You Ain’t Seen Nothing Yet

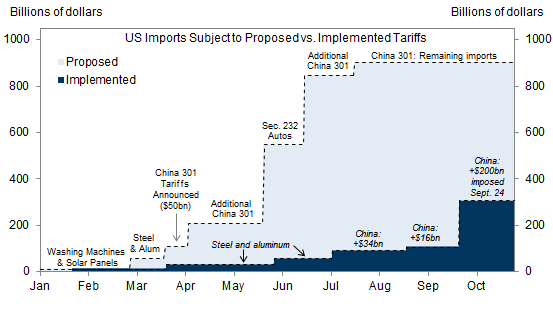

Taxes announced, proposed, on Chinese imported goods. Or, shoot yourself in the foot edition.

Source: Hatzius, et al. “The Trade War: Bigger Numbers, Same Conclusion,” GS 5 Oct 2018.

With Vice President Pence’s speech, I’m confident that the Trump administration will push forward in implementing fully the programs of imposing tariffs on China sourced imported goods (while still failing to sanction ZTE, …FFS).

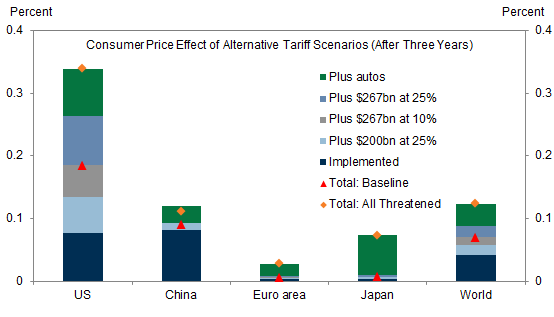

What are the likely macro impacts. On output, minor, unless stock markets take a dive. On the other hand, consumers will almost certainly face price increases, either relative or general.

Source: Hatzius, et al. “The Trade War: Bigger Numbers, Same Conclusion,” GS 5 Oct 2018.

On a separate matter, I am compelled to note several inaccuracies and omissions (!) in Mr. Pence’s panegyric:

When China suffered through indignities and exploitations during her so-called “Century of Humiliation,” America refused to join in, and advocated the “Open Door” policy, so that we could have freer trade with China, and preserve their sovereignty.

I am tempted to extend my remarks, but I will restrain myself, and merely refer people to this book, among many others. Mr. Pence also omits mention of the Exclusion Laws despite the similarities to the administration’s current immigration control framework.

Don’t get me wrong. I believe we are in a multi-faceted competition with China, but tariffs are an ineffective means of countering Chinese economic misbehavior. Nor is rescinding sanctions on ZTE. Nor are tax cuts when we need to fund a military buildup in the Pacific. In other, it’s not clear the Trump administration really has an intent to oppose China, but rather to whip up xenophobic and other less-than admirable inclinations in the electorate.

Disclosure: None.

#1 I think that right now tariffs are seen by the administration as a way to help the budget deficit, however, a poor one as many have pointed out. In reality, to plug the gap from the tax cuts they need to look at real cuts in government spending. #2 There is some concern about making China as the bad player in this trade war, however, it is already too apparent that the US is the one calling the shots. Also China is expanding, not contracting its global footprint which is a concern to US competitiveness. Also, as many have pointed out, China's manufacturing is under long term decline anyways as SE Asia is more cost competitive and will be more able to deal with manufacturing as time goes on like Japan was vs. the US in the past, then Taiwan, Hong Kong, and Korea was to Japan in the past, and China was to Taiwan, Hong Kong, and Korea. Now Vietnam, Cambodia, Thailand, the Philippines, and Malaysia are the treats to China and is why China is getting so aggressive in the Pacific Ocean. The US is a symptom of a wider problem for China and the US fighting vs. China over manufacturing is like fighting the last manufacturing war instead of looking at the future global battleground. It is diverting attention to the wrong issue. The issue is the constant manufacturing movement to the lowest cost labor with the lowest environmental laws. To counter this, automation will help, as well as global regulations on environmental manufacturing. #3 The last scary issue is China is quickly realizing its need to move to a higher end economy and is producing more and more patents and innovation. China does need to protect patents better for its own future sake. This will happen naturally. Also China needs to open up its freedom of information to enable creativity and a more global landscape, however, Facebook incidents and Russian hacking have shown even the US the potential for misuse. There needs to be discussion on this topic, however, government information control ends up hurting China's economy in the long run by it stymieing global competitiveness and creativity. #4 The lack of China allowing for the free trade of its currency also hurts its potential to be a global financial leader. It is making small advances on this. Right now China is trying to keep its currency up, not push it down. This is at contradiction to claims its playing currency manipulation games and most people realize this. Once again, helping China be open to free currency helps China more than it hurts it. #5 Last, demonizing China isn't that good if you plan on running a continuing deficit and depend on it for so much trade that obviously America wants even with trade tariffs. To move forward on this is a bit silly given Americans will realize quite rapidly how much they depend on China to keep their standard of living. The US essentially has been exporting not only its deficits but also its inflation. If the US stops imports it will quickly realize how much inflation its deficit spending really causes and it will become frightening rapidly. Republicans by and large realize our trading partners are partners and not enemies. Let us hope clearer minds will prevail for our sake.

Eventually Americans will feel tariff pains and it won't be fun anymore.

We need to fund a military buildup in the Pacific? Really, prof?