Will China’s Breakdown Cause A Global Bear Market?

More bad news continues to flow out of the world’s second largest economy, and it could be warning signs of an impending bear market. Bret Jensen shares his strategy on how he is de-risking his portfolio from exposure to what could be a global economic crisis.

Last week, the markets had their worst opening to start a year since 1932. This was the year before FDR came to the White House, the year the New York Times won its second Pulitzer for describing what a “worker’s paradise” this guy Stalin was building in Russia and the year before Adolf Hitler became Chancellor of Germany. In short, it has been a long time since we have had such a down start to an investment year.

There were two main triggers to the large sell-off that started off 2016 with a bang. First, the rift between Saudi Arabia and Iran escalated to a new level even after the two countries have been fighting a proxy war for years, most notably in Yemen. The cause of this tension was Saudi Arabia executed a prominent Shiite dissident leader and several dozen other convicted extremists. Saudi Arabia’s consulates were then ransacked in Iran’s two largest cities. This caused Saudi Arabia to suspend commercial and diplomatic relations with Iran for the first time in decades.

Crude oil initially spiked some four percent on this new source of turmoil in the Middle East. However, after new readings continued to show a glut of inventory at the key transit hub of Cushing, crude gave up all of those gains. This shows how hard it might be to get a sustainable rally in energy in the early part of 2016. In addition, oil prices are also reflecting the broader decline in the market triggered by increasing concerns about slowing growth and demand in China.

China’s market was halted overnight last Monday as their main stock indices fell by the maximum limit; down seven percent. This was repeated on Thursday when Chinese stocks hit their circuit breaker in just 30 minutes. This was the bigger trigger for the opening decline in our markets to start 2016. At this point, I think it is fairly obvious that the Middle Kingdom is not growing anywhere near the official seven percent GDP levels. I have seen opinions speculating that real growth in China is nearer to two percent at the moment despite authorities’ best efforts to boost the economy and intervene in the equity markets. My own opinion is China’s GDP growth is more in the four to five percent range at the moment. The Chinese Yuan fell to four-year lows in trading against the dollar today as well.

Turmoil in China was the major driver behind the correction our markets went through last summer and another similar event cannot be ruled out for 2016. The fact that oil, copper, iron, and other commodity prices are at multi-year and in some cases decade-lows speaks to the slowdown in Chinese growth to a large extent.

China is trying fervently to migrate to a more consumer driven economy as it has been quite evident that the country has a glut of manufacturing capacity even as it loses competitiveness against lower cost manufacturing countries such as Vietnam. This is not going to be an easy transition for China and it will play out over many years.

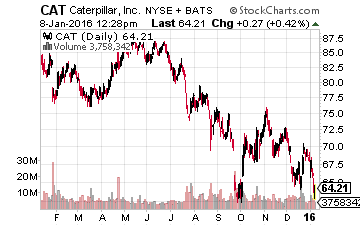

I think it is important for investors to differentiate between China’s manufacturing economy and its consumer economy. The former will probably struggle for years with its overcapacity while the consumer part of the economy should weather this transition on firmer footing. This is one reason I am completely out of both the energy and commodity sectors as I think the bust in those areas has to have one big “washout” before it is investable. I would also avoid industrials like Caterpillar (NYSE: CAT) and Joy Global (NYSE: JOY) that count on China and commodity demand for a good portion of their demand.

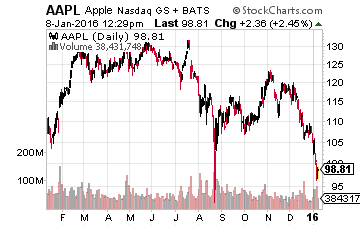

The consumer part of Chinese economy should hold up much better. This is one reason I have added to my stake in Apple (AAPL) recently on its about 25% pullback despite reports it is trimming iPhone orders. The tech giant from Cupertino is seeing the majority of its growth come from the Middle Kingdom, and this should continue to be the case over the long-term. At less than 10 times forward earnings, with a massive cash hoard, and a two percent yield, the stock is cheap here.

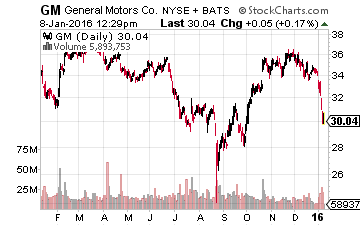

In addition, General Motors (NYSE: GM) and Ford (NYSE: F) are good value picks at less than eight times forward earnings with near four percent yields. Auto sales are starting to pick up in China after a lull through most of 2015. Overall auto sales in China are just a bit more than in the United States despite having roughly four times the population which bodes well for future robust sales growth.

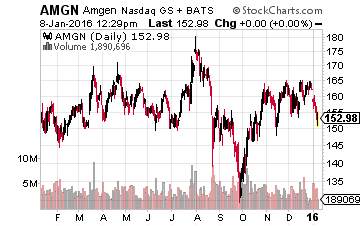

If you want to sidestep the whole conundrum around estimating what the actual growth level of China is, the right move is to avoid anything that depends on China altogether. Large biotech stocks like Amgen (NASDAQ: AMGN) and AbbVie (NASDAQ: ABBV) should continue to show solid revenue and earnings growth in 2016, sell for less than overall market multiple, and pay solid dividends to boot. I plan to pick up additional shares in both should the rough start to 2016 continue in the week ahead.

The weeks ahead may be choppy until the global environment starts to stabilize some. This is how I plan to play the recent turmoil coming from China and the Middle East.

Position: Long AAPL, GM, F, AMGN, ABBV

Small Cap Gems analyst Bret Jensen has identified his top 3 takeover stocks ...

more

spot on as usual Brett- I am a fan.: may I ask around what price is your ABBV bid in on? I am long GM F ABBV AMGN cheers Carol