Monday, November 6, 2017 6:33 AM EDT

The Japanese Yen traded broadly lower in Asia Pacific trade, stung by a familiarly dovish tone in minutes from September’s BOJ policy meeting and similarly-themed comments from BOJ Governor Haruhiko Kuroda. It is somewhat surprising that such well-worn tropes were market-moving, especially against given a drop in Tokyo-listed shares that might have been expected to boost the typically anti-risk currency.

The New Zealand Dollar also declined, falling alongside local front-end bond yields. The move may have reflected pre-positioning ahead of the upcoming RBNZ rate decision. The day’s offering of economic data didn’t help matters. An ANZ report said the price of New Zealand’s commodity exports on global markets fell in October while the central bank’s inflation expectations survey pointed to bets on a slowdown.

A seemingly busy European economic data docket is nonetheless short of eye-catching releases. The day’s offering of US news-flow is only slightly more compelling, with speeches form the New York Fed’s Simon Potter and Bill Dudley unlikely to break much new ground. That might put sentiment, with FTSE 100 and S&P 500 futures hinting at a risk-off mood that might help the Yen regain some lost round.

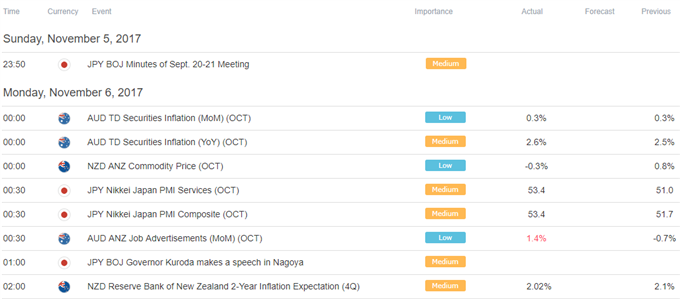

Asia Session

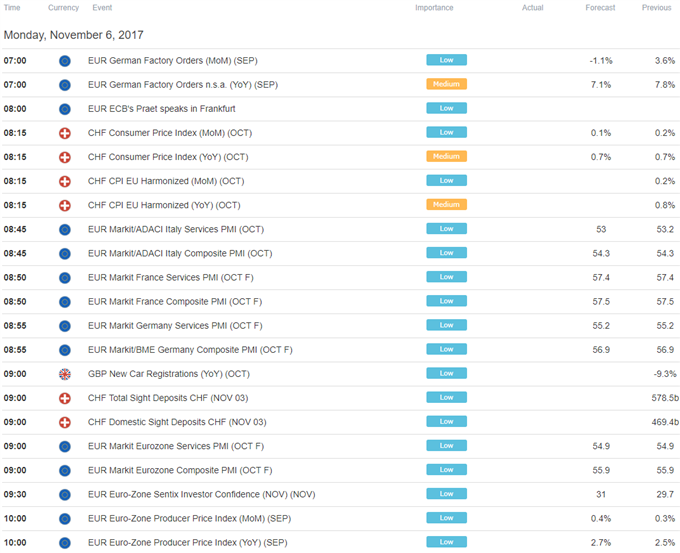

European Session

Disclosure: DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the ...

more

Disclosure: DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the fundamental and technical influences driving the currency and commodity markets. With nine internationally-based analysts publishing over 30 articles and producing 5 video news updates daily, DailyFX offers in-depth coverage of price action, predictions of likely market moves, and exhaustive interpretations of salient economic and political developments. DailyFX is also home to one of the most powerful economic calendars available on the web, complete with advanced sorting capabilities, detailed descriptions of upcoming events on the economic docket, and projections of how economic report data will impact the markets. Combined with the free charts and live rate updates featured on DailyFX, the DailyFX economic calendar is an invaluable resource for traders who heavily rely on the news for their trading strategies. Additionally, DailyFX serves as a portal to one the most vibrant online discussion forums in the forex trading community. Avoiding market noise and the irrelevant personal commentary that plague many forex blogs and forums, the DailyFX Forum has established a reputation as being a place where real traders go to talk about serious trading.

Any opinions, news, research, analyses, prices, or other information contained on dailyfx.com are provided as general market commentary, and does not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

** All times listed in GMT. See the full DailyFX economic calendar here.

less

How did you like this article? Let us know so we can better customize your reading experience.