In the chart 2-pack below, we look at Gold and the US Dollar Index on a monthly basis.

Gold (NYSEARCA: GLD) is attempting to form a bottoming base in the form of an inverse head & shoulders pattern. At the same time, the U.S. Dollar is forming a potential head and shoulders topping pattern.

Perhaps it’s too obvious… but traders should pay attention to these patterns and how they play out!

Gold vs US Dollar Chart – Head & Shoulders Patterns?

(Click on image to enlarge)

Sign up for Chris's Kimble Charting Solutions' email alerts--click here.