Will German Elections Move Gold?

On Sunday, federal parliamentary elections will be held in Germany. What does it imply for the gold market?

On September 24, Germans will elect members of the Bundestag, who will ultimately decide whether Angela Merkel, the incumbent chancellor, will govern for another four years. The opinion polls indicate that this is indeed likely to happen – and Merkel will win a fourth term in office.

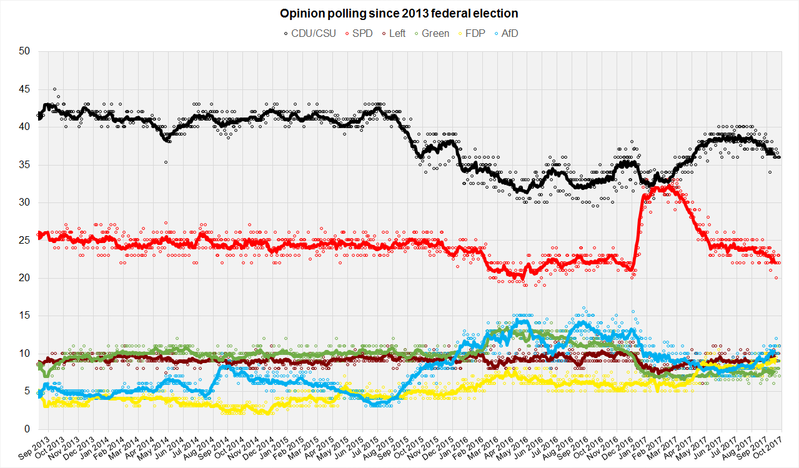

As one can see in the chart below, Merkel’s CDU/CSU has about a 15-percent lead over the SPD, its main rival. And the AfD, which is a right-wing populist and Euroskeptic party, is expected to get only about 10 percent (or as much as 10 percent, as it could enter the parliament for the first time in history and even become the third party in the parliament).

Chart 1: Opinion polling for the German federal election, 2017.

What does it all mean for the gold market? Well, Merkel’s victory will be an important geopolitical event, as it may start a new era for Europe. Witch Emmanuel Macron as the president of France and Angela Merkel as the chancellor of Germany, there may be political accord between Paris and Berlin to reform the EU. The Merkel-Macron alliance could, thus, strengthen further the optimism in the Eurozone and the euro. In such a scenario, the EUR/USD exchange rate would rise, which should be supportive for the price of gold.

However, while Macron’s victory was uncertain, Merkel’s success is widely expected. Therefore, her triumph may actually do not change anything, or we could even see a “buy the rumor, sell the fact” scenario. In other words, although Merkel’s win should be fundamentally supportive for the euro and gold in the long term, it may be not enough to change the negative sentiment toward the yellow metal which set in after the surprisingly hawkish FOMC meeting in September.

The key takeaway is that Germans will vote on Sunday in federal parliamentary elections. Merkel’s party is expected to win and get about 36 percent of votes. Any surprise to the upside may strengthen the euro and, thus, gold. Contrary, a major downside shock should support the greenback, which would not be positive for the yellow metal. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly more